Centralized crypto exchanges are increasingly incorporating DeFi components into their platforms, a shift that Animoca Manufacturers examine suggests will be main them in the direction of turning into so-called “universal exchanges” or UEXs.

In a characterize shared with The Defiant, the analysts acknowledged that UEXs could waste recognition amongst a noteworthy wider audience on fable of they offer larger than correct trading, including on-chain tokens and tokenized real-world property.

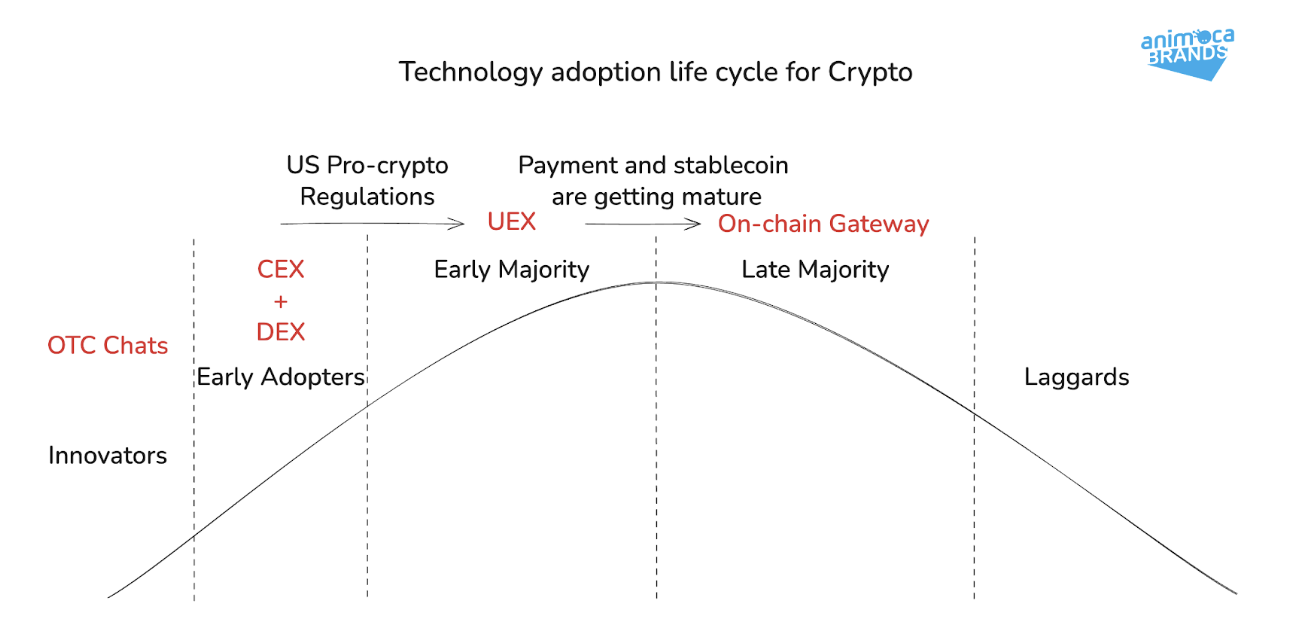

While centralized exchanges (CEXs) had been central to crypto’s growth for years, the growth amongst crypto-native customers is slowing, analysts mark, including that fresh tools, equivalent to memecoin launchpad Pumpfun and decentralized exchanges (DEXs), are pulling customers away.

To protect linked, mammoth exchanges are actually increasingly including wallets, on-chain trading, and DeFi components, the analysts added.

In commentary for The Defiant, Scott Shapiro, head of trading at cryptocurrency substitute Coinbase, explained that bringing DeFi into the centralized finance role is the “factual path forward in increasing a more universal abilities,” including that these updates unlock bag correct of entry to to “fresh asset classes and thousands and thousands of onchain property while affirming a neatly-identified, approachable abilities for merchants.”

“This notion is reflected in our broader honest of changing into the ‘every little thing substitute’ – empowering merchants to fetch fresh alternatives, whether or no longer that’s by DEX trading and perpetual futures, or by prediction markets and tokenized equities,” Shapiro told The Defiant.

Upcoming Revolution

Animoca’s examine notes that CEXs are also integrating DEX tokens. Platforms like Binance Alpha and Bitget Onchain let customers substitute tokens that had been beforehand simplest on hand on decentralized platforms. The Defiant reached out to Binance however didn’t hear attend by press time.

Gracy Chen, CEO of Bitget, told The Defiant that the following period of monetary merchandise “will be apps that dispute banks and outmoded monetary establishments,” noting that platforms will integrate the protection of CEXs, with the bag correct of entry to to tokens supplied by DEXs, alongside with TradFi’s tokenized shares and bonds.

Animoca says the UEX pattern is tied to coverage adjustments as the fresh expert-crypto guidelines within the U.S. are making it more uncomplicated for exchanges to connect real-world property on-chain, which opens up alternatives for outmoded merchants to attempt crypto without navigating complex on-chain mechanics.

Addressing whether or no longer integrating DeFi into CeFi creates regulatory challenges, Chen explained that many merchandise and services and products “aloof absorb a gray role.”

She added that, as of now, “custodial and non-custodial merchandise are separated,” however hybrid items, equivalent to UEXs, will “progressively push regulators to refine their stance and make frameworks that hit upon the advantages of decentralization while aloof maintaining customers.”