Marathon Digital, a pacesetter in the Bitcoin mining sector, on February 28 unveiled to the final public the manufacture of the Anduro blockchain, a layer-2 resolution geared in direction of fixing the scalability issues with the world’s most neatly-identified cryptographic community.

Conceptually comparable to the Lightning Community nonetheless on the identical time very different on a technical stage, Anduro is save of living to turn into the most effective arrangement for Bitcoin developers who must create fresh successful purposes and implementations.

In the period in-between Marathon reports financial results above expectations in the final quarter, consolidating its arrangement on the Nasdaq with MARA inventory costs up 300% in comparison to a year ago.

Let’s scrutinize the total runt print below.

Summary

Marathon Digital broadcasts the start of Anduro, a layer-2 blockchain built to enhance Bitcoin scalability

Marathon Digital, a firm dedicated to cryptocurrency mining, launched on Wednesday, February 28th that it has began work on Anduro, a layer-2 blockchain in a position to enhancing the performance of the predominant Bitcoin community.

In the firm’s weblog put up, we are in a position to read that it’s a multichain resolution, designed to bustle the style and adoption of Bitcoin, providing developers an supreme arrangement to create the style forward for the chain.

This day, we’re asserting Anduro: a multi-chain, layer-two community on #Bitcoin. pic.twitter.com/kgEAlbJdto

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) February 28, 2024

Even though first and main take into legend, Anduro would perhaps seem comparable to the Lightning Community, a secondary community of Bitcoin in a position to supporting financial and rapid transactions, it the truth is has very different traits.

The introduction of the substantial Marathon Digital became once if truth be told designed the truth is to enhance the introduction of just a few sidechains, in a position to differentiating and fragmenting the a lot of weight of transactions on the predominant layer.

By the methodology, the miner is already working in specific on 2 sidechains, Coordinate and Alys, conceived respectively to present a fertile ground for the proliferation of Ordinals and to permit compatibility with Ethereum and with the tokenization operations of institutional sources.

Surely, this layer-2 became once basically designed to facilitate the work of developers and explore fresh connections with web3, sooner than enhancing the final person abilities.

As written in the weblog, Anduro is programmed for:

“systematically integrate decentralized governance, with the aim of changing into essentially the most decent and developer-oriented layer-2 of Bitcoin”

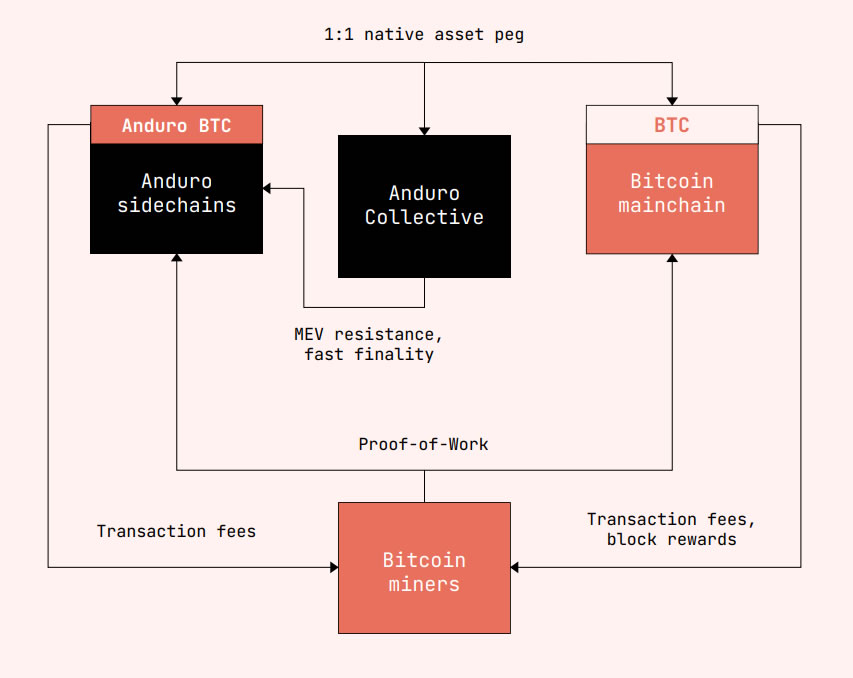

It’s value noting how Anduro contrivance an revolutionary arrangement called “merge-mining“, which permits Marathon to create concurrently from both Bitcoin mining and transaction charges of the fresh blockchain, all with safety against MEV attacks.

On the heart of the mission is the “Anduro Collective“, a form of heterogeneous consortium light of entities notably dedicated to Bitcoin, that would perhaps seemingly address the governance of the chain

in the early phases of existence and should tranquil incessantly be abandoned with other decision-making ideas no longer in accordance with believe.

Source: Litepaper Anduro

As highlighted by Fred Thiel, president and CEO of Marathon, the Bitcoin ecosystem needs a shake-up from an architectural point of leer of the blockchain, in a position to supporting a brand fresh wave of innovation:

“We mediate in experimentation, iteration, and letting the market tell which solutions are successful. Anduro is one of those solutions that affords payment to Bitcoin holders and application developers, while moreover strengthening the long-period of time sustainability of Bitcoin’s Proof-of-Work.”

The layer-2 will not be any longer live but; at this stage Marathon is focusing on discovering “influential and aligned” commercial companions in a position to investing in the mainstream adoption of Bitcoin.

Marathon’s financial performance and prognosis of the MARA inventory

On the identical day as the announcement of the Bitcoin Anduro layer-2, the Marathon Digital miner famend the unlock of fourth quarter financial results recording info in stable recount in comparison to the old year.

In specific, the cryptocurrency miner reported a get profit of 261.2 million greenbacks (1.06 greenbacks per diluted share) which stands out from the get lack of 994 million greenbacks (6.12 greenbacks per diluted share) recorded in the final quarter of 2022.

The revenues elevated by 229% to $387.5 million in 2023 starting from a scandalous of $117.8 million in 2022.

Obviously, the wonderful performance is thanks to the healthiness of the Bitcoin blockchain, the save the firm bases its core industrial: block production in 2023 for Marathon became once bigger than 210% elevated than final year, thus managing to mine more coins that on the identical time boast an elevated payment on average of 101%.

The revenues of Marathon simply listed the truth is basically reach from the sale of the Bitcoins mined from the community, having liquidated about 74% of what became once produced in the calendar year.

The miner’s stable financial arrangement is confirmed by the records on the liquidity of the firm, which as of December 31, 2023 held $357.3 million in unrestricted and an identical funds in its stability sheet as neatly as to a stability of 15,126 bitcoins.

Overall, money and bitcoin quantity to 997.0 million greenbacks, prepared to be invested or frail to enhance your online industrial construction.

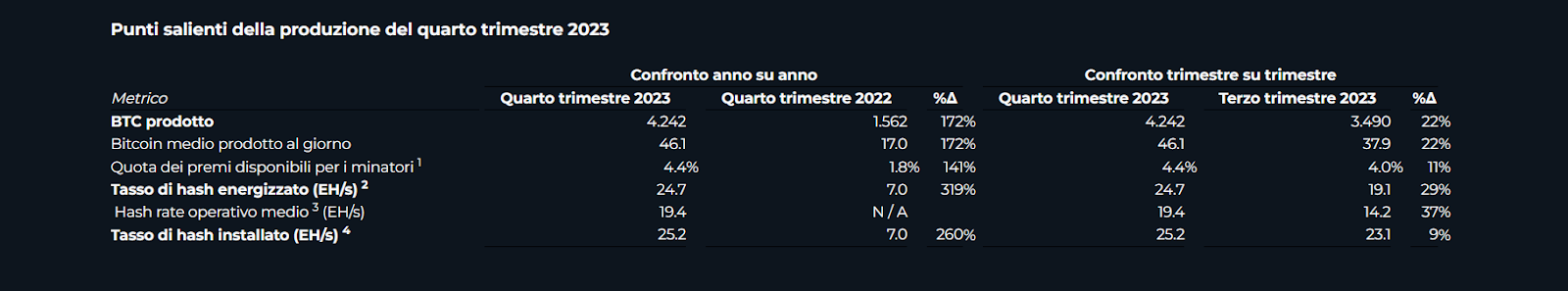

Below is a snapshot of Marathon’s mining production, with a year-over-year and quarter-over-quarter comparison.

For more info you would possibly perhaps consult the press unlock from the firm the save all financial info are detailed.

In a context enjoy this, made largely obvious by Marathon’s stable presence in Bitcoin mining, the MARA inventory can have an even time a revived designate trail after a disastrous 2022.

Following a 95% drawdown from the highs of November 2021 to the lows of January 2023, the inventory listed on the Nasdaq reports an total designate recount of 650% up to the contemporary day.

In contrast with March 1, 2023, the amplify in the value of MARA shares became once as an different 300%, pushed by the recovery of the crypto market.

The payment trail so bullish of Bitcoin, has positively influenced the performance of the mining inventory, whose fate depends on that of the digital gold that the firm extracts day-to-day.

MARA even items an elevated volatility in comparison to its underlying Bitcoin, with very evident mood swings in the center of bull and admire market phases.

In the intervening time costs are keeping above the 50-week EMA and are combating the $30 threshold that separates the inventory from one more bullish leg up.

Even though we would inquire of a runt correction for the inventory at this point, notably if Bitcoin does no longer develop positively, the course from right here to the following couple of months for MARA is marked upwards.

Indicatively, we inquire of it to save on the least 50 greenbacks, notably if Marathon manages to be triumphant amongst the Bitcoin neighborhood with the start of the layer-2 Anduro.