A Bitcoin whale, dormant since advance Bitcoin’s genesis block, neatly suited moved $634,000 in BTC to the Kraken alternate. This transfer, flagged by crypto intelligence platform Arkham on X, comes from a pockets preserving $73.4 million in Bitcoin and ought to tag shifts in market sentiment with the BTC label hovering around $63,870.88.

Here’s no longer the principle time this whale has made waves. Correct a month ago, they transferred one other part of their holdings, marking their reemergence after years of inaction.

ANCIENT BTC WHALE MOVES ANOTHER $600K TO KRAKEN

A prolonged-dormant whale preserving $73.4M Bitcoin who wakened 1 month ago moved one other $634K BTC to Kraken this morning.

His BTC used to be mined ONE MONTH after Bitcoin’s genesis block. pic.twitter.com/PtNqeX3vdK

— Arkham (@ArkhamIntel) October 7, 2024

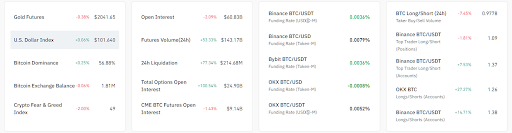

The most neatly-liked market records displays a combination of volatility and cautious sentiment right thru cryptocurrencies and commodities. Bitcoin’s label rose by 2.06% within the past 24 hours. Its trading quantity hit roughly $29.64 billion, demonstrating real investor curiosity. Moreover, Bitcoin’s market capitalization is now at $1.26 trillion. The circulating offer holds at 19,764,400 BTC, with a most offer of 21 million BTC.

In other places, the broader market ambiance is experiencing fluctuations. Gold futures fell by 0.38%. Nonetheless, the U.S. buck Index saw exiguous strengthening. Bitcoin’s dominance remained real at 56.86%, while alternate balances dropped.

This decline suggests that traders are lively their Bitcoin holdings off exchanges, potentially to wintry storage or private wallets. This habits in most cases aligns with a decrease in selling stress. When fewer Bitcoins are readily available on exchanges, it outcomes in a offer squeeze that can have a definite have an effect on on BTC label.

Trading Job and Trends

Futures trading has considered a surge no longer too prolonged ago, with a critical 53.3% elevate in quantity. Also, there used to be a appealing upward push in liquidations, pointing to heightened market volatility.

Funding rates paint a blended picture of trader sentiment. While OKX’s BTC/USD pair shows a rather bearish bias with a negative funding payment, its BTC/USDT pair indicates bullish sentiment. Both Binance and Bybit lean in opposition to prolonged positions with definite funding rates right thru their BTC/USD and BTC/USDT pairs. Prolonged/instant ratios on Binance and OKX point to a cautious shift, with more traders picking instant positions.

Technical Indicators

Most modern technical evaluation paints a bullish picture for Bitcoin. The Relative Power Index (RSI) hovers around 56.53, indicating real upward momentum. While no longer but in overbought territory, this means additional label will enhance are that you may maybe well maybe reflect of.

Most modern technical evaluation unearths appealing insights. The Relative Power Index (RSI) sits at 56.53, indicating that Bitcoin is nearing the greater neutral zone. While it has no longer but entered overbought territory, this implies that the asset is gaining momentum.

If purchasing for stress continues, Bitcoin may maybe maybe also retain its upward trajectory. Nonetheless, warning is informed because it approaches the overbought threshold.

Read furthermore: Bitcoin Whales HODLing: Are They Anticipating Retail Traders?

The Transferring Lifelike Convergence Divergence (MACD) additional supports this bullish outlook. Though the MACD line, 572, is at the second below the tag line, 781, the hole is narrowing, hinting at a seemingly bullish crossover. This crossover, if confirmed, may maybe maybe also trigger a surge in purchasing for process. Crimson bars on the histogram command that bearish momentum exists, despite the indisputable truth that it appears to be weakening.

Institutional Hobby

Bitcoin’s October efficiency has shown just a few promising trends. After seven days of trading, Bitcoin is within the golf green for the month. Historical averages from 2013 to 2024 command a seemingly elevate of 21%. Plus, a upward push of 15% may maybe maybe also push Bitcoin to hit a recent all-time excessive (ATH) this month.

#Bitcoin de Ekim ayı için 7 gün sonra yeşile döndü. 2013-2024 yılların ortalaması +%21. ATH için %15 yeterli.

Şayet bu gerçekleşirse, bu ay içinde $BTC için tekrar ATH göreceğimiz anlamına gelir.📈 pic.twitter.com/vMKNbutXz5

— MAMcrypto (@mamiicrypto) October 7, 2024

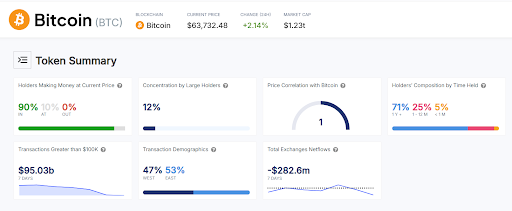

Bitcoin has roughly 90% of holders in profit, and its market capitalization has climbed to $1.23 trillion. What’s more, mammoth holders now contain 12% of the total offer. Correct closing week, transactions over $100K topped $95 billion, exhibiting necessary institutional curiosity.

The records indicates a bullish sentiment as Bitcoin experiences a win outflow of 282.6 million BTC from exchanges. This pattern displays growing self belief amongst traders, as many resolve to retain their sources in suppose of promote. Severely, 71% of holders have maintained their Bitcoin for over a twelve months, underscoring their perception in Bitcoin’s prolonged-term seemingly.

Disclaimer: The records supplied in this article is for informational and academic functions thoroughly. The article does no longer portray monetary advice or advice of any kind. Coin Model is no longer to blame for any losses incurred as a outcomes of the utilization of protest, merchandise, or services and products mentioned. Readers are informed to deliver warning earlier than taking any circulation associated to the firm.