Bitcoin (BTC) has confirmed signs of a relief rally this week, offering a glimmer of hope to investors after the fresh market downturn.

Despite this transient uptick, analysts are warning that the upward momentum would possibly presumably well well now not final lengthy.

Will Bitcoin’s Rally Closing?

In step with records from BeInCrypto, Bitcoin’s designate has recovered by 2.0% over the final week. The good points enjoy more than doubled over the fortnight, with the coin appreciating by 5.0%. On the time of writing, the supreme cryptocurrency traded at $87,381, representing a diminutive 0.1% dip over the final day.

Discipline Bitcoin alternate-traded funds (ETFs) enjoy moreover considered inflows for nine consecutive days, in step with records from SoSo Worth. Since final Friday, the ETFs enjoy collectively attracted $944 million in inflows.

This sustained ardour suggests rising self assurance amongst institutional investors. But, analysts are unconvinced of the rally’s possible.

In its most stylish Cryptocurrency Compass publication, be taught company Fairlead Suggestions predicted that Bitcoin’s relief rally would possibly presumably well well persist for but any other one to two weeks. On the opposite hand, founder Katie Stockton warned that a designate tumble would possibly presumably well well note.

“Intermediate-term momentum is to flinch, and the weekly stochastics have to now not but oversold, rising threat that the rebound is fleeting. We take a look at the same for many threat property,” she wrote.

Despite the bearish outlook, Stockton acknowledged transient positives. Bitcoin’s approach-term momentum has improved, and the associated price soundless has room to upward push sooner than hitting overbought territory. On the opposite hand, she cautioned that this window would possibly presumably well well shut by month’s pause.

This would possibly well presumably well well doubtlessly plan off a section of consolidation—or “digestion.” This implies that Bitcoin’s upward momentum would possibly presumably well well sluggish down or pause for a longer duration because the market adjusts and absorbs the fresh good points.

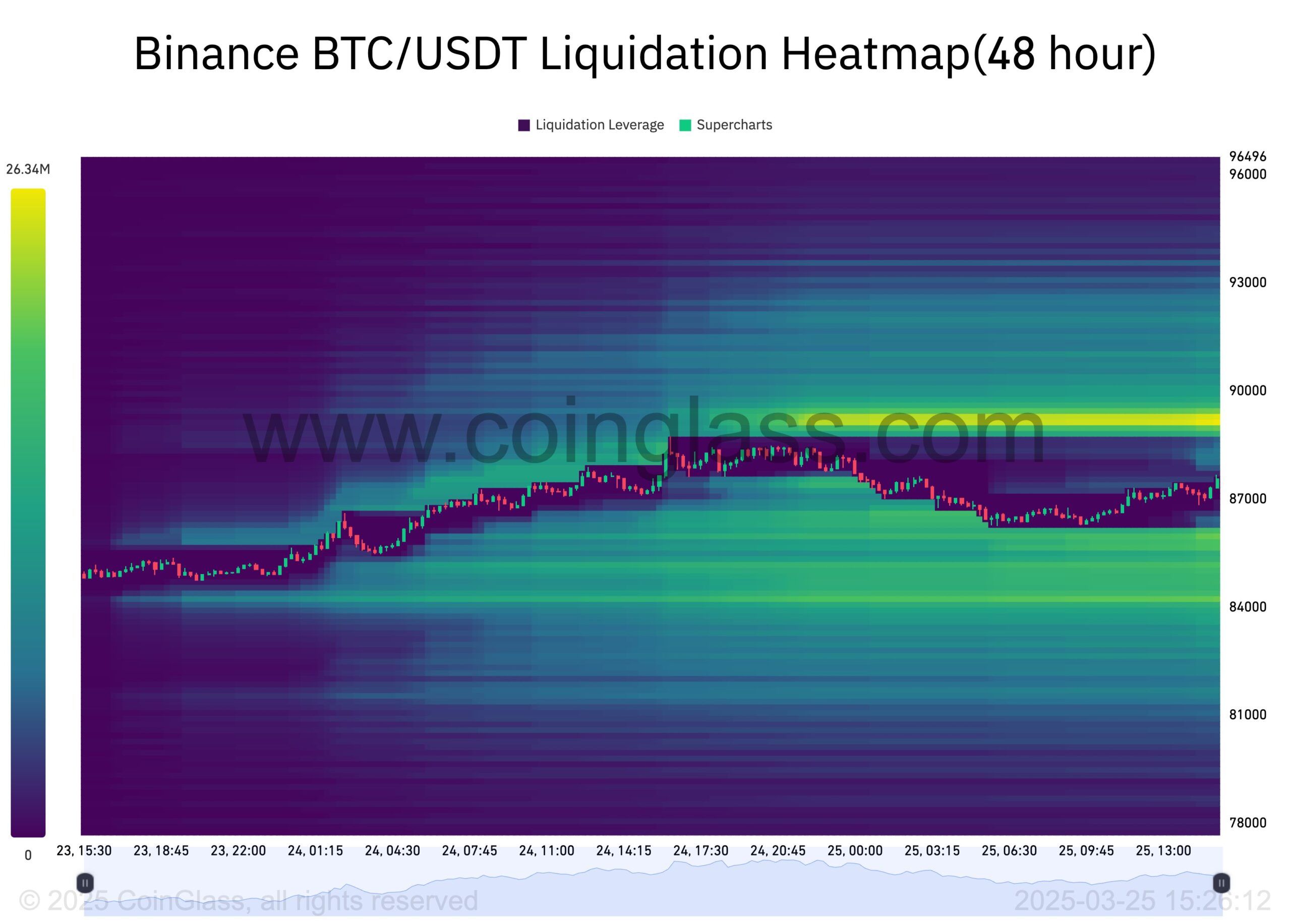

One other analyst moreover shared a cautious outlook. In a fresh publish on X (formerly Twitter), Koroush AK estimated Bitcoin’s possible designate movements utilizing a liquidation heatmap.

He favorite that there’s significant selling stress around $89,000 (fundamental present) and shopping ardour around $85,000 (question).

“The postulate of a HTF uninteresting cat bounce is soundless accurate if designate reverts on the highs exact by the ≈$90K key zone,” he wrote.

For context, a “uninteresting cat bounce” refers to a transient restoration or transient upward movement in the associated price of an asset after a extended downtrend. Right here’s adopted by a continuation of the downtrend. On the opposite hand, he added that the bearish scenario would be nullified if Bitcoin manages to destroy past the resistance level.

Meanwhile, changing macroeconomic prerequisites are moreover a rising distress, specifically with US President Donald Trump’s tariff bulletins scheduled for April 2. Of their fresh listing, K33 Evaluate wired that although markets are in the intervening time stable, the upcoming tariff choices would possibly presumably well well plan off substantial volatility available in the market.

“Tariffs live the foremost producer of market-appealing headlines, rendering most traders threat-averse as we design a tremendous day of tariff bulletins on April 2,” the listing be taught.

The listing further told caution and suggested warding off leverage due to the the anticipated tariff-introduced on volatility.

Lately, BeInCrypto moreover explored how Trump’s tariff plans would possibly presumably well well impression crypto markets. High tariffs would possibly presumably well well stress threat property love Bitcoin, doubtlessly mirroring the market’s response in February. Conversely, if tariffs are delayed or utilized selectively, investor fears would possibly presumably well well ease. This, in turn, would possibly presumably well well result in a doable restoration in crypto prices.