The cryptocurrency market has requisite changes, main many analysts to caution towards investing in altcoins.

Historically, bull markets contain considered Bitcoin and Ethereum upward push first, followed by altcoins. Nonetheless, latest conditions imply a shift on this pattern.

Why Shopping for Altcoins Now Is Dreadful

Quinn Thompson, founder of the crypto hedge fund Lekker Capital, suggested towards investing in altcoins right this moment. He pointed to several indicators of market instability, together with excessive leverage and open ardour, an absence of scare-pushed buying for, and stagnant stablecoin provide.

He believes the market is experiencing increased selling rigidity, in particular from project capital funds needing to elevate capital, which ends in extra selling than buying for. This topic, blended with low summer trading volumes, makes it not easy for altcoins to reach traction.

“I’ve there would possibly perhaps be serious cascade risk in crypto, and in explicit, expect most altcoins to be taken out assist. The market appears to be like to contain lost any capability to jump, even in majors, while at the identical time, leverage and open ardour remains excessive,” Thompson acknowledged.

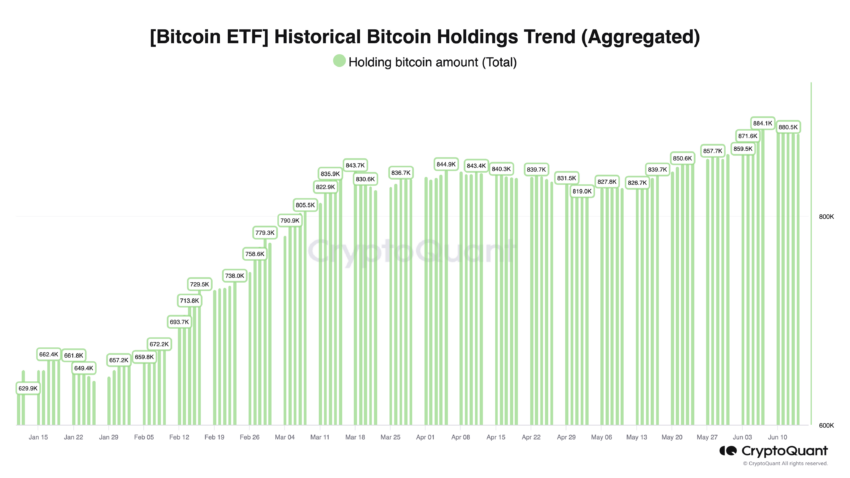

Thompson identified two most necessary reasons for his stance. First, the affect of Bitcoin and Ethereum substitute-traded funds (ETFs) and the converse of altcoin provide inflation.

The introduction of Bitcoin and Ethereum ETFs has modified the market construction. In the previous, capital would float from most necessary cryptocurrencies love Bitcoin and Ethereum into altcoins during bull markets. Nonetheless, with over $50 billion now invested in Bitcoin ETFs, these funds attain not contain identical mechanisms for investing in altcoins.

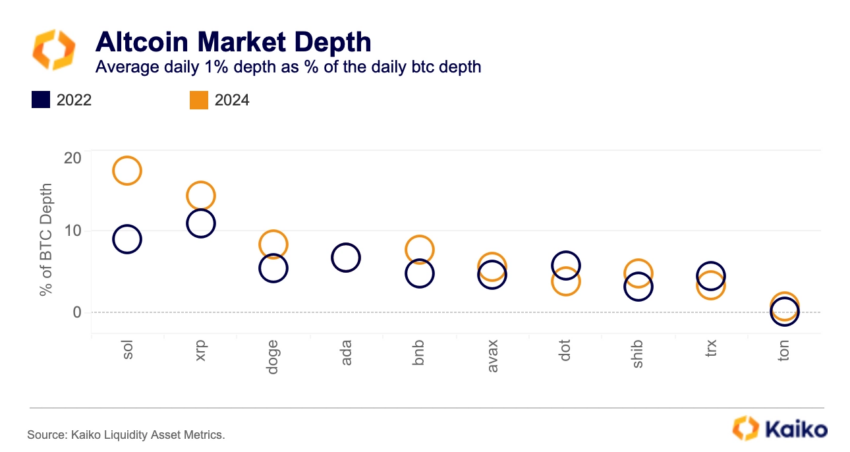

This shift has restricted the capital on hand to altcoins, making it extra tough for them to upward push in payment. In line with Samara Epstein Cohen, Chief Investment Officer of ETF at BlackRock, feeble market participants increasingly focal point on Ethereum for tokenization, which further sidelines altcoins.

Be taught extra: How To Make investments in Actual-World Crypto Resources (RWA)?

The expeditiously open of latest altcoins has furthermore flooded the market, creating necessary inflationary rigidity. Many initiatives release sizable portions of tokens aggressively, main to a provide that far exceeds inquire of of.

Thompson identified that there’s an absence of inquire of of to beef up the approximately $3 billion of monthly altcoin provide inflation expected over the next one to 2 years. Whereas some altcoins must gentle put effectively, figuring out these a success tokens will be extra not easy than in old years.

“Altcoins contain a fixed crawl of promote rigidity. As we enter an already low-volume summer interval, the combo of great token provide unlocks and project capitalists’ promote rigidity is ceaselessly too solid of an uphill fight for tons of tokens,” Thompson concluded.

Meanwhile, Will Clemente, co-founder of Reflexivity Study, reflected on how the market has matured. In 2020, investing in excessive-beta altcoins change into as soon as a a success strategy as these resources outperformed Bitcoin. Nonetheless, this capability is now not efficient.

Many altcoins contain underperformed Bitcoin in latest months, indicating that the market dynamics contain modified.

“In 2020, you exit on the probability spectrum, those things are going to contain higher beta to Bitcoin and likewise you honest rating lengthy the entire vaporware and all that stuff goes up. We now have not considered that this time. Loads of the altcoin to Bitcoin pairs contain honest been bleeding out for several months now and it hasn’t essentially been as easy as honest purchase whatever vaporware altcoin and likewise you’ll outperform Bitcoin,” Clemente emphasized.

Technical analyst Michaël van de Poppe highlighted that Bitcoin is shut to or at an all-time excessive, while most altcoins have not reached their old peaks. This discrepancy indicates an absence of self belief in altcoins, which continue to war within the latest market surroundings, suggesting that the times of easy gains from altcoins would possibly perhaps perhaps also very effectively be lined.

Be taught extra: 10 Splendid Altcoin Exchanges In 2024

Buyers wants to rep in mind of the heightened risks and protect in mind new conditions sooner than making decisions within the cryptocurrency market.