Bitcoin (BTC), after briefly reclaiming the $61,000 stamp stamp the day long gone by has now fallen under it persevering with its bearishness as of at present time. Amid this unfavorable stamp circulation, the asset’s hash stamp, a key metric reflecting miners’ profitability, has reached traditionally low phases.

In step with a as a lot as the moment prognosis by Woominkyu, a CryptoQuant analyst, this fundamental fall in hash stamp would possibly perchance signal a top procuring opportunity for investors.

Thought The Hash Mark And Its Relation To Buying for Opportunity

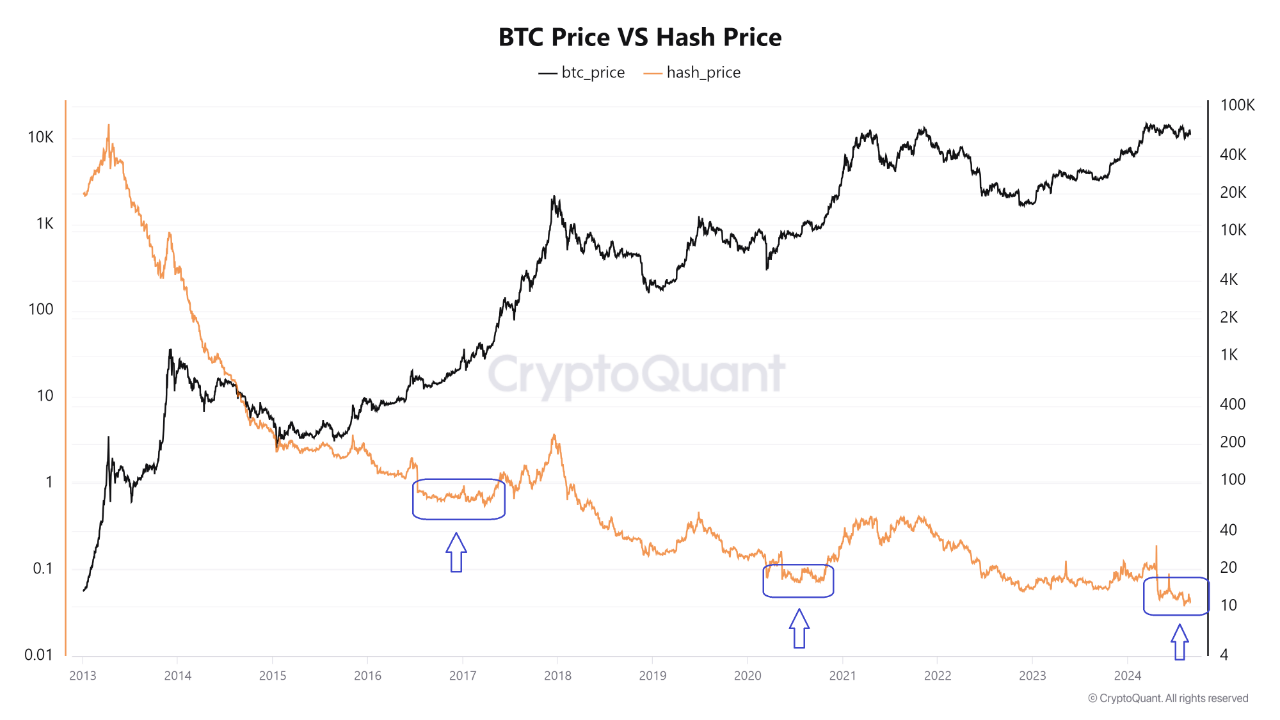

Woominkyu revealed in his prognosis that the hash stamp, which measures the connection between Bitcoin’s stamp and the income miners generate per unit of computational energy, has shown a fixed pattern. When this metric falls to lower phases, it usually coincides with Bitcoin’s stamp bottoming out.

Woominkyu’s extra shared a chart highlighting that the blue-unlit sections on the chart signify lessons where the hash stamp dipped, a lot like instances when Bitcoin’s stamp became as soon as at or near its lowest facets.

The historical files means that these lessons were followed by fundamental stamp recoveries. Woominkyu believes that the unique low hash stamp would possibly perchance point out that Bitcoin is near a bottom, presenting a possible procuring opportunity for lengthy-duration of time investors.

Lowest Bitcoin Hash Mark Indicating the Purchase Opportunity

“The highlighted sections within the chart point out lessons where the Hash Mark dropped to lower phases, a lot like instances when #Bitcoin prices were furthermore at or near their lowest facets.” – By @Woo_Minkyu

Link 👇… pic.twitter.com/ZPf0cSTnNN

— CryptoQuant.com (@cryptoquant_com) August 30, 2024

Yet one more Analyst Aspects To Re-Accumulation Bitcoin Portion

Echoing Woominkyu’s sentiment, but any other infamous crypto analyst usually known as Moustache shared insights on the Puell More than one, a metric dilapidated to assess Bitcoin’s market cycles.

The Puell More than one, which compares the each day issuance of Bitcoin to its historical life like, is at the moment at a level that Moustache believes offers the 2d-most though-provoking “re-accumulation” opportunity since 2022.

In a put up uploaded on X earlier at present time, Moustache emphasised that Bitcoin’s unique market map is equivalent to previous fundamental lessons in 2012, 2016, and 2020.

These were instances when the market became as soon as primed for tall upward movements following an aspect of consolidation.

#Bitcoin – The Puell More than one

I name it right here: Here is your 2d most though-provoking chance after 2022 to re-win earlier than the following wave begins.$BTC is where it became as soon as in 2012, 2016 and 2020.

Even if it doesn’t feel admire it, I dangle we’ve some extremely interesting months sooner than us. pic.twitter.com/lpVXQOXvtC

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) August 30, 2024

Moustache advised that despite the unique sentiment, the following few months would possibly perchance issue “extremely interesting” tendencies for Bitcoin.

Featured image created with DALL-E, Chart from TradingView