Analysts possess raised Bitcoin’s ticket target to $112,000 following a spike in substitute-traded fund (ETF) inflows.

This elevated activity suggests bullish sentiment among institutional investors, doubtlessly riding the cryptocurrency to new highs.

Bitcoin ETF Inflows to Trigger Label Increase

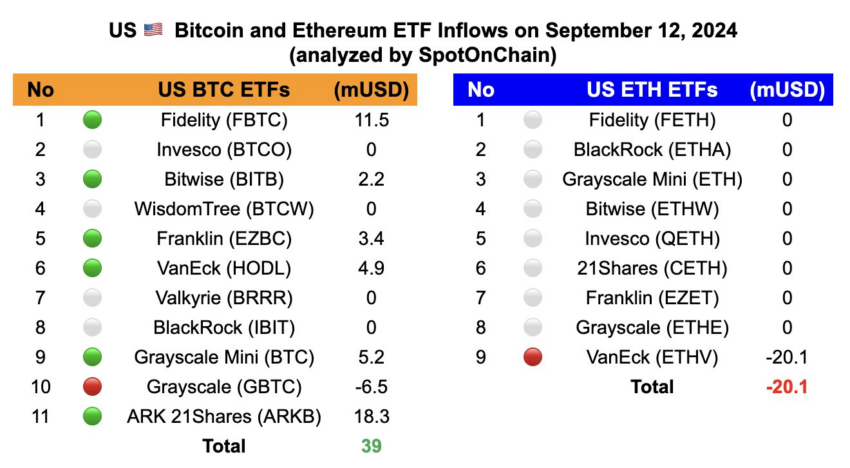

SpotOnChain analysts reported well-known inflows into Bitcoin ETFs. Bitcoin’s fetch float grew to change into walk, with $39 million in inflows, reversing old weak volumes.

In distinction, Ethereum ETFs saw fetch outflows for the 2nd consecutive day, with Grayscale’s ETHE experiencing a $20 million outflow, while a form of US Ethereum ETFs had zero fetch float.

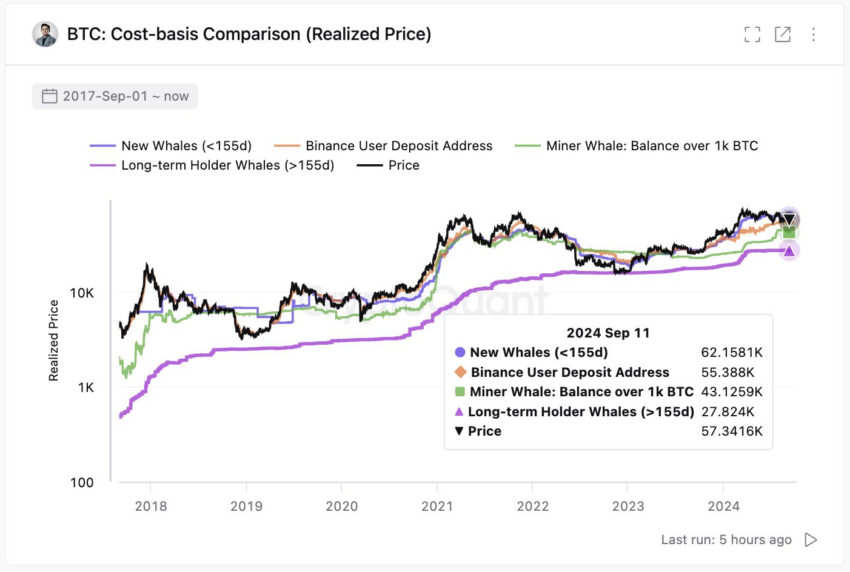

The walk inflows happen when Bitcoin ETF investors’ ticket basis is elevated than Bitcoin’s ticket. CryptoQuant CEO Ki Younger Ju distinguished that the worth basis for “Unique Custodial Wallets/ETFs” is $62,000, while Bitcoin trades at round $57,000.

Primarily primarily based on Ark Make investments Compare Accomplice David Puell, these market stipulations imply that the in vogue ETF investor also can simply be at a loss. Composed, the historic perspective reinforces the possibility of worthy upward movement

“When measured towards bitcoin’s rolling yearly highs, the p.c ticket drawdown in 2024 aloof suggests the roughly correction associated historically with bitcoin’s bullish indispensable traits, admire these seen in 2016 and 2017, let’s utter,” Puell stated.

The convergence of elevated ETF inflows, institutional accumulation, and historic patterns contributes to the consensus among analysts that Bitcoin is poised for a well-known rally. Miky Bull, let’s utter, raised his Bitcoin ticket target of $112,000, reflecting self assurance in the cryptocurrency’s ability to surpass old highs.

“Bitcoin to a first target of $112,000 this one year. History has indeed prevailed. In 2016 and 2020 Q4 put up-halving witnessed the starting of a parabolic rally to a cycle high,” Bull affirmed.

Learn extra: Bitcoin (BTC) Label Prediction 2024/2025/2030

His prognosis aspects to Bitcoin’s cyclical ticket movements, especially following halving events that decrease mining rewards and precede astronomical ticket increases. The most modern spike in ETF inflows might possibly well presumably help as a catalyst, influencing investment and adoption.