Altcoins are braving turbulent market prerequisites as Q3 nears its pause, leaving merchants serious about what Q4 would possibly per chance perchance perchance well bring.

September is incessantly a month of heightened caution, but Analyst Michael Van De Poppe believes the tide would possibly per chance perchance perchance well simply shift this year, with definite tokens poised to shine.

Repeating History? No longer in actual fact

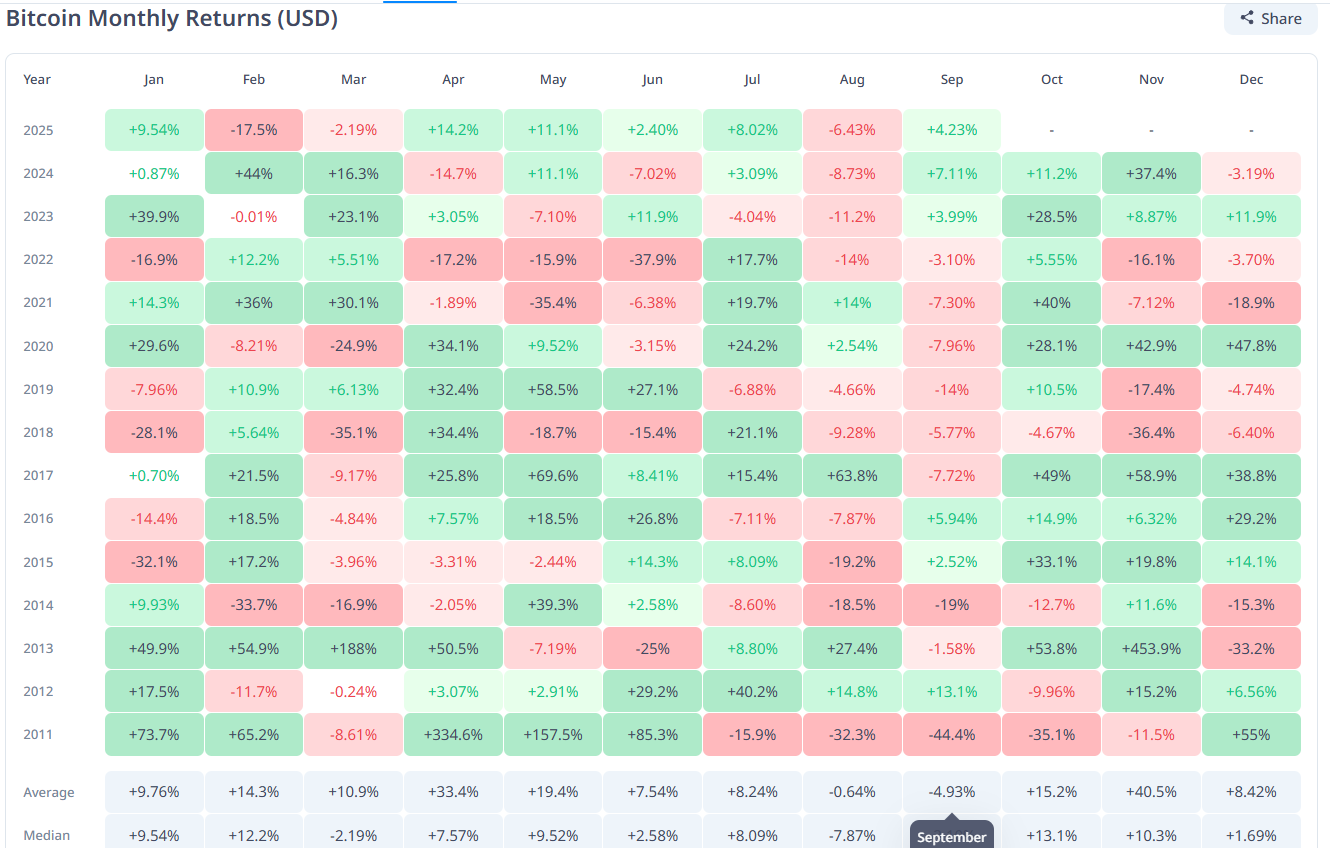

Traditionally, September has been the weakest month for Bitcoin and altcoins. Files exhibits that Bitcoin averaged a 5% decline during the month, making it the correct constant shedding duration for the crypto leader. Such drops in total lunge altcoins decrease as wisely.

Nonetheless, talking to BeInCrypto, analyst Michael Van De Poppe suggested this cycle would possibly per chance perchance perchance well smash custom. He argued that altcoins bear favorable prerequisites to face up to Bitcoin’s seasonal weak point.

“It’s pretty that this cycle has been totally diverse than the old cycles and that’s why I contain that this cycle will proceed to be diverse than the old ones. In most as a lot as the moment years, the markets bear viewed a correction in August and a bullish destroy result for September. I contain that we’ll be on the head of the correction slightly quickly, which would most likely signal that altcoins are going to outperform Bitcoin, and I contain that we’ll peep a bullish Q4,” talked about Michael.

FOMC Rate Resolution

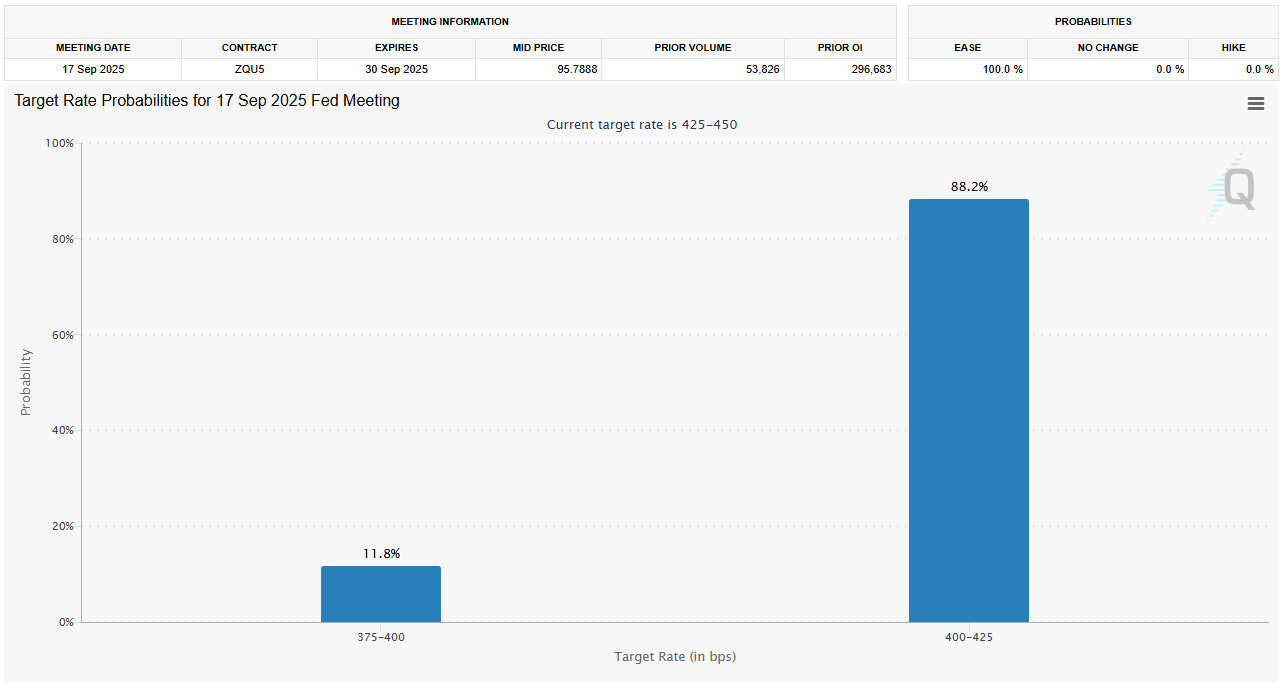

One factor utilizing optimism is the upcoming Federal Initiate Market Committee (FOMC) assembly. The U.S. central monetary institution is expected to in the crop rate of hobby rates for the principle time this year. Currently at 4.25% – 4.50%, the forecast is for the FOMC to carve the rates by 25 bps, bringing them to 4.00% – 4.25%.

The CME FedWatch Application exhibits an 88% probability of this destroy result, fueling investor self assurance. A rate in the crop rate of would ease monetary prerequisites, strengthen liquidity, and enhance bigger-menace resources admire cryptocurrencies. For altcoins, this can spark inflows as merchants learn about issue alternatives.

“The trade cycle and the monetary expansion haven’t been in the correct native weather for menace-on resources, admire altcoins, to surge. Nonetheless, as Ethereum is the principle mover, it’s expected to behold strength from the total crypto market when a rate in the crop rate of and monetary expansion is going to rob problem. Basically the most as a lot as the moment stage of the cycle is equivalent to Q4 2019 or Q1 2020,” Michael acknowledged.

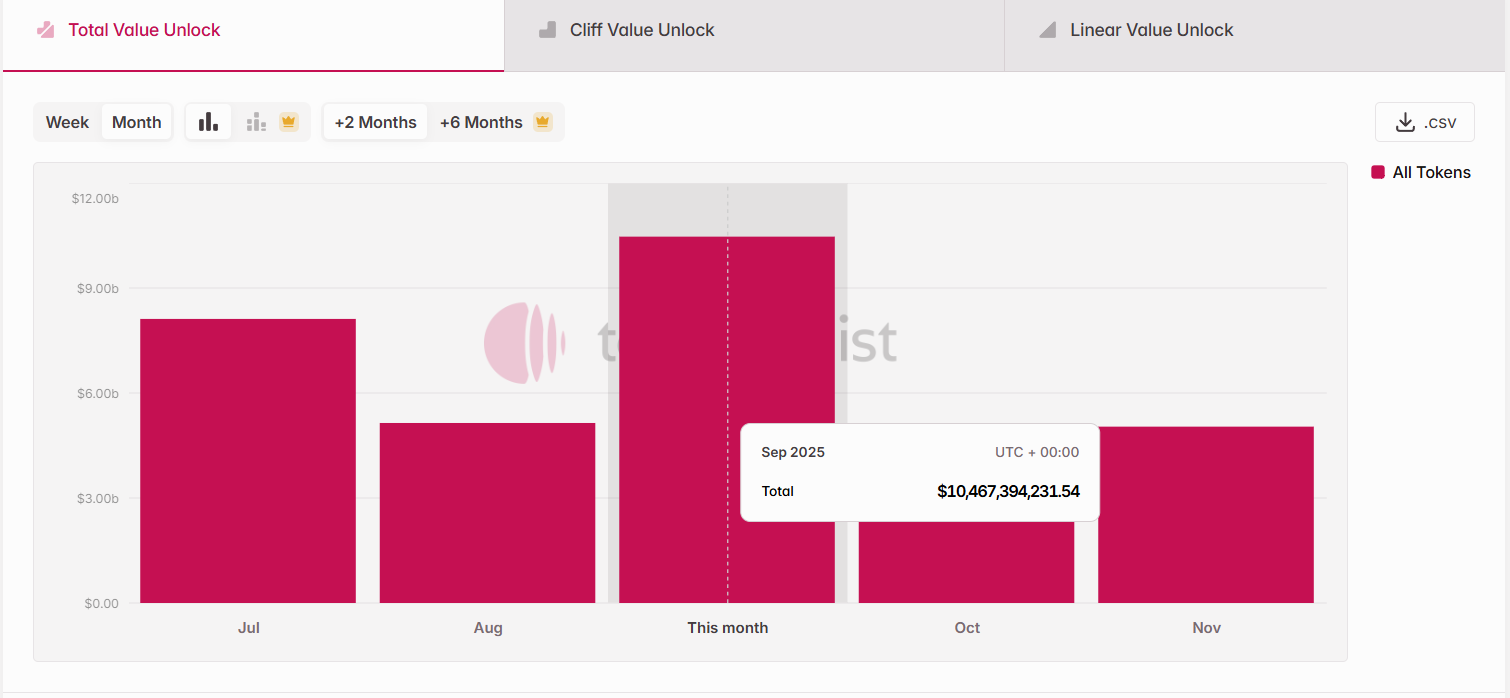

$10 Billion Token Unlocks Forward

Adding to the cautious optimism, BTC and altcoins, in September, will peep token unlocks rate with reference to $10 billion. Regularly, huge unlocks weigh heavily on prices by flooding the market with offer. This dynamic in total suppresses features and results in sell-offs.

This time, nonetheless, bullish cues during the broader market would possibly per chance perchance perchance well simply cushion the impact. With bettering sentiment and ability macroeconomic enhance, altcoins would possibly per chance perchance perchance well rob in the provision influx.

“Almost every time, the unlocks are being rolled over via fresh OTC contracts, so the correct impact of the unlock is reach zero. Nonetheless, it’s most likely that money that don’t bear any unlocks are inclined to outperform money that attain bear unlocks. That’s something to absorb tips ought to you’re building one intention for your self,” Michael in actual fact useful BeInCrypto.

Altcoins To Leer

Talking to BeInCrypto, Michael highlighted that in the coming days, the altcoins to seek forward to will mostly be from the DeFi and DePIN sectors, as wisely because the ETH Ecosystem.

“These are the three explicit verticals for me which would be most likely going to attain wisely, and we’ve viewed the principle signs of such a season with Chainlink initiating to fire up, but furthermore the large expansion on the stablecoin facet,” Michael renowned.

Chainlink’s keep is up 5% previously 24 hours, trading at $23.64. The altcoin is attempting to flip $23.40 correct into a solid enhance floor, which would provide steadiness and doubtlessly serve merchants to push LINK towards bigger ranges.

The Parabolic SAR, at show off appearing above the candlesticks, is transferring downward, suggesting a most likely switch below them. The kind of alternate alerts an brisk uptrend for Chainlink. This momentum would possibly per chance perchance perchance well gasoline a rally, enabling LINK to scheme $25.81 resistance and enhance its recovery route.

If bearish prerequisites persist in the broader market, LINK would possibly per chance perchance perchance well simply battle to withhold momentum. A failure to preserve $23.40 would possibly per chance perchance perchance well result in a decline, doubtlessly dragging the associated charge to $22.06 or decrease, thereby invalidating the short-duration of time bullish outlook for the altcoin.

The submit Analyst Suggests These “Altcoins Will Possible Outperform Bitcoin in Q4″ looked first on BeInCrypto.