Bitcoin (BTC) has surged 7% staunch by the last two weeks, rallying from $59,400 to $69,300. This intriguing restoration has reignited market optimism, with an analyst figuring out lots of key factors suggesting a doubtless bullish breakout for Bitcoin.

With the U.S. Presidential election factual two weeks away, merchants and analysts are closely searching at how key occasions, just like the election and ancient worth cycles, would possibly space off Bitcoin’s next indispensable transfer.

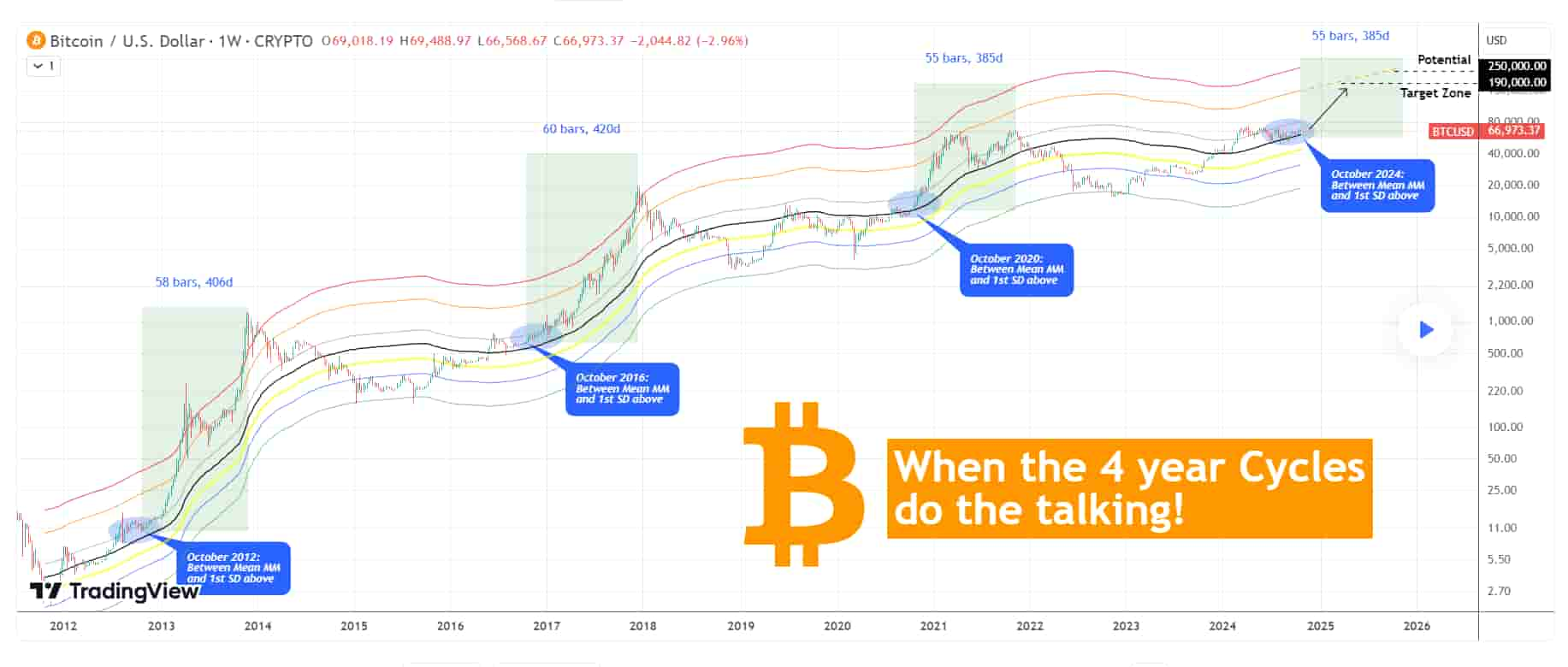

Significantly, an prognosis by TradingShot leverages the Mayer Extra than one Band, with Bitcoin hinting at a that you would have confidence bullish breakout that aligns closely with its established four-one year cycle sample.

Historical 4-one year cycles: A blueprint for the subsequent rally

In step with TradingShot, Bitcoin’s worth has demonstrated a relentless four-one year cycle, the place it tends to endure indispensable bull runs after sessions of accumulation and consolidation.

As of gradual October 2024, Bitcoin’s worth is shopping and selling between the Point out Mayer Extra than one (MM) line and the 1st recurring deviation (SD) above it, a sample that has looked at an identical factors in previous four-one year cycles.

This vary used to be also evident in October 2020, October 2016, and October 2012, exhibiting a repeating sample of worth habits.

In every occasion, Bitcoin rallied from this space to galvanize extended bull runs. In October 2012, Bitcoin peaked 58 weeks later; in 2016, it took 60 weeks; and in 2020, the pinnacle took place in 55 weeks.

If Bitcoin follows this sample, analysts wait for its next top would possibly presumably occur by mid-November 2025, assuming it adheres to the minimal 55-week scenario. The four-one year cycle means that the cost would possibly presumably all over all but again commence a parabolic rise from this point onward.

The Typical Deviation vogue traces provide additional insights into doubtless worth targets for Bitcoin. In every the 2012 and 2016 cycles, Bitcoin surpassed the 3rd SD, whereas in 2020, it reached the 2nd SD.

Assuming a extra conservative scenario the place Bitcoin easiest reaches the 2nd SD line, the aim worth vary for the upcoming bull flee is at chance of be between $190,000 and $250,000.

Alternatively, Bitcoin’s potential to interrupt by the intense $70,000 resistance diploma is indispensable for this momentum to continue. Failure to breach this diploma would possibly presumably end result in a pullback, stalling the most fresh rally and doubtlessly pushing Bitcoin abet into a consolidation segment.

These projections are grounded in ancient efficiency, but they hinge on lots of key factors that can impression Bitcoin’s future trajectory.

U.S. Presidential election: A key catalyst?

Thought to be one of many most discussed doubtless catalysts for Bitcoin’s next rally is the U.S. Presidential election. Market sentiment indicates that a Donald Trump victory would possibly provide a predominant boost to Bitcoin, with bullish outlooks already being priced in by some analysts.

On October 16, Trump launched his World Liberty Monetary (WLFI) token, although it fell attempting expectations.

While Bitcoin’s ancient cycles and election-pushed catalysts expose bullish doubtless, regulatory headwinds loom. The SEC has incorporated cryptocurrencies in its examination priorities for 2025, signaling doubtless regulatory hurdles that would impression Bitcoin’s trajectory.

Bitcoin worth prognosis

As of press time, Bitcoin used to be shopping and selling at $66,504, a drop of practically 0.5% within the past 24 hours. The monthly chart reveals gains of over 5%.

With Bitcoin on the cusp of one more doubtless breakout, all signs point toward a thrilling and volatile length forward, presumably pushing costs wisely into the six-figure vary.

Alternatively, no matter the favorable ancient precedent, investors must remain vigilant. The market is never any longer immune to external factors, just like macroeconomic situations or regulatory decisions, which would maybe presumably impression this outlook.