Toncoin (TON) has faced a prolonged downturn, struggling to rep upward momentum after a tricky week. Even though it no longer too long ago recorded a little day-to-day develop, the asset remains trapped in bearish territory, shopping and selling underneath the $4 mark.

Without reference to this no longer easy brand performance, analysts counsel that Toncoin would possibly presumably very neatly be nearing a wide accumulation fragment.

Key Metrics Gift Potential Recovery

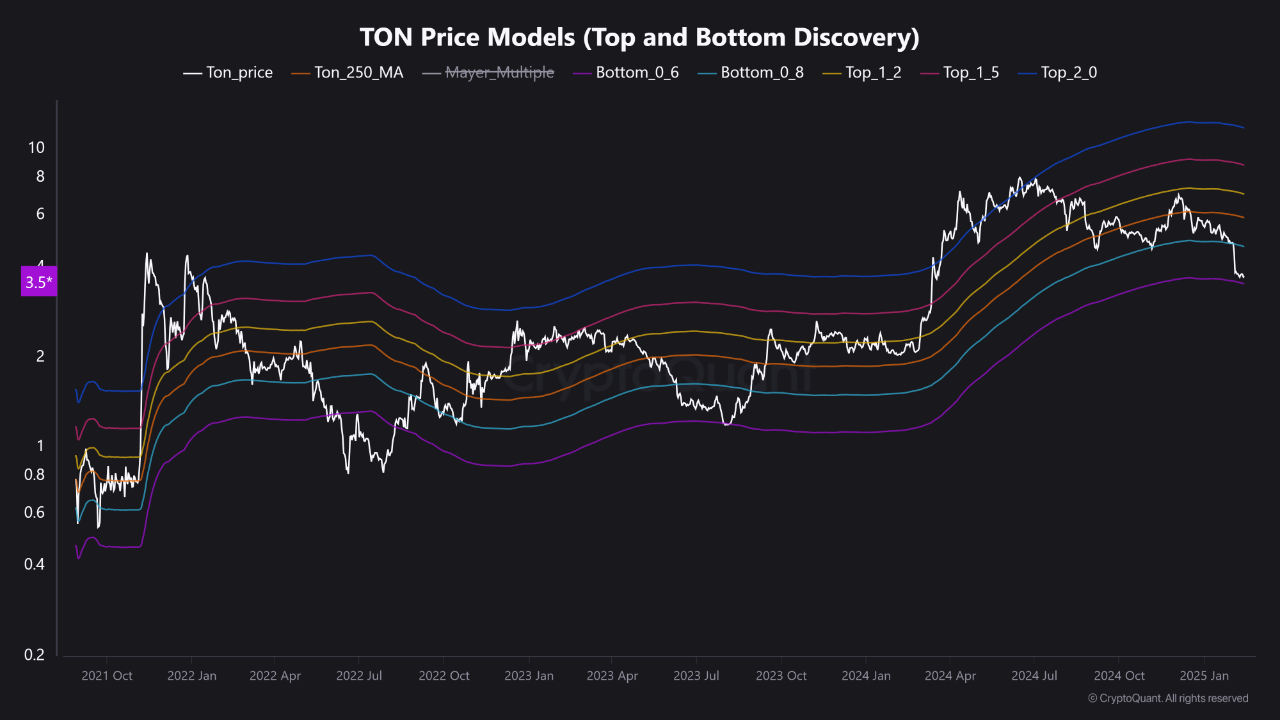

Amid these market stipulations, a CryptoQuant contributor, Crazzyblockk, no longer too long ago shared a detailed outlook on TON. In a post titled “TON Enters Key Aquire Zone – A Top Opportunity,” the analyst outlined key findings from the Ton Ticket Objects.

These items indicate that Toncoin has reached the 0.6x 250-day transferring average bottom zone—historically actually apt as a formidable accumulation level. Crazzyblockk notes that this target=”_blank”>TON is undervalued, presenting a capacity shopping different for long-time duration investors.

Notably, the Ton Ticket Objects leverage ancient info to title oversold stipulations and capacity entry parts. In conserving with Crazzyblockk, property shopping and selling design 0.6x–0.8x of their 250-day transferring average in most cases signal grand buy stipulations.

Historically, these ranges own served as supreme accumulation zones sooner than main market upturns. The analyst emphasised that TON’s contemporary brand explain aligns with old setups which own led to well-known brand recoveries, making it a promising target for target=”_blank”>$3.8 nearing the $4 mark.

Apparently, whereas TON’s brand has risen on the present time, its day-to-day shopping and selling volume is particularly decrease in contrast to final Friday, when the asset became once shopping and selling at a identical brand level. Final Friday, TON’s shopping and selling volume exceeded $214 million. On the opposite hand, as of on the present time, it has reduced to $161.2 million.

Person that it’s doubtless you’ll presumably be able to reflect reason of this fall in shopping and selling volume in total is a shift in investor habits, with some market members holding their positions in decision to actively shopping and selling, potentially in anticipation of persisted brand appreciation.

Talking of brand appreciation, a famend crypto analyst identified as Ali on X has no longer too long ago shared a charming diagnosis on Toncoin the utilization of the TD Sequential indicator.

This indicator is a instrument that helps title capacity pattern reversals and exhaustion parts in brand movements. It works by counting a series of consecutive brand bars that end higher (in an uptrend) or decrease (in a downtrend) than old bars, forming a sequential count.

As soon as the count reaches a particular number—in most cases 9 or 13—the indicator suggests that the present pattern would possibly presumably very neatly be losing momentum and would possibly presumably well mute reverse or quit. In conserving with Ali, TON is on the verge of a rebound basically based mostly on this instrument.

#Toncoin $TON is showing indicators of a capacity rebound as the TD Sequential indicator flashes a buy signal on the weekly chart! pic.twitter.com/nRtabmxjxQ

— Ali (@ali_charts) February 14, 2025

Featured picture created with DALL-E, Chart from TradingView