Bitcoin (BTC) has been on an upward development in new weeks, exhibiting obvious designate actions that appear moderately attention-grabbing to investors.

In step with a new CryptoQuant analysis, a key metric, “keen address momentum,” paints a bullish image for the cryptocurrency.

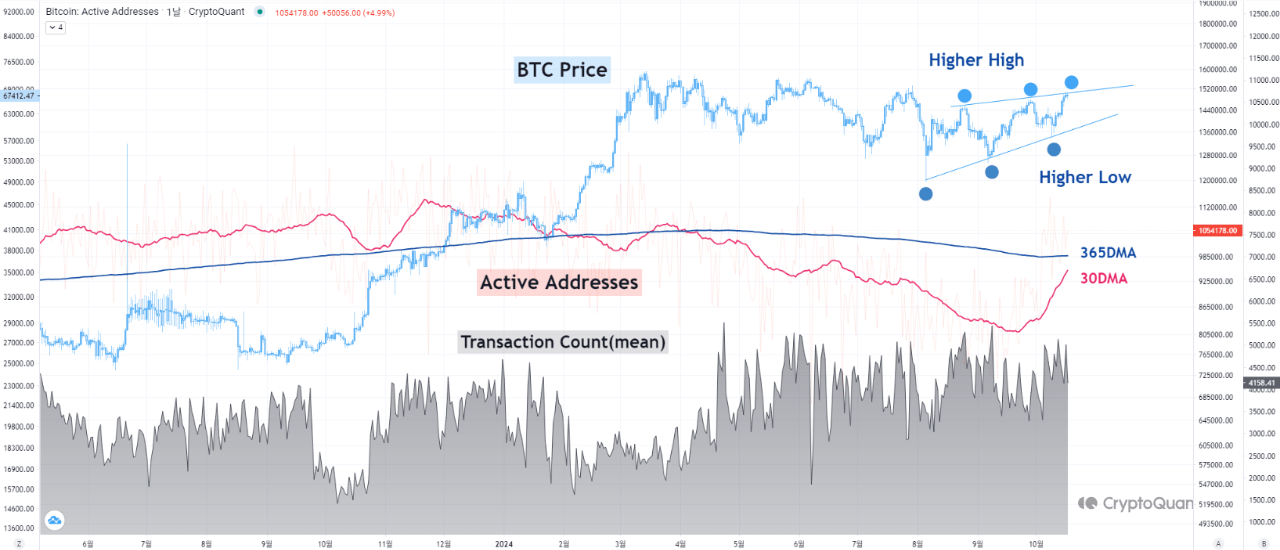

Stuffed with life Address Momentum Signals Upward Market Construction

Stuffed with life addresses signify the form of irregular addresses conducting transactions on the Bitcoin network, offering insights into network assignment and investor engagement.

By making insist of a 30-day keen moderate (30DMA) and a 365-day keen moderate (365DMA) to this indicator, the CryptoQuant analyst would per chance per chance also assess the network’s increasing momentum.

The analyst emphasized that the 30DMA has sharply risen now not too long ago and is closing in on the 365DMA. If a “golden unhealthy” occurs, where the 30DMA surpasses the 365DMA, it would per chance per chance also signal an extra bullish development for Bitcoin, dent finds.

The CryptoQuant analyst added that Bitcoin has considered excessive transaction volumes for the reason that 2d half of of the year, supporting increased network assignment.

Whereas the brand new upward momentum is encouraging, the analyst additionally warned of doable volatility on account of a “rising wedge” formation in Bitcoin’s designate chart—a pattern that also can outcome in important designate swings if the wedge continues to tighten.

Bitcoin Rally To $90,000 In Sight?

Bitcoin’s new designate efficiency has added to the optimism amongst investors. Over the last week, the cryptocurrency has surged by over 10%, and it has persisted its upward trajectory, rising by an extra 1.98% within the previous 24 hours to interchange at $68,708 on the time of writing.

This upward circulation has helped Bitcoin ruin via a well-known resistance zone on its each day chart, sparking predictions of even better costs.

One critical prediction came from crypto analyst Javon Marks, who now not too long ago shared his outlook on X. Marks highlighted that Bitcoin has broken out of a “descending broadening wedge” pattern. Statistically, this pattern means that as soon as the resisting line is broken, the designate diagram is reached in 81% of conditions.

In Bitcoin’s case, Marks believes that this breakout would per chance per chance also push the designate of Bitcoin to a unfold between $90,000 and even bigger than $96,000.

#Bitcoin (BTC) is now broken out of the displayed ‘descending broadening wedge’ pattern and statistics from this invent of pattern states that in 81% of conditions, the pattern’s designate diagram is reached when the resisting line is broken.

Bitcoin’s Mark Purpose:

$90,000-$96,000+ https://t.co/lPZZtJm7pi pic.twitter.com/hudApLSlDj

— JAVON⚡️MARKS (@JavonTM1) October 17, 2024

Featured image created with DALL-E, Chart from TradingView