The day gone by, Bitcoin recovered the major stage of 70,000 USD with a each day candle of +3.97%, following Sunday’s pump which saw one other +5% printed: let’s gaze how the ticket diagnosis has now changed.

Now is the 2d of fact: this most modern movement opens the doorways to a restart of the crypto asset against novel all-time highs or will there be a rejection sooner than $74,000?

Listed here we can gaze an diagnosis of costs and an in-depth glimpse at ETF recordsdata and spinoff market metrics.

The final details below.

Summary

Bitcoin ticket diagnosis: the crypto recovers 70,000 USD

After 10 days of suffering, Bitcoin returns to push on the charts going to improve the ticket stage of 70,000 USD; so crucial for the ticket action of the foreign money, which could per chance now aim for note spanking novel highs.

Technical diagnosis indicators the possibility of an impending attack within the $74,000 zone, however bulls desires to observe out of that you’re going to be ready to receive fraudulent actions or bear absorptions.

The game is conducted here, within the macro ticket vary between 74,000 and 60,000 USD: except Bitcoin breaks in one course or the diversified, we can’t have affirmation of what is occurring.

Within the case of a bullish breakout, shall we inquire of a apply-up in inquire of about 5% within the next hours, with an estimated cost of the crypto equal to 77,700 USD.

On the diversified hand, in case of a bearish breakdown from fresh costs, if the EMA 50 have been now not to defend, shall we hypothesize a first response signal around 59,000 USD, with the 2d at 55,000 USD and the third at 52,000 USD.

Clearly the major pattern is strongly bullish, however it completely comes after an prolonged section by which the crypto has conducted at its handiest within the excellent 2 months, rising by 65%.

The market volumes within the excellent candles are now not particularly encouraging, particularly that of Sunday, March Twenty fourth (arrived with American markets closed) where on Coinbase most efficient 6,500 BTC have been exchanged.

Even the RSI doesn’t glimpse very promising, with the indicator signaling the presence of a tired chart making an strive to improve after a provocative slowdown.

Within the medium time duration, the prospects are extra obvious and much less controversial, with the bulk of experts within the sphere agreeing on an optimistic ticket diagnosis, that can doubtless gaze the breaking of $100,000 USD interior the next two years and the celebration of a ancient bull creep.

This could be very attention-grabbing to monitor the explain of the yellow coin within the next two months, observing for the London Stock Replace to launch the so-called crypto trade-traded notes (ETN) on Might per chance well Twenty eighth.

From here on, diversified regulated markets from around the sphere could per chance launch up to speculation in Bitcoin, Ethereum and diversified cryptocurrencies, offering novel tools that by investing at as soon as within the underlying of these sources created shortage on the provision aspect.

All of this, mixed with the memoir of the halving, that can decrease the emissions of original BTC by 50%, will be fundamental in pushing its ticket against novel, serene unexplored horizons.

The final outlook appears to be largely bullish, particularly furious by the most fresh words of Powell in excellent week’s FOMC assembly where supportive words have been adopted for the extra speculative American markets.

Prognosis of ETF recordsdata and spinoff markets

To offer a full reflection after examining costs, let’s rob a glimpse on the knowledge related to the cash flows of the previous couple of days for Wall Aspect toll road situation ETFs and gaze what the knowledge from the spinoff markets counsel.

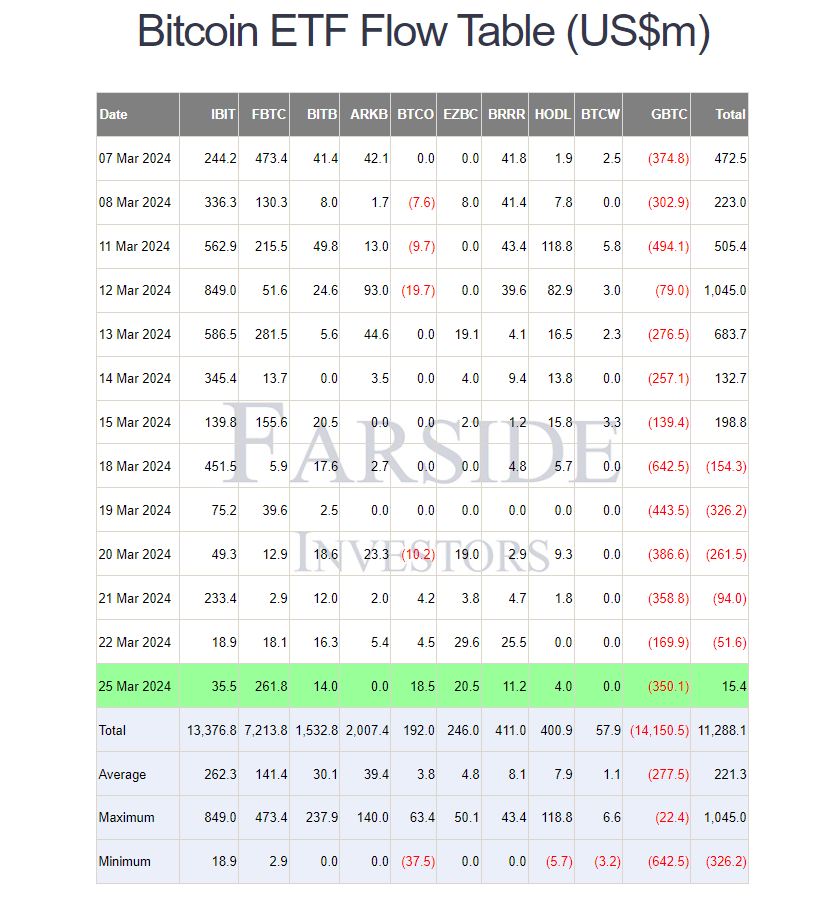

On the ETF entrance, we can gaze how, in retaining with what became as soon as reported by “Farside”, the day prior to this became as soon as overall obvious for Fund Supervisor investments, with obvious flows of excellent $15.4 million.

Among customers, Fidelity became as soon as the ideal the day prior to this with $261.8 million followed by BlackRock with $35.5 million

The solutions, although representative of a resolution serene in stability, makes us smile because of it comes after a protracted week of heavy outflows, with GBTC alone unloading almost 2 billion bucks.

The outcomes of the following couple of days regarding capital flows from ETFs will be fundamental to present us a belief of what to anticipate on crypto asset costs.

Indicatively, with every obvious netflow, Bitcoin records necessary will enhance, while with every opposed netflow, it is far negatively affected graphically.

Total, we can snarl that so far the introduction of these funding tools has benefited the ticket action of the foreign money, which has considered procure inflows of capital into the markets for 11.2 billion bucks from January so far.

In due course, this pattern could per chance rob on extra and extra bullish connotations, considered and furious by the conception of experts devour the funding bank Celebrated Chartered, which predicts an influx of $100 billion into the Bitcoin ETF market by the tip of the year.

🔸As a lot as $100 BILLION could per chance waft into #Bitcoin ETFs this year, says international banking extensive Celebrated Chartered pic.twitter.com/H3ayVChvHI

— Bitcoin Archive (@BTC_Archive) March 18, 2024

Now fascinating on to the diagnosis of recordsdata on spinoff markets, we can spotlight the presence of a “launch interest” serene vastly excessive, amounting to 19.7 billion bucks on the time of writing the article, with speculators’ interest increasing extra and extra because the crypto approaches its historical highs.

We do now not omit that excellent 2 months ago this indicator represented half of the hot cost: there are attributable to this truth almost 10 billion bucks entered the market within the excellent 60 days which have started having a wager on BTC costs better than 42,000 USD.

If the launch interest have been to skills a provocative drop, Bitcoin would with out a doubt be negatively affected as successfully. As long because the metric remains at these levels, the explain is under regulate.

The funding price on all cryptocurrencies present within the futures markets is clear, with funding price values starting from 0.027% for Bitcoin to 0.08% for Pepe.

It’s price noting how after the day prior to this’s excellent bullish movement, the funding price has remained largely unchanged, which draw that merchants have now not uncovered themselves in with out a doubt one of many two instructions extra than they have been the day sooner than.

The market bias remains, as said several instances, openly bullish; the odds of a endured bullish pattern far outweigh those of a hypothetical reversal.

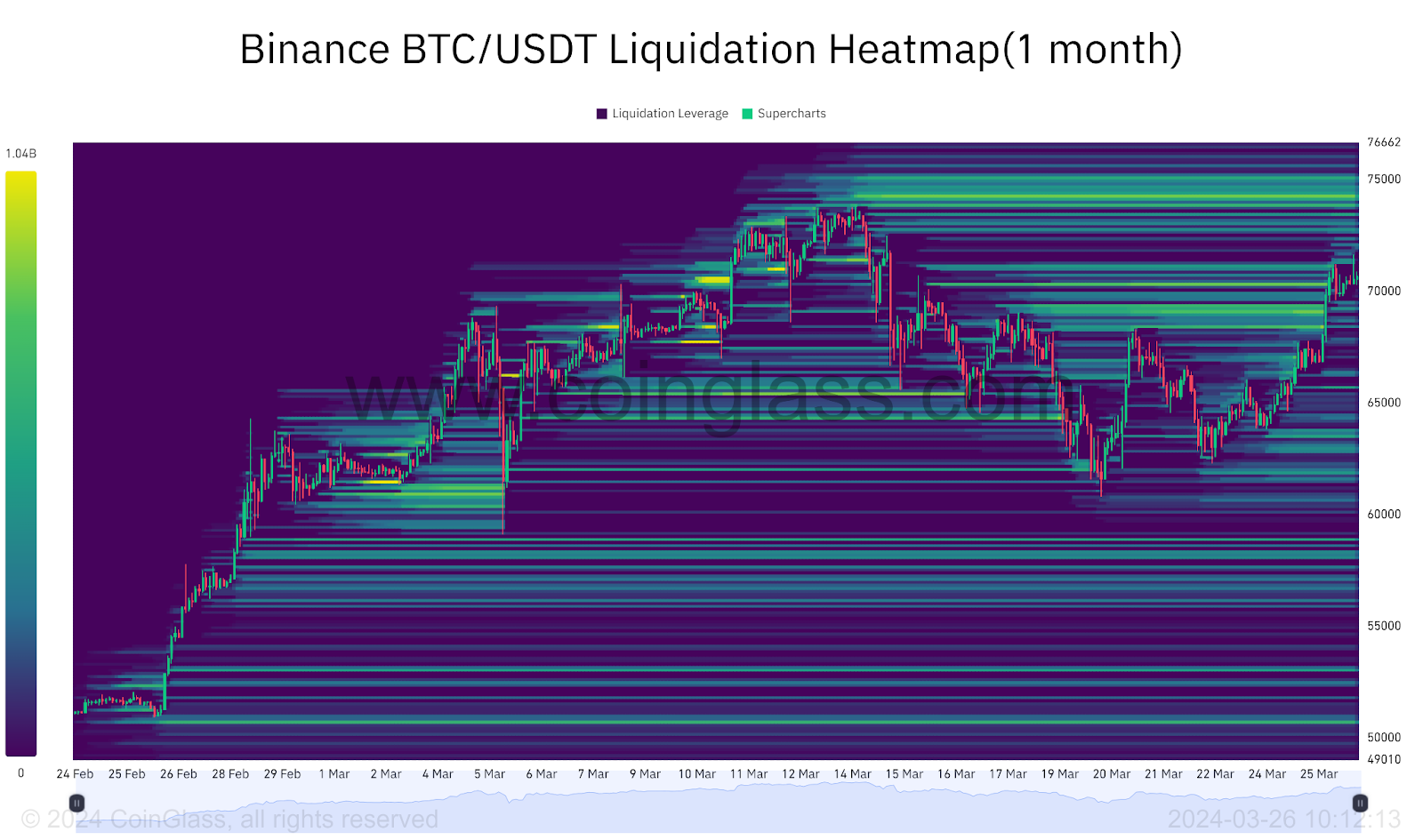

There don’t appear to be any necessary liquidations to myth within the previous couple of hours, where few monetary operators have misplaced cash attributable to market volatility.

At most, we insist the presence of a a have to-have liquidation stage on the Bitcoin highs threshold of 74,000-75,000 USD, where a break can also lead to the evaporation of over 2 billion bucks in transient positions.