Amp crypto tag has plunged and entered a delight in market this 365 days, mirroring the performance of most altcoins.

Amp (AMP) dropped to $0.0033 on Tuesday, down by over 77% from its absolute most realistic stage in November last 365 days. Its market cap has slipped from over $965 million to $283 million at the present time.

A seemingly explanation why Amp has plunged is that the general price locked on Flexa has been in a free drop this 365 days. It has dropped to $20.8 million, down from the 365 days-to-date high of $295 million.

Exercise on the Flexa Network is legendary for Amp, as the token provides the collateralization mechanism that underpins the platform. Flexa is a payments community that integrates with point-of-sale programs to permit merchants to settle for crypto. Corporations equivalent to Chipotle, GameStop, and Ulta Beauty are amongst these utilizing it.

Amp serves as collateral to guarantee payments. If a transaction fails or takes too prolonged to settle, staked AMP tokens may maybe most likely maybe also be liquidated to accomplish definite merchants get funds promptly.

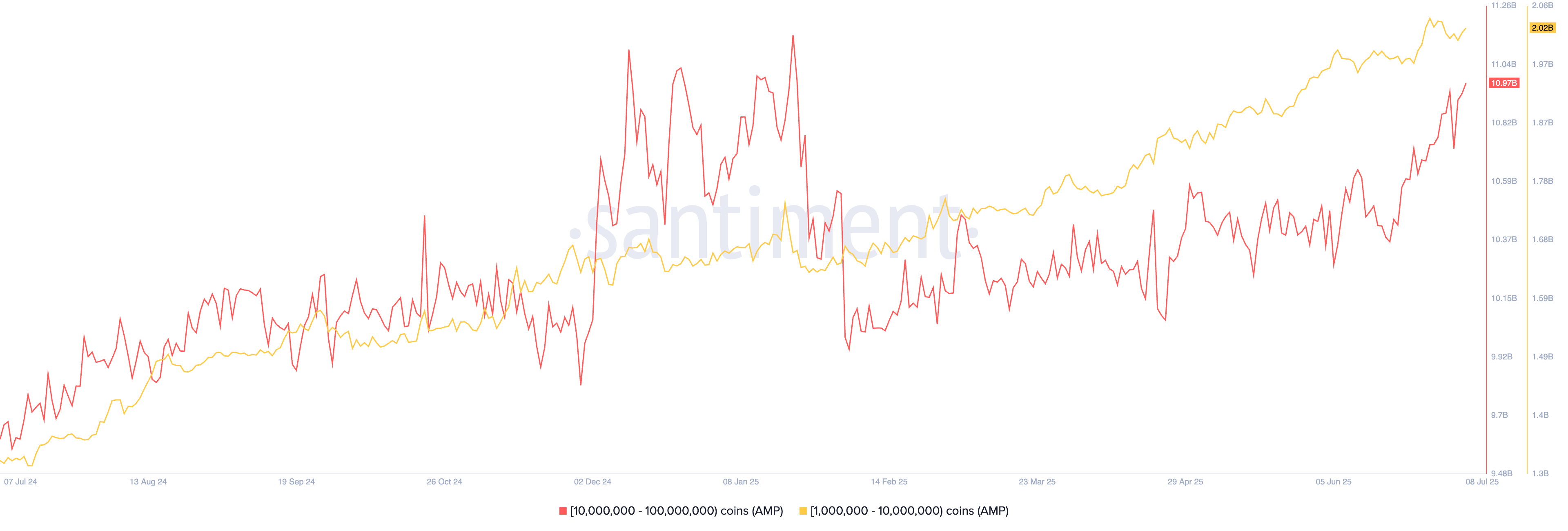

On the sure aspect, on-chain knowledge means that whales are peaceful amassing Amp tokens, most likely making a bet on a rebound. Addresses preserving between 10 million and 100 million AMP now control 10.97 billion tokens, up from 9.95 billion in February, in step with Santiment.

Extra knowledge from Nansen exhibits that the provide of AMP tokens on exchanges has dropped by over 43% within the previous 90 days. Right here is in most cases seen as a bullish signal, indicating that traders are transferring tokens to private wallets instead of developing ready to promote.

Amp crypto tag prediction

The day-to-day chart exhibits that Amp has fashioned a double-backside pattern at $0.00306, a bullish setup in technical prognosis.

Meanwhile, the Relative Strength Index has rebounded from an oversold discovering out of 28 in June to the most modern 44. The Inviting Moderate Convergence Divergence indicator has also flashed a bullish crossover.

These indicators counsel a seemingly bullish reversal. If momentum continues, the next design may maybe most likely maybe most likely be $0.00573, the swing high from May maybe 14, which would signify a manufacture of about 70% from most modern ranges. However, a drop under the make stronger at $0.0030 would invalidate the bullish thesis.