An analyst identified for making macro crypto calls thinks the altcoin market is poised to spark steep rallies equivalent to those witnessed in 2016 and 2021.

Pseudonymous analyst TechDev tells his 451,900 followers on the social media platform X that he’s watching the OTHERS chart, which tracks the overall market cap of crypto rather than for the ten-top possible digital resources and stablecoins.

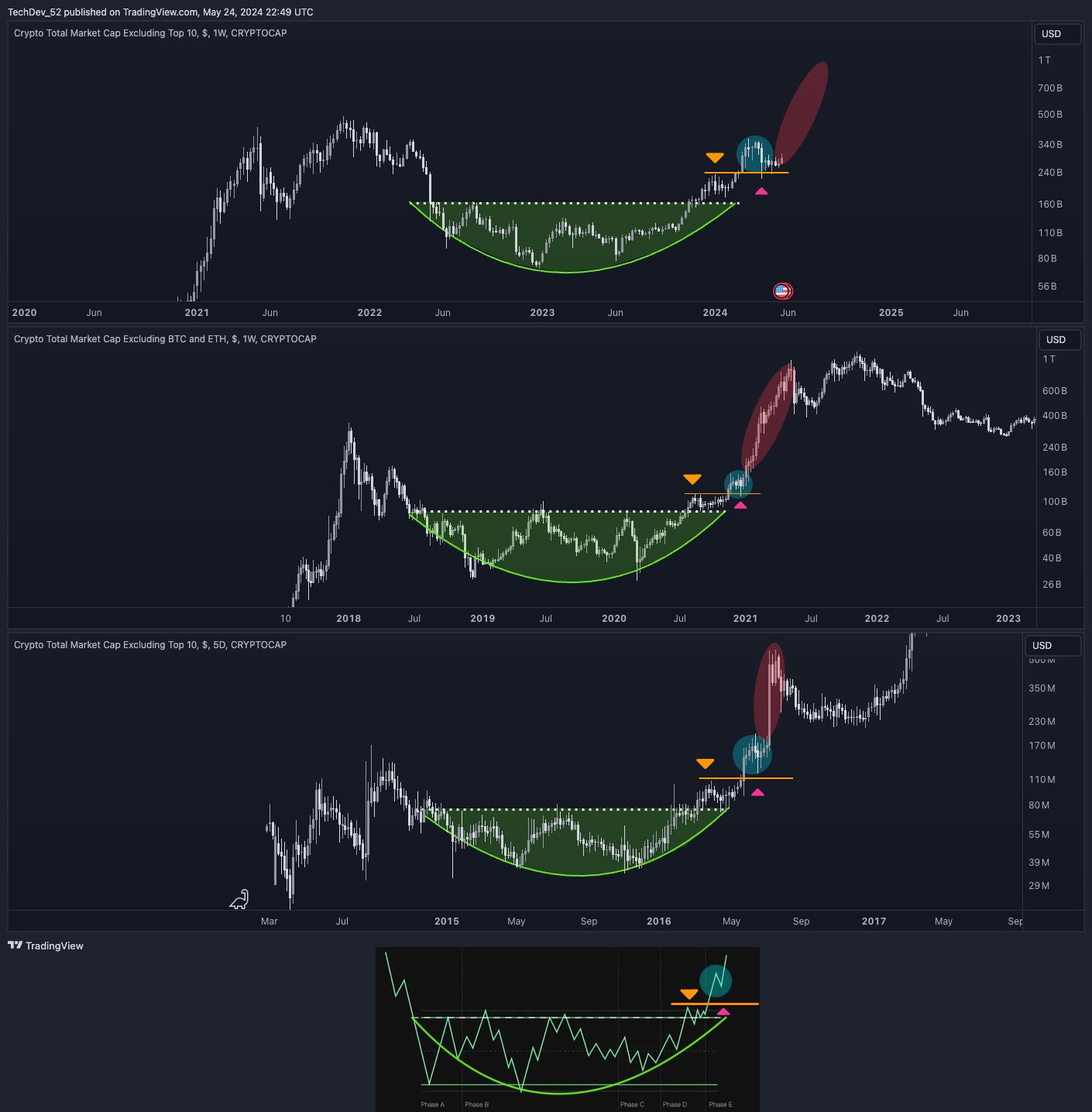

In step with the crypto strategist, OTHERS appears to be like to be following a “textbook” bullish formation after breaking out from a rounding bottom sample.

“Alts are getting into textbook markup.”

Taking a search at the dealer’s chart, OTHERS appears to be like to like printed the very same sample viewed for the duration of the 2016 bull market cycle. The TOTAL3 chart, which tracks the overall market cap of crypto rather than for Bitcoin (BTC), Ethereum (ETH) and stablecoins, moreover generated the same sample in 2021 sooner than launching a massive burst to the upside.

In preserving with the chart, TechDev predicts that OTHERS will rally to as excessive as $1 trillion for the duration of its markup portion. At time of writing, OTHERS is hovering at $291.35 billion, suggesting an upside possible of more than 243% if it hits TechDev’s target.

The analyst is moreover searching at assorted connected charts to crimson meat up his bullish stance on altcoins. In step with TechDev, both the Bitcoin dominance (BTC.D) and Tether dominance (USDT.D) charts are flashing bearish indicators.

Bitcoin dominance tracks how worthy of the crypto market cap belongs to BTC whereas Tether dominance measures how worthy of the crypto market cap belongs to USDT. If both charts are bearish, it means that merchants are intriguing their capital to altcoins.

“Bitcoin dominance is breaking down from a massive distribution. Tether dominance is marking down within the acceleration portion of its distribution. Alts haven’t expanded from this stage of macro compression since Dec 2020. The following yarn is across the nook.”

TechDev says the yarn that can per chance ignite an altcoin surge is the begin of put market Ethereum alternate-traded funds.

“Cue the following alt yarn shimmering on time. ETH ETF.”