What factors are using the bearish pattern in altcoins, and when assemble we are looking ahead to a turnaround?

Within the previous month, the crypto market, in particular altcoins, has faced a persistent downturn, with many seeing striking losses.

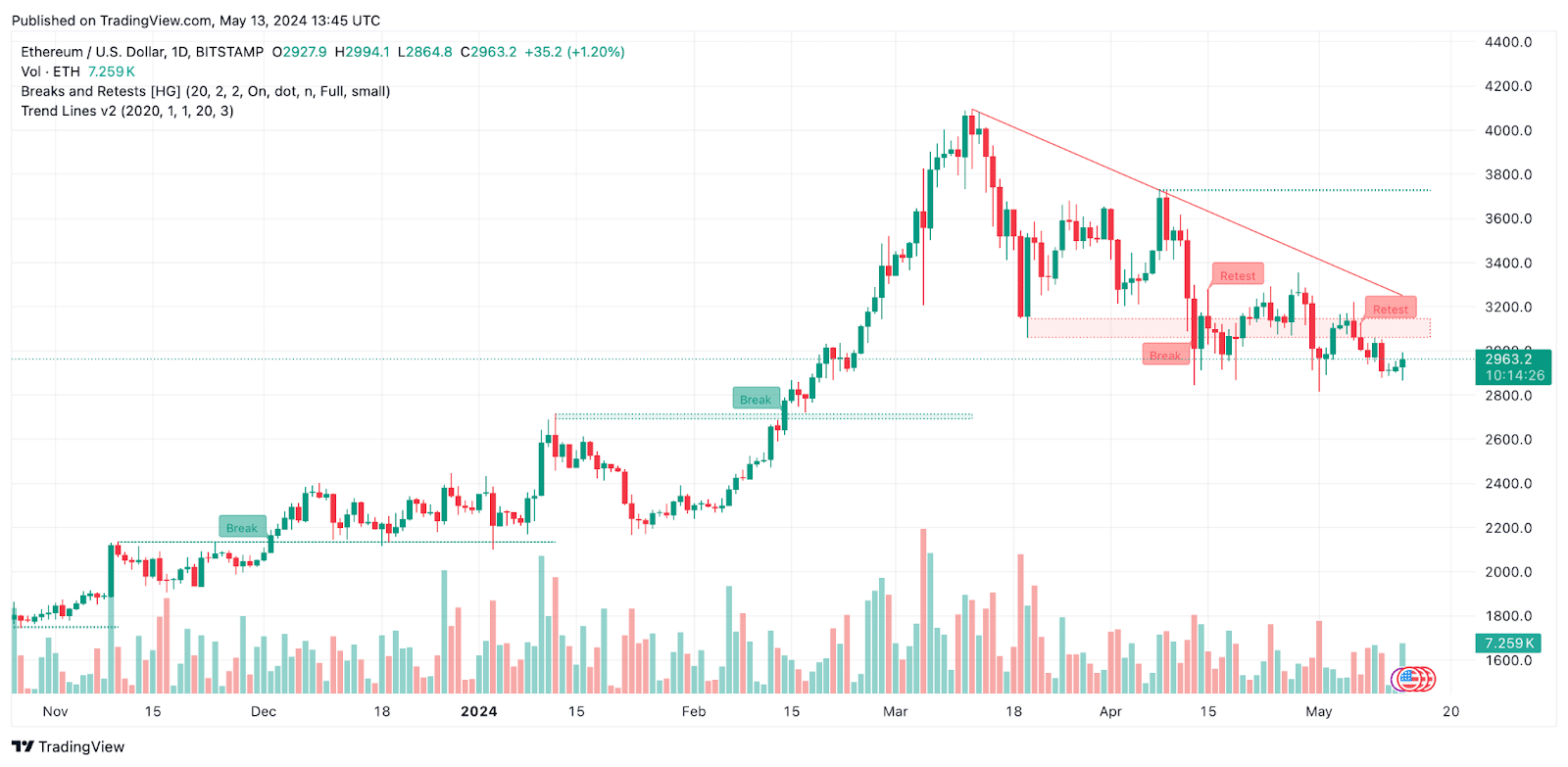

Ethereum (ETH), the 2d-biggest crypto by market cap, misplaced nearly 10% of its fee within the last 30 days, procuring and selling at spherical $2,960 as of Would possibly maybe per chance well also simply 13.

Nonetheless, Ordinals (ORDI) has been hit the hardest, dropping by 40% and now procuring and selling at simply $36.80.

This market downturn aligns with world financial inclinations, such because the modern resolution by the Federal Reserve (Fed) to preserve its hobby rates between 5.25% to 5.50%.

The Fed’s cautious intention to monetary protection, aimed at addressing inflation and financial declare, would possibly well simply occupy created uncertainty amongst crypto patrons, main them to want more established sources esteem Bitcoin (BTC).

BTC has largely traded above $60,000 ranges at some stage in this downturn, with BTC dominance even reaching a excessive of simply about 57% in April, a vital amplify from last year’s Forty five-46% ranges. As of Would possibly maybe per chance well also simply 13, BTC dominance stands at over 55%.

Furthermore, the Fed’s announcement relating to its bond holdings reduction technique, slowing the gallop of allowing maturing bond proceeds to roll off without reinvestment, would possibly well repeat potential financial challenges forward.

This signal would possibly well simply occupy additional reduced investor self belief in altcoins, diverting attention and capital away from riskier sources.

As the crypto market faces this downturn, the quiz arises: when will altcoins jump lend a hand? Let’s detect.

What assemble consultants assume?

Analysts occupy supplied a wide selection of views on the modern inform of the altcoin market. Here’s what they assume

Patric H. | CryptelligenceX

Patric H. stays bullish on the total market, looking out at for a continuation of the bull market until mid-Q3/Q4 2024.

🚨 Contrarian understanding: The backside is no longer in.

Would possibly maybe per chance well also simply is going to be emotionally though-provoking for loads of #Bitcoin and #Altcoins patrons.

Sometime within the subsequent 2-6 weeks, we will ogle the top probably shake-out earlier than the breakout.

🧵Here’s what to wait for in this turbulent section.

— Patric H. | CryptelligenceX (@CryptelligenceX) April 30, 2024

Nonetheless, he warns of a turbulent section within the quick length of time, in particular in Would possibly maybe per chance well also simply. He predicts a final shake-out within the subsequent 2-6 weeks, per chance revisiting $52k for Bitcoin and $2 trillion for the total market cap.

He attributes the prolong in reaching the backside to the inability of ample ache available within the market, indicating that sentiment stays too euphoric.

Patric advises monitoring the Danger and Greed Index for indicators of a shift in direction of ‘terror’. He additionally mentions to preserve a take a look at on divergence in sentiment and traded volumes, which would possibly well point out a doable reversal.

Benjamin Cowen

Benjamin Cowen attracts parallels to the outdated cycle, noting that ALT/BTC pairs are inclined to capitulate simply earlier than price cuts. He suggests that ALT/BTC pairs would possibly well tumble any other 40% from recent ranges over the subsequent few months.

Final cycle, we saw #ALT /#BTC pairs capitulate simply earlier than price cuts.

Maybe this time is no longer assorted? This would point out ALT/BTC pairs tumble any other 40% from right here over the subsequent few months.

Non permanent countertrends assemble no longer invalidate this look. pic.twitter.com/BK3VIrCBJ2

— Benjamin Cowen (@intocryptoverse) April 30, 2024

Cowen attributes the continuing struggles of altcoins to a decline in social hobby, likening the modern market motion to that of 2019.

Altcoins preserve on struggling since the social possibility is plummeting. Folk simply assemble no longer surely seem to care.

This total dawdle level-headed looks 2019-esque to me. Social hobby additionally dropped then simply earlier than price cuts arrived, and then ALT/BTC pairs at last bottomed when the Fed pivoted pic.twitter.com/SEKbLRMTaX

— Benjamin Cowen (@intocryptoverse) April 29, 2024

He capabilities out that social hobby declined earlier than price cuts within the previous, hinting at a doable bottoming for ALT/BTC pairs coinciding with a pivot in Fed’s protection.

Gallop be taught the feedback within the quoted tweet under from January.

Basically no person believing that #ETH / #BTC would preserve on fading and laughing on the postulate presented.

WHERE ARE THEY NOW?

Potentially calling the backside on ETH/BTC as soon as more. https://t.co/4ySS6XiNxz pic.twitter.com/nkmW9ryo6h

— Benjamin Cowen (@intocryptoverse) Would possibly maybe per chance well also simply 13, 2024

Michaël van de Poppe

Michaël van de Poppe notes that altcoins are experiencing a typical correction in USD valuations, but in BTC valuations, they’re down sharply, nearing cycle lows.

The #Altcoin market capitalization is having a typical correction (in USD valuations).

In BTC valuations, they’re down loads and on cycle lows.

Undervaluation vs. Actuality.

Here is no longer the moment to narrate away from crypto, but to attack the markets by greater possibility. pic.twitter.com/h298e63ory

— Michaël van de Poppe (@CryptoMichNL) Would possibly maybe per chance well also simply 12, 2024

He suggests that this undervaluation items an opportunity to attack the markets with greater possibility barely than turning away from crypto.

What to beget out of it?

These analyses point out a cautious outlook for the altcoin market within the quick length of time, indicating that more corrections will seemingly be coming.

Nonetheless, they additionally repeat a conceivable bullish pattern within the medium to lengthy length of time. This plan that that you would possibly well maybe occupy to preserve alert and flexible because the market evolves.

The next few weeks will seemingly be necessary for the altcoin market, with factors esteem sentiment, procuring and selling volumes, and exterior financial events at possibility of occupy a key impact.

Capability catalysts for market restoration

The crypto market is at a severe juncture, with potential catalysts that would possibly well restore normalcy and revive bullish sentiment.

One predominant pattern is the event of the Monetary Innovation and Abilities for the twenty first Century (FIT21) Act within the U.S. Dwelling, which targets to bring regulatory clarity to digital sources.

If passed (will seemingly be in would possibly well simply itself), the bill would possibly well place of living federal standards for digital sources, present an explanation for the jurisdiction of regulatory bodies esteem the Commodity Futures Shopping and selling Commission (CFTC) and the Securities and Alternate Commission (SEC), and put a regulatory framework for digital asset markets.

The crypto industry has lengthy sought regulatory clarity, and the FIT21 Act would possibly well provide necessary-wanted easy task for market participants and patrons, doubtlessly boosting self belief and investment within the field.

Furthermore, the bill’s provisions for allowing secondary market procuring and selling of digital commodities and imposing requirements on registered entities would possibly well toughen market transparency and integrity.

One more potential market mover is the upcoming resolution by the SEC on VanEck’s space ETH alternate-traded fund (ETF) application, scheduled for Would possibly maybe per chance well also simply 23, 2024. A favorable resolution would possibly well ignite a rally in ETH costs, the same to the ETF-driven Bitcoin surge earlier in 2024.

Concerns linger relating to the SEC’s classification of ETH as a commodity or security, which would possibly well impact the approval of space ETH ETFs.

The recent sentiment surrounding the launch of space ETH ETFs within the U.S. is largely pessimistic, with worries about regulatory uncertainty and the SEC’s stance below Chair Gary Gensler.

Nonetheless, industry consultants assume that a space ETH ETF will at last be greenlit, mirroring the path of space BTC ETFs, which within the initiate faced rejections earlier than prevailing in a lawsuit in opposition to the SEC.

Within the quick length of time, a rejection of the gap ETH ETF would possibly well trigger heightened tag volatility and a decline in ETH costs because the market absorbs the knowledge.

Within the meantime, regulatory clarity and the approval of space ETH ETFs would possibly well propel altcoin market restoration and bullish inclinations within the upcoming months.

ETH tag evaluation

As of Would possibly maybe per chance well also simply 13, Ethereum is procuring and selling at spherical $2,970. ETH has been following a descending pattern, main to considerations that it can well maybe occupy to also tumble under the $2,500 designate.

The recent pattern in ETH costs has been bearish, with weekly trades opening decrease than the outdated week’s closing, suggesting a scarcity of bullish momentum.

Within the outdated 24-hours, ETH/USD has been procuring and selling positively, breaching $2900 ranges, but going thru solid resistance across the EMA50 at $2990. For a bearish pattern to resume, ETH needs to damage under $2900, doubtlessly heading in direction of $2800 and $2620 ranges.

On the assorted hand, a continuation of the rise and a breach of $2990 would possibly well outcome in additional features as much as $3130 ranges.

The expected procuring and selling vary for ETH is between $2800 (strengthen) and $3050 (resistance), with the pattern forecast last bearish.

ETH evaluation suggests that costs would possibly well simply face persevered downward stress, impacting assorted altcoins available within the market as successfully.