Key Highlights

- QwQiao argues that major L1 networks and tokens lack lasting competitive advantages, ceaselessly referred to as a moat, which makes it susceptible

- He believes that the main tell is that it is now too uncomplicated for customers and builders to replace between varied blockchains, which draws down the lengthy-duration of time payment of their tokens

- He proposed a solution, saying that blockchains have to create apps and products and services today on their networks

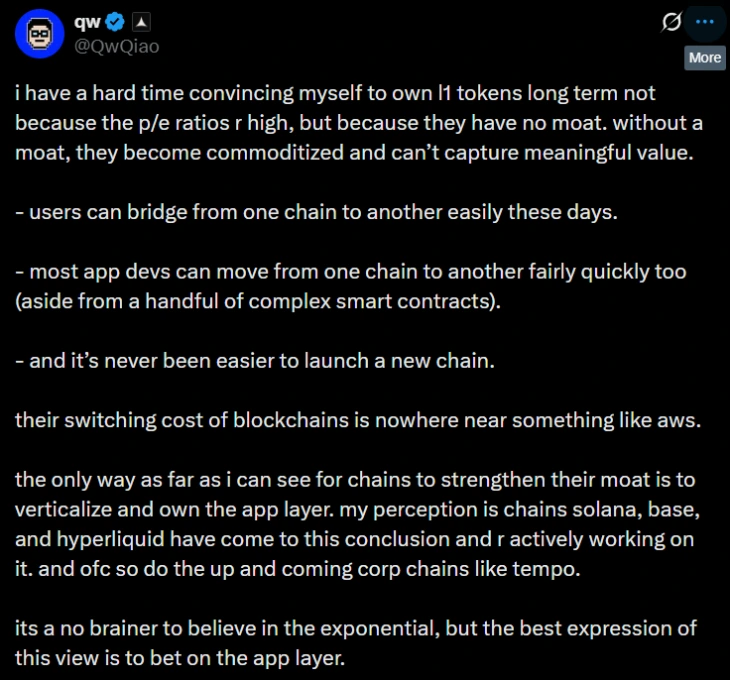

On November 27, QwQiao, a partner on the Alliance DAO, shared a tweet through which he raised questions referring to the lengthy-duration of time payment of L1 tokens.

(Source: QwQiao on X)

In basically the most up-to-date submit on X, he said that he has a “disturbing time convincing” to withhold Layer 1 (L1) blockchain tokens for the lengthy duration of time. His field used to be no longer about their most up-to-date high prices. As an different, he puzzled their very core structure by declaring that L1 networks create no longer indulge in a “moat.”

With out this mighty-wanted security, he believes that these infrastructure chains will change into uncomplicated commodities, admire electricity or water. On account of this, this might per chance also be unable to take cling of major payment over time.

L1 Tokens Own No Moat: QwQiao

The principle point of QwQiao’s argument is amazingly uncomplicated. He talked about that in on the present time’s crypto sector, there is practically no friction in stopping customers, builders, or capital locked on the blockchain from leaving one blockchain for one other.

Per QwQiao, it most attention-grabbing takes a pair of minutes to pass digital sources between varied blockchains, thanks to superior bridge applied sciences admire Wormhole and LayerZero. The entire volume of these harmful-chain transfers has already surpassed billions of bucks in 2025.

For builders, the activity of intriguing an utility is also uncomplicated. Most can transfer their code all over admire minded chains in a pair of days. The rise of user-friendly pattern tools has even simplified the activity of intriguing to non-admire minded networks.

Besides this, it upright takes weeks to delivery an completely contemporary blockchain or utility-essentially essentially essentially based rollup, no longer years, with the serve of readily accessible kits.

This infrastructure makes the payment of switching blockchains low in comparability to the tell of intriguing a firm’s data off a cloud carrier provider admire Amazon Web Companies (AWS).

Qw said that “its a no brainer to factor in in the exponential, however the correct expression of this take into memoir is to wager on the app layer.”

QW is partner of Alliance DAO, which is a firm is named one in every of basically the most a success DAOs in the cryptocurrency dwelling. It is a long way ceaselessly referred to as the DeFi Alliance. This crew has helped delivery major tasks admire Pump.stress-free and Fantasy Top.

It has raised $50 million in the fundraising spherical by top-tier funding firms admire Sequoia and Paradigm.

Sooner than this, Qw has also raised earlier warnings in 2025 about dangers in retail ETFs, and AI tokens indulge in confirmed staunch. Now, his views on L1 tokens indulge in change into a topic topic of debate amongst the crypto neighborhood.

QwQiao Thinks Vertical Integration is a Resolution

QwQiao has also shared his solution for the survival of L1 networks. He argues that they have to quit acting as pure infrastructure and as a replacement completely pass to salvage the utility layer built on top of them.

“basically the most attention-grabbing technique as a long way as i’m able to demand for chains to present a elevate to their moat is to verticalize and salvage the app layer. my thought is chains solana, sinful, and hyperliquid indulge in come to this conclusion and r actively engaged on it. and ofc so create the up and coming corp chains admire tempo,” he said.

He talked about Putrid, an L2 network from Coinbase, as an illustration. It is a long way today attracting a nice user sinful of most up-to-date DeFi activity. He also talked about Hyperliquid, which is a decentralised change (DEX) built by itself high-efficiency Layer 1 blockchain.