Bitcoin (BTC) followers are maintaining a shut direct on the pioneer crypto’s subsequent circulate as the US Greenback Index (DXY) surges to a 26-month high of 110.

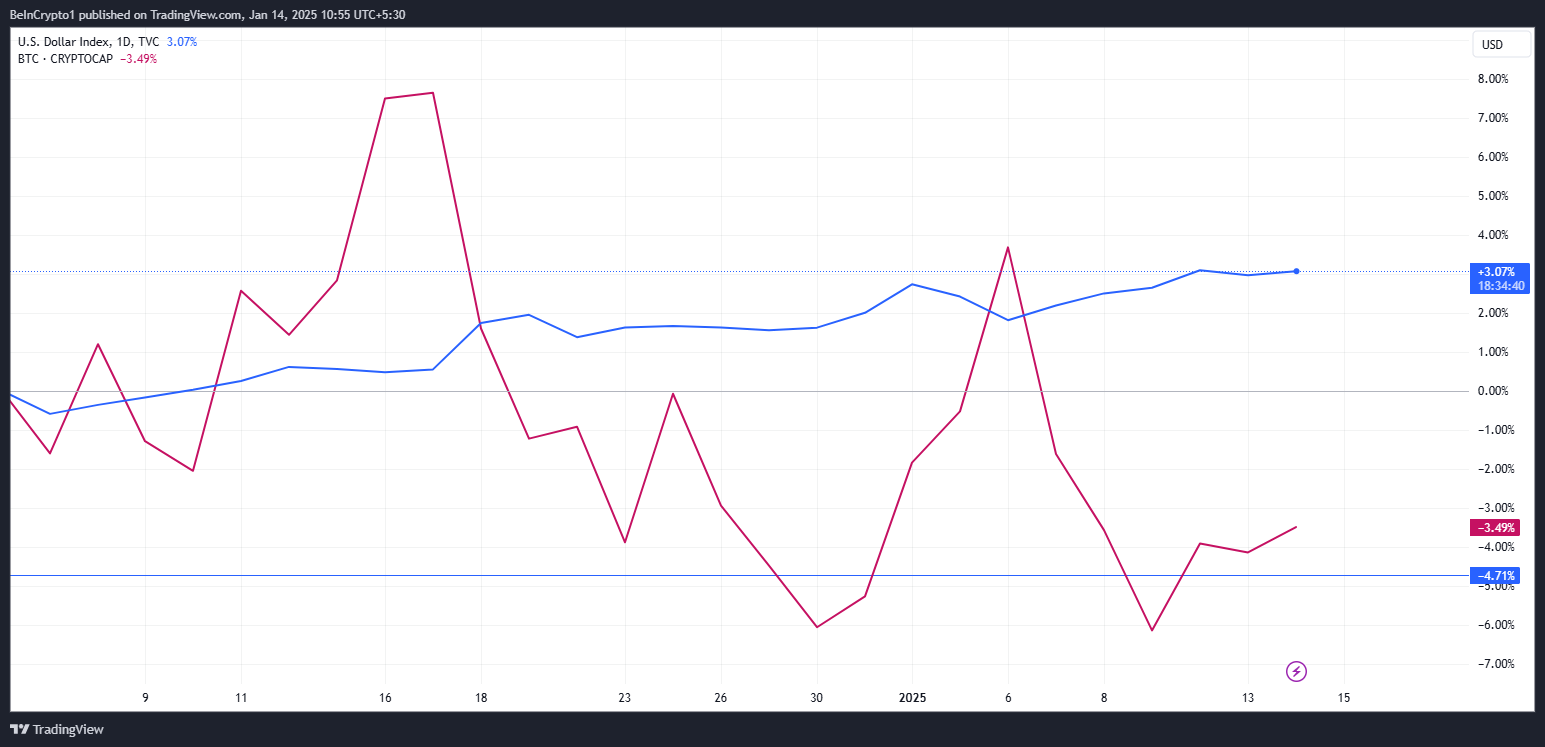

Historically, Bitcoin’s performance has proven an inverse correlation with the DXY, prompting hypothesis that a pivotal 2d for the digital asset can be on the horizon.

Crypto Consultants Sound the Fear As DXY Soars to 110

Quinten Francois, a famend crypto educator, illustrious the historical significance of DXY ranges in a recent post. He additionally highlighted that when DXY goes down, Bitcoin goes up, predicting that this will also honest occur in 2025.

“Remaining time DXY used to be this high, BTC used to be at $20,000. One thing expansive is brewing,” he mentioned.

The comments replicate rising anticipation all around the crypto neighborhood that the DXY topping out could well pave the fashion for Bitcoin to rally. In other locations, HZ, a crypto researcher, warned of the broader risks associated with a surging DXY.

“DXY at 110 is unhealthy. A few more aspects up, and markets will collapse. A surging buck triggers a world credit score crunch, kills liquidity, wrecks earnings, and crushes emerging markets. While you’re overleveraged, you’re standing on a trapdoor,” HZ cautioned.

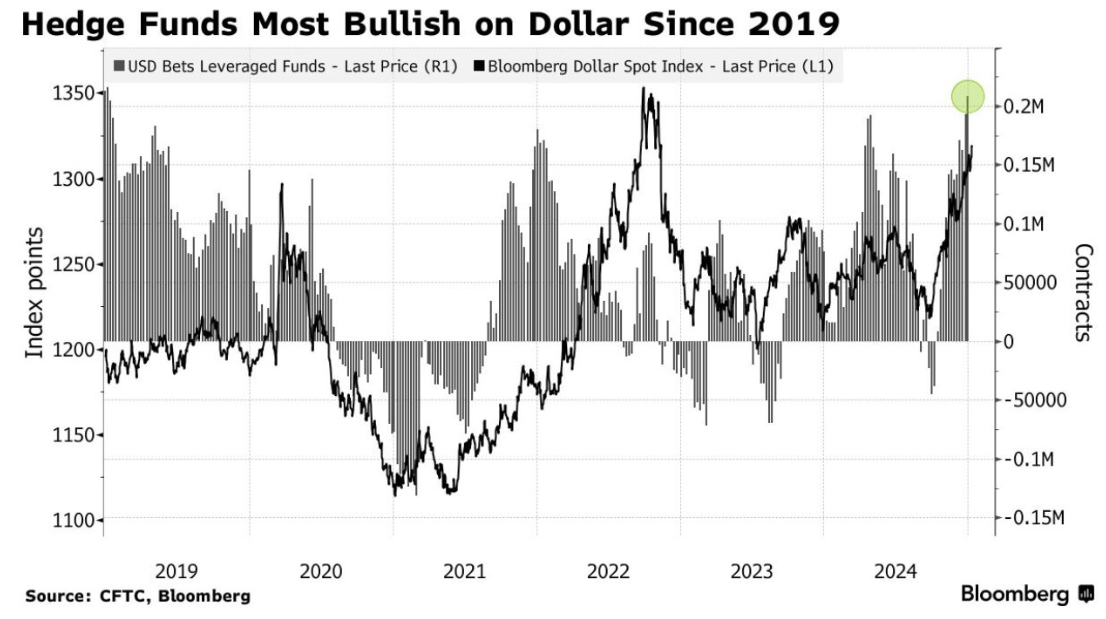

Including to the dialogue, the financial analytics platform Barchart highlighted that hedge funds had been the most bullish on the US buck since early 2019. This sentiment reflects the strengthening buck’s allure as a refuge amid ongoing world financial uncertainties.

Bitcoin and Misfortune Resources Face Key Tests

Meanwhile, Capital Hungry, a market be taught firm, identified that the DXY’s surge has been partly pushed by tariff fears. It additionally highlighted upcoming financial data as mandatory for market direction.

“If we understand lower PPI Tuesday or honest CPI Wednesday, bearish retracement on DXY brief term from intraday highs, US equities and menace resources could well catch a snort,” Capital Hungry predicted.

This is succesful of well receive favorable prerequisites for Bitcoin to withhold above $94,000 and doubtlessly climb to $ninety nine,000 within the brief term. Nonetheless, a stronger-than-anticipated DXY could well invalidate this field, pushing Bitcoin costs lower.

The DXY’s actions withhold important implications past cryptocurrency. A stable buck can stress emerging markets and world liquidity, doubtlessly triggering financial slowdowns. On the flip aspect, any signs of easing within the DXY could supply relief for menace resources, together with Bitcoin.

In August, the DXY hit its 2024 lows in a dip that coincided with a brief Bitcoin rally. This bolstered the inverse relationship between the 2 resources. If the buck index retraces from its most up-to-date highs, analysts direct Bitcoin could well ride renewed upward momentum.

The crypto market’s optimism is extra buoyed by institutional traits. Capital Hungry highlighted BlackRock’s newly launched BTC ETF (alternate-traded fund), which could well vastly affect Bitcoin’s trajectory. The rising involvement of primitive financial giants love BlackRock is seen as a important endorsement of Bitcoin’s legitimacy and doable for mainstream adoption.

Nonetheless, the crypto market remains at a crossroads, with Bitcoin’s subsequent necessary circulate doubtlessly hinged on the direction of the DXY.

Whereas the buck index currently exerts downward stress on menace resources, a reversal could well space the stage for a Bitcoin surge.