Blockchain platform Algorand executed significant beneficial properties in key metrics in the future of the year’s first quarter (Q1), aligning with the total upward vogue observed in the crypto market ecosystem.

Then as soon as more, no matter this development, its native token ALGO experienced a 22% trace lower for the explanation that foundation of Q2, placing a indispensable pork up line to the test and elevating questions in regards to the cryptocurrency’s possibilities.

Algorand Revenue Skyrockets

In accordance with a yarn by Messari, Algorand’s income witnessed a gargantuan 1,747% quarter-on-quarter (QoQ) surge, essentially pushed by a 288% lengthen in transactions and a 50% upward push in the stylish trace in the course of the quarter. The Orange memecoin project moreover contributed to this development.

In Q1 2024, ALGO’s dedication to governance on the Algorand platform declined by 60% year-on-year (YoY) and 3% Quarter-on-Quarter, reaching its lowest stage in a year at 1.7 billion ALGO staked.

Per the yarn, this downturn may perchance perchance well presumably moreover moreover be attributed, no longer less than in section, to the diminishing governance rewards disbursed per governance duration. As an instance, governance individuals obtained 68.2 million ALGO in Q1 2023, but this resolve dropped seriously to supreme 21.9 million ALGO in Q1 2024.

The market cap for stablecoins on the Algorand platform declined 6% QoQ to $73 million. Circle’s USDC market cap on Algorand lowered by approximately 9% QoQ to $50 million.

In distinction, Tether’s USDT stablecoin market cap remained stable in the future of the same duration with no QoQ trade, even though it recovered 2% of the stablecoin market share.

As a outcome, USDC’s market share lowered by 3% to 68% QoQ, while USDT’s market share elevated by 2% to encompass 30% of Algorand’s full stablecoin market cap.

Algorand’s DeFi TVL And Market Cap Lead The Pack

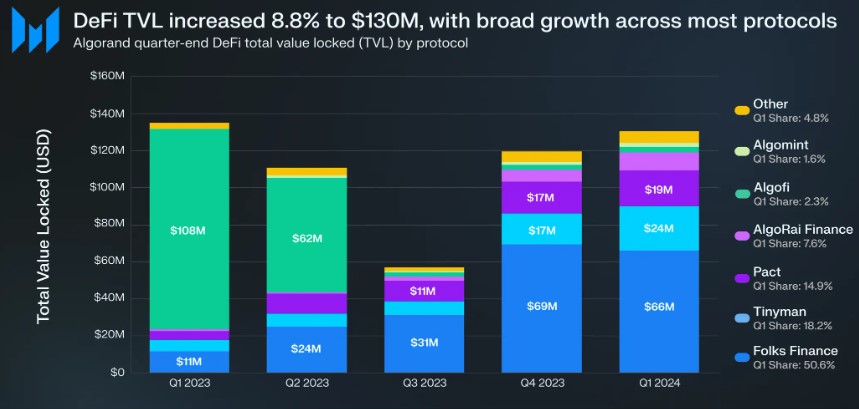

Algorand’s full decentralized finance (DeFi) full cost locked (TVL) witnessed development for the 2nd consecutive quarter, rising by 9% QoQ to $130 million.

Despite the truth that TVL experienced a decline in Q3’23 due to Algofi’s deprecation, the total DeFi market on Algorand rebounded and surpassed Q2’23 ranges, virtually reaching the ranges seen in Q1’23.

Individuals Finance retained its set up of residing as the tip DeFi protocol by TVL on Algorand. Even supposing its TVL fell by 5% QoQ in Q1, it maintained correct over 50% market share.

Pact and Tinyman moreover demonstrated great beneficial properties, taking pictures approximately 15% and 18% of the DeFi TVL market share in Q1. AlgoRai Finance experienced the most gargantuan development, with a good fifty three% lengthen in its TVL QoQ.

Lastly, in the future of Q1, Algorand’s market cap expanded by 18% QoQ, reaching $2.1 billion. The realm crypto market cap moreover witnessed indispensable development in the future of the same duration, nearing all-time highs of round $3 trillion, denoting a 50% lengthen from the old quarter.

Despite the truth that Algorand capitalized on this upward vogue with an 18% lengthen in its market cap, it experienced a more gargantuan surge of 123% in the preceding quarter.

Making an attempt out Key Wait on Ranges

ALGO’s efficiency in the early phases of the 2nd quarter has been predominantly bearish. On the 2nd, the token is procuring and selling at $0.1935, with a possibility of additional sorting out the pork up line at $0.1904. A breach of this stage may perchance perchance well presumably moreover outcome in a continuation of the decline in direction of the following pork up at $0.1789.

On the upside, the $0.1988 zone items a indispensable resistance stage for ALGO. Notably, the token has tried to surpass this threshold three times in the past 10 days without success.

Featured image from Shutterstock, chart from TradingView.com