Right here is a section from the 0xResearch e-newsletter. To read elephantine editions, subscribe.

Equities ripped greater the day earlier than nowadays, with the Nasdaq up 2.15% and the S&P 500 up 1.39% after Nvidia beat earnings and guided for $65 billion in Q4 revenue. Crypto moved the assorted capacity: BTC fell, most sectors closed purple, and utterly a pair of outliers held up. Nowadays we destroy down the divergence, Aave’s 2.6x YoY TVL development and novel app rollout, and why Solana’s fairness-perp ecosystem is lagging Hyperliquid’s HIP-3 flywheel.

Indices

Despite the restoration in equities the day earlier than nowadays, BTC persevered to clarify weakness and fell -1.66% on a day when the Nasdaq, S&P 500, and Gold were up 2.15%, 1.39%, and 0.77%, respectively.

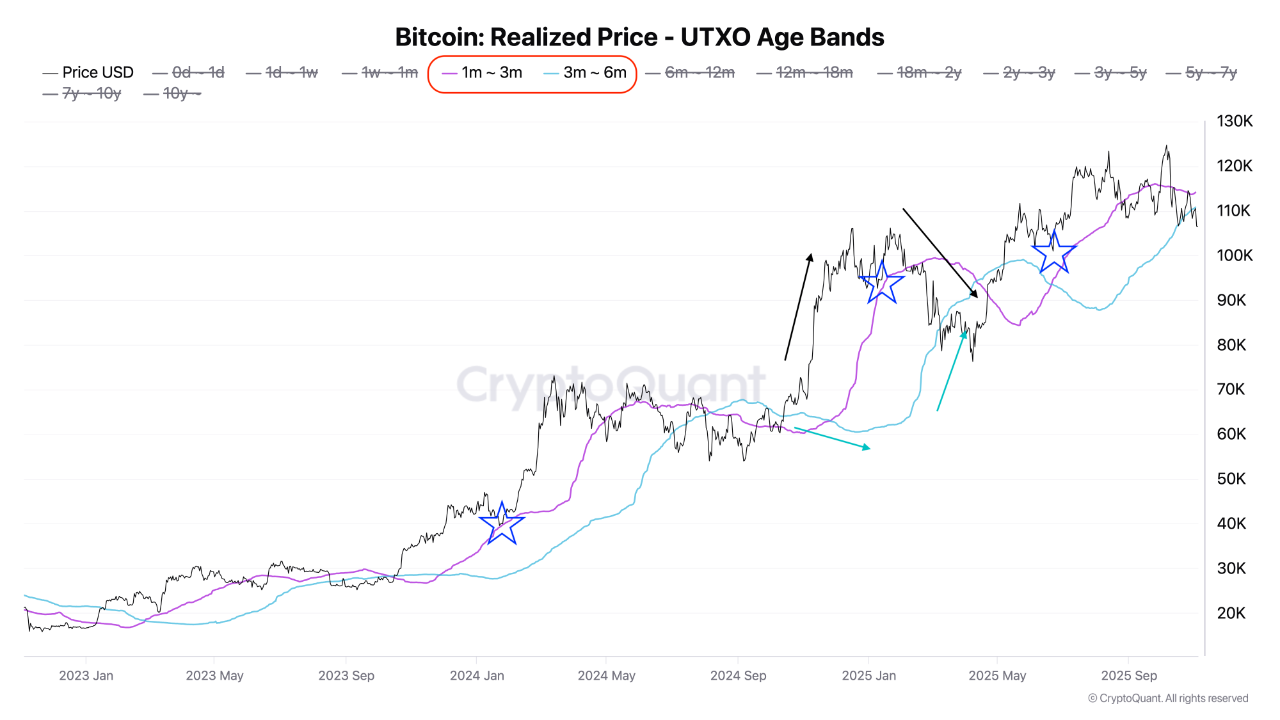

Nvidia’s earnings helped tranquil fears of the AI bubble popping, no longer no longer as much as for now. The chipmaker beat analyst expectations with strong records heart inquire, and projected fourth quarter revenue of $65 billion, when compared to the $61 billion estimate. With Nvidia shares up 5% after hours, the tech-heavy indices may perchance perchance well presumably moreover simply aloof proceed to search some relief. The case for BTC is less easy, with OG Bitcoin whales continuing to promote as BTC struggles to reclaim the vital $100,000 stage.

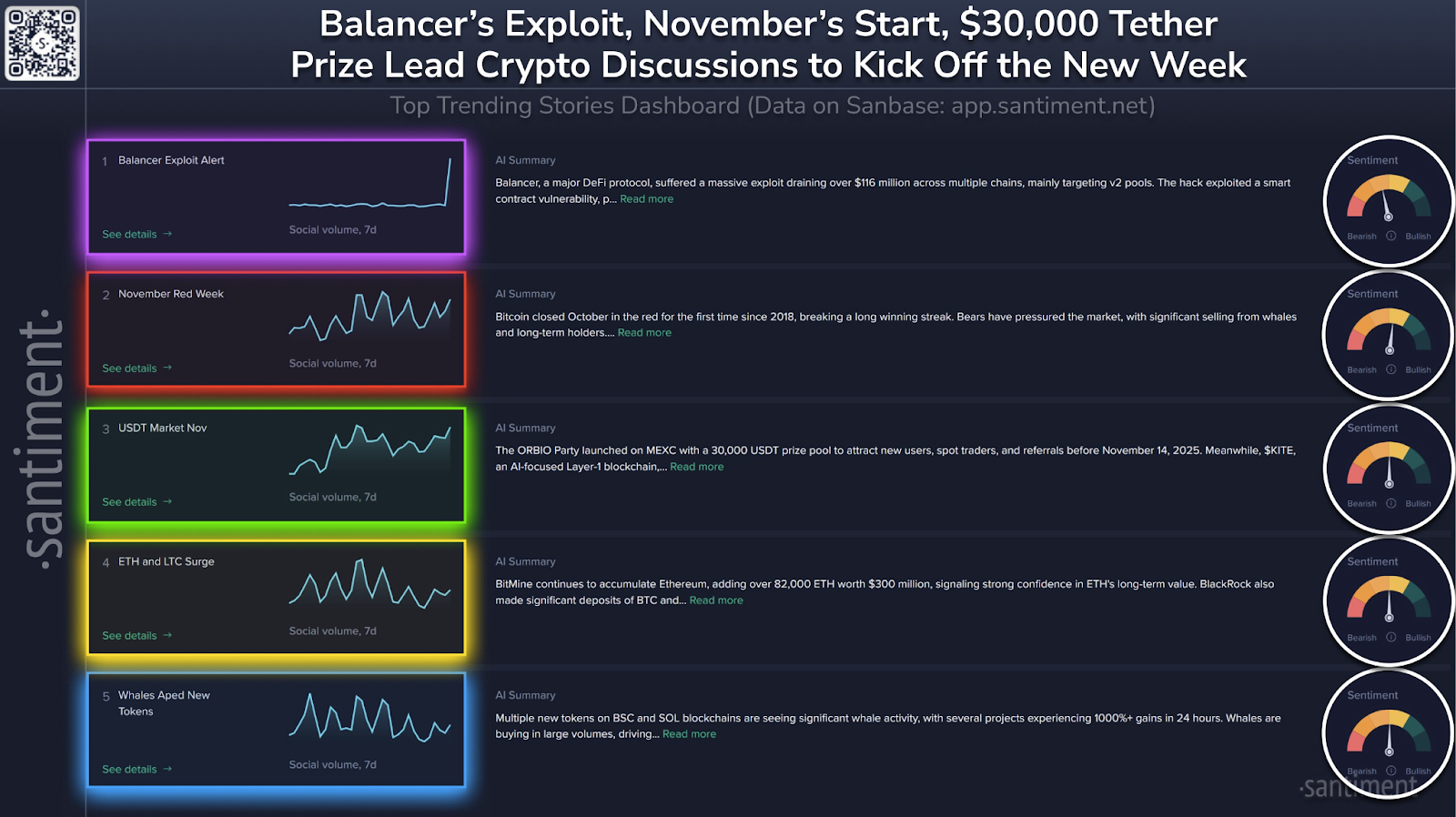

The weakness in BTC spread across the crypto market, with virtually every sector closing in the purple. Memes were the rare outlier, rising 0.2% on the day, pushed by SPX and MemeCore — which gained 6.3% and a pair of.3%, respectively. L2s moreover held up better than most, down utterly -0.5%.

Starknet stood out in the crew, jumping 20.8% on the day and 81% on the week as it picked up the privacy myth speak following records that the crew plans to initiating Ztarknet, a Starknet L2 designed for Zcash.

On the diagram back, Crypto Miners fell -5.9% with out reference to Nvidia’s strong outcomes reinvigorating the AI alternate. The No Income index turned into once the next weakest, dropping -4.5%, with XRP and XLM down -4.9% and -3.9%, respectively, on the day. Even tokens with strong fundamentals weren’t spared, with the Income index finishing -3% lower.

E-newsletter

Subscribe to The Breakdown

Market Change

It may perchance perchance well presumably smartly be hard to set optimistic in markets like this, nonetheless it is payment remembering that some groups are aloof shipping, aloof innovating, and aloof strengthening their fundamentals week after week. These are the initiatives that on the total emerge strongest when sentiment lastly turns. One title that stands out heavenly now for me is Aave, which rolled out both the novel Aave App and Aave v4 this week.

Let’s initiating with fundamentals. All over the last 300 and sixty five days, the total tag of sources deposited into Aave has grown from $20.5 billion to a height of $74 billion in early October. Even after the novel market pullback introduced that number the total method down to $fifty three.8 billion, Aave is aloof up roughly 2.6x 300 and sixty five days over 300 and sixty five days, which speaks to precise, sustained inquire for the protocol.

The rate of the Aave token may perchance perchance well presumably smartly be drifting shut to April lows, nonetheless weekly revenues repeat a assorted listing. Revenues nowadays are about 2.6x greater than they were help then, this capacity that that the token is seeing multiple compression pushed extra by sentiment than by fundamentals.

These fundamentals are primed to purple meat up additional with the initiating of the Aave App. The goal is understated: Get rid of complexity and give everyday customers a natty, intuitive savings abilities. And the pitch is mighty. Aave is offering hobby rates of as much as 6.5% on USD deposits, smartly above the 0.40-3.50% fluctuate offered by savings accounts.

Onboarding is designed to be easy, with deposits supported through bank accounts and debit playing cards, and balances marketed as insured as much as $1 million. The app is on hand in early get entry to on iOS with Android toughen on the capacity.

Then again, the insurance coverage half deserves a more in-depth look. The coverage is offered by Relm Insurance coverage, a firm that specializes in rising industries comparable to fintech, digital sources, AI and the distance financial system. Relm’s crypto asset insurance coverage includes coverage for dangers like natty contract exploits, stablecoin depegs, oracle manipulation, liquidity pool exploits and governance attacks. What remains unclear are the coverage limits, the possibility premiums Aave is paying, and whether or no longer Relm has the steadiness sheet strength or reinsurance in space to backstop remarkable claims. For context, insuring $1 million of USDC on Aave v3 through Nexus Mutual charges about 1.9% yearly.

As a doable user, I would need these essential aspects across the insurance coverage promise laid out clearly and upfront sooner than I’d feel tickled depositing capital into the app. And as an investor, it raises questions on the tag structure of offering both high savings rates and insurance coverage at scale. These uncertainties sit down alongside the broader quiz of how prolonged Aave intends to subsidize the disagreement between the 6.5% yield offered in the app and the 4% APY on hand in stablecoin markets on Aave nowadays.

Even with those uncertainties, this 2nd feels essential. The Neobank myth is gaining momentum, and Aave is now positioned straight away in that slipstream. Pair that with the advent of Aave v4, and also you’ve got got the root for what may perchance perchance well presumably smartly be the protocol’s subsequent essential development fragment.

Solana fairness perps?

Solana has prolonged positioned itself as a platform reason-constructed for institutional procuring and selling, with Anatoly Yakovenko describing the imaginative and prescient as “Nasdaq, nonetheless on a public, permissionless blockchain.” Central to this mission is bringing TradFi sources onchain, a goal that’s slowly materializing. Since June 30, 2025, over 60 tokenized shares from essential US companies and ETFs (e.g., Apple, Nvidia, S&P 500) are if truth be told on hand for non-US folk to aquire and support like they’d any SPL token.

These tokenized shares have gained essential traction on Solana, reaching $143 million in AUM when compared to factual $6.3 million for the EVM-primarily primarily based xStocks model. Furthermore, Galaxy Digital’s technique to tokenize its GLXY fairness during the Opening Bell platform, along with its work with Superstate, indicators that institutional adoption is slowly gaining momentum.

Then again, on the assorted facet — fairness perpetuals — Solana appears to be like to be lagging in the help of. While Solana is advancing its capabilities by enabling CLOB latency (through BAM) to toughen procuring and selling of man-made perps, Hyperliquid’s HIP-3 mainnet and subsequent “Boost Mode” (offering a 90% rate good aquire) has modified the panorama. With TradeXYZ clearing $400 million in every single day volume, there may perchance be a quiz of whether or no longer Hyperliquid’s dominance is already too some distance forward.

The principle argument for Solana’s warfare here is Hyperliquid’s distribution advantage through HIP-3. Usually, same outdated-reason chains have the advantage of customers’ “proximity to capital” — the friction of bridging to a brand novel substitute and developing a pockets typically makes customers settle on to set inner their hold ecosystem. Then again, through Builder codes, Hyperliquid has secured integrations with high distribution channels: Phantom now straight away provides HIP-3 equities through its frontend interface.

Alternatively, the argument is that Solana retains a structural advantage attributable to its proximity to tokenized space tokens (e.g., xStocks). This simplifies the assignment for market makers, as they are able to with out command hedge between space and perps (theoretically, as xStocks currently lack the onchain volume). In this regard, protocols like Drag that attention on scaling composability are smartly-positioned. Shall we embrace, customers may perchance perchance well presumably moreover with out command enter delta-goal positions (collateralizing xStock to short an xStock perp). This may perchance likely well well moreover resolve a essential command with perps currently: the extremely high tag of carry.

That being stated, most Solana protocols have aloof no longer integrated perpetual equities, so it remains to be viewed how they originate on this theoretical advantage.