- TON and Avalanche active addresses bigger than doubled in the previous month.

- TON derivatives imprint largely bullish trader sentiment no topic itsy-bitsy quick dominance.

- Avalanche trading quantity dropped but open ardour and bullish sentiment live high.

Recent recordsdata reveals a neat lengthen in active user addresses on the TON and Avalanche blockchain networks, reflecting heightened engagement over the last month. Both networks relish seen their active addresses bigger than double, signaling a resurgence of job in these ecosystems. This pattern is fraction of a broader overview of active addresses all the procedure via major digital currencies spanning mid-2023 to mid-2025.

Amongst leading blockchains, Tron (TRX) maintains the perfect desire of active addresses, fluctuating between 1.5 million and 3.5 million all the procedure via the duration. The network experienced a spike in job from August to October 2024 and currently holds above 2.5 million active addresses.

The desire of active addresses on TON and Avalanche has been trending up for the previous month.

In both conditions, the quantity bigger than doubled, indicating necessary renewed job on these networks. pic.twitter.com/RQfCnt9qdU

— Sentora (previously IntoTheBlock) (@SentoraHQ) July 2, 2025

Bitcoin (BTC) has displayed stable user job, with active addresses constantly ranging from 800,000 to 900,000. Ethereum (ETH) has proven popular issue in active addresses, rising from approximately 400,000 in mid-2023 to easily about 600,000 by mid-2025, inserting it second in user engagement in the advantage of Tron.

Other networks equivalent to Litecoin (LTC) and Cardano (ADA) point out more variability, with active addresses fluctuating between 100,000 and 400,000. Cardano peaked in early 2025 earlier than experiencing a decline in direction of mid-2025. Bitcoin Cash (BCH), Avalanche (AVAX), Ton, Algorand (ALGO), and Dogecoin (DOGE) relish recorded lower and more unstable active address counts, largely final under 200,000.

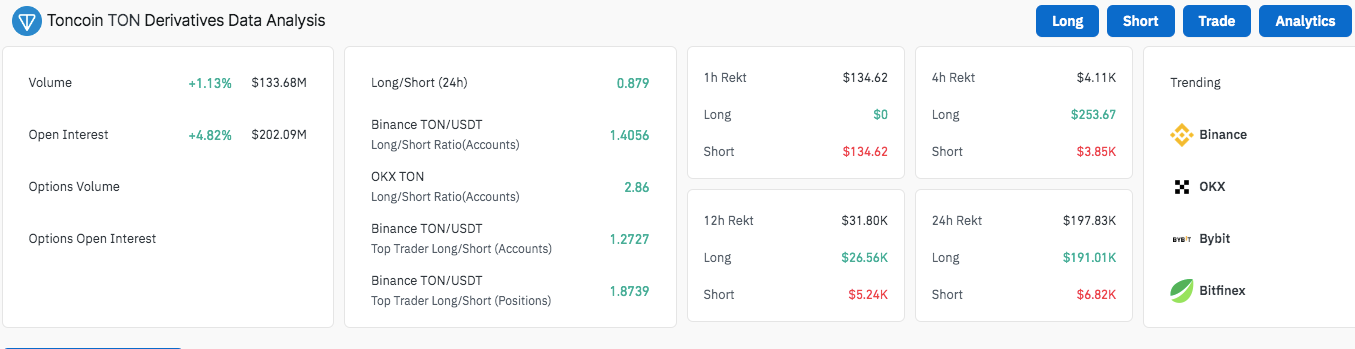

TON Derivatives Market Reveals Bullish Positioning

Derivative metrics for Toncoin imprint a cautious yet optimistic trader sentiment. Trading quantity elevated by 1.13%, reaching $133.68 million, whereas open ardour rose by 4.82% to $202.09 million. The 24-hour overall prolonged-to-quick ratio is 0.879, indicating a itsy-bitsy predominance of quick positions.

Nonetheless, myth-level recordsdata from Binance’s TON/USDT market unearths a prolonged/quick myth ratio of 1.4056, and OKX reports a honest better bullish ratio of 2.86. Prime merchants on Binance take care of a balanced but assured stance, with a prolonged/quick myth ratio of 1.2727 and a just ratio of 1.8739.

Liquidation figures over the last four hours imprint better losses on quick positions, with $134.62 lost in the final hour and $3,850 over four hours. Lengthy positions experienced better liquidation totals over 24 hours, totaling $191,010, in comparison with $6,820 for shorts.

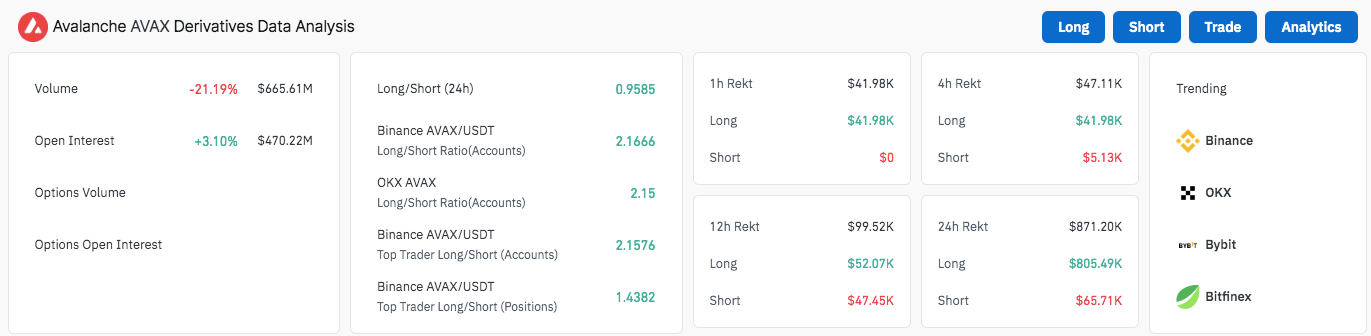

Avalanche Derivatives Mirror Blended Signals

Within the derivatives market of Avalanche, the detrimental traits are noticed, as the quantity of trades has lowered by 21.19% and amounted to $665,61 million, which testifies to a decrease in trading job. Even supposing here’s the case, the open ardour has grown up 3.10% to be at a rate of $470.22 million as a signal of persevered accumulation and keenness among merchants.

The 24-hour prolonged/quick ratio stands near to balanced at 0.9585 overall. Nonetheless, myth recordsdata parts to bullish sentiment: Binance’s AVAX/USDT market reveals a prolonged/quick myth ratio of 2.1666, whereas OKX’s stands at 2.15. Prime Binance merchants take care of a prolonged/quick myth ratio of 2.1576 and a just ratio of 1.4382.

Moreover, unique recordsdata on liquidation point out prolonged positions are on the frontline entertaining the loss. Within the previous hour, prolonged liquidations totaling $41,980 were liquidated versus no quick liquidations. Over the final 24 hours, prolonged liquidations totaled 805,490, bigger than 12 instances in comparison with shorts at 65,710.