AAVE rate is sending receive bullish indicators on every the each day and hourly charts. After months of consolidation and decline, the latest breakout above key resistance levels hints at a doubtless vogue reversal. Let’s decode the associated fee action the usage of the latest TradingView files and resolve the put Aave rate would possibly perhaps well perhaps perhaps also head subsequent.

Aave Label Prediction: What Does the Each day Chart Verbalize?

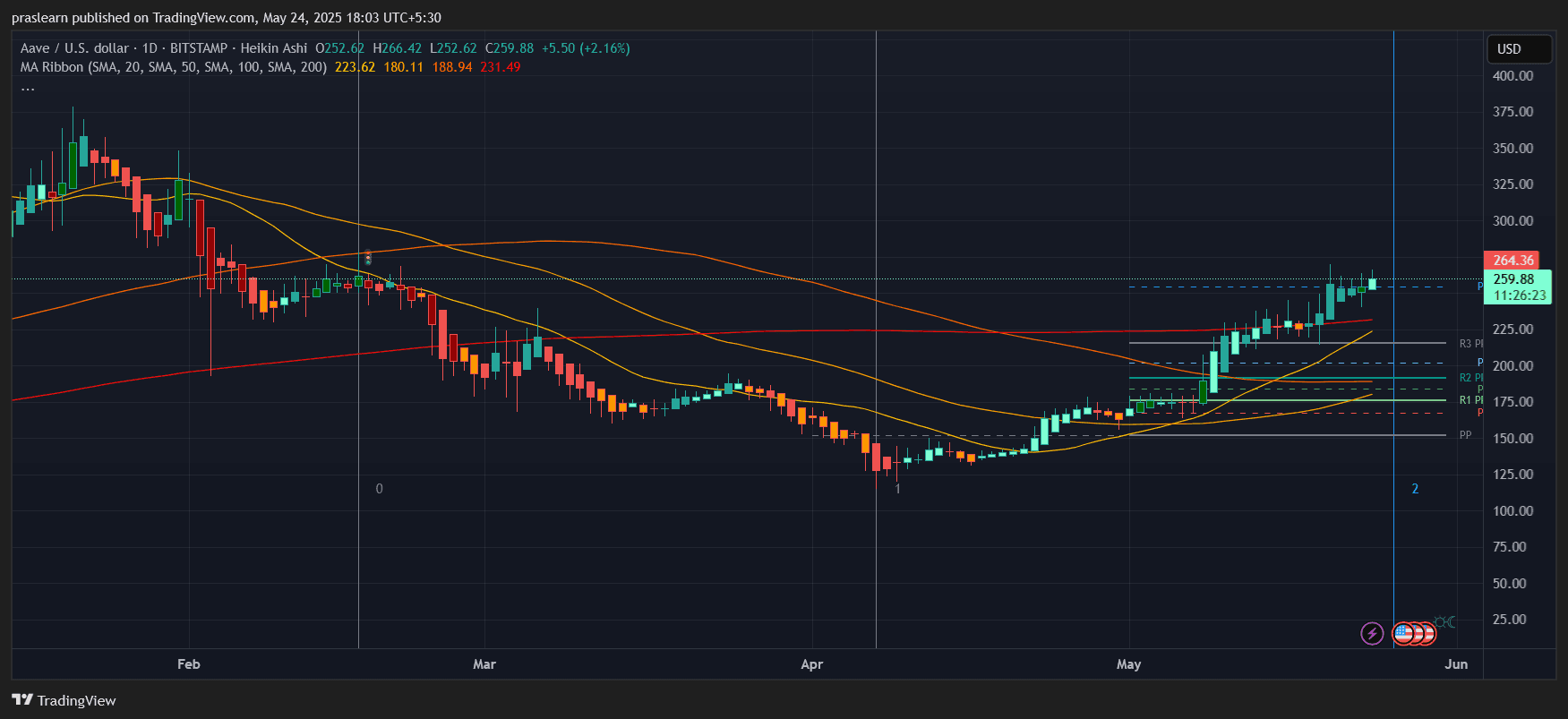

The each day chart of AAVE rate reveals a sturdy breakout pattern. Label is for the time being shopping and selling at $259.88, up 2.16% on the day. Extra importantly, AAVE rate has broken above its 100-day and 200-day transferring averages, which would possibly perhaps well perhaps perhaps even be for the time being round $231.49 and $223.62, respectively. This pass is technically important as it marks a shift from bearish to bullish momentum.

Notably, the transferring realistic ribbon (20, 50, 100, 200 SMAs) is starting up to flip, with the shorter-term MAs now sloping upwards and making ready to contaminated over the long-term MAs. This MA compression and doubtless crossover is in total seen sooner than a sustained rally.

The Heikin Ashi candles replicate receive bullish momentum with consecutive inexperienced bodies and no decrease wicks, suggesting minimal promoting stress. The breakout above the horizontal resistance at $250–$255, now became into give a enhance to, gives bulls extra management.

What’s the Hourly Chart Telling Us?

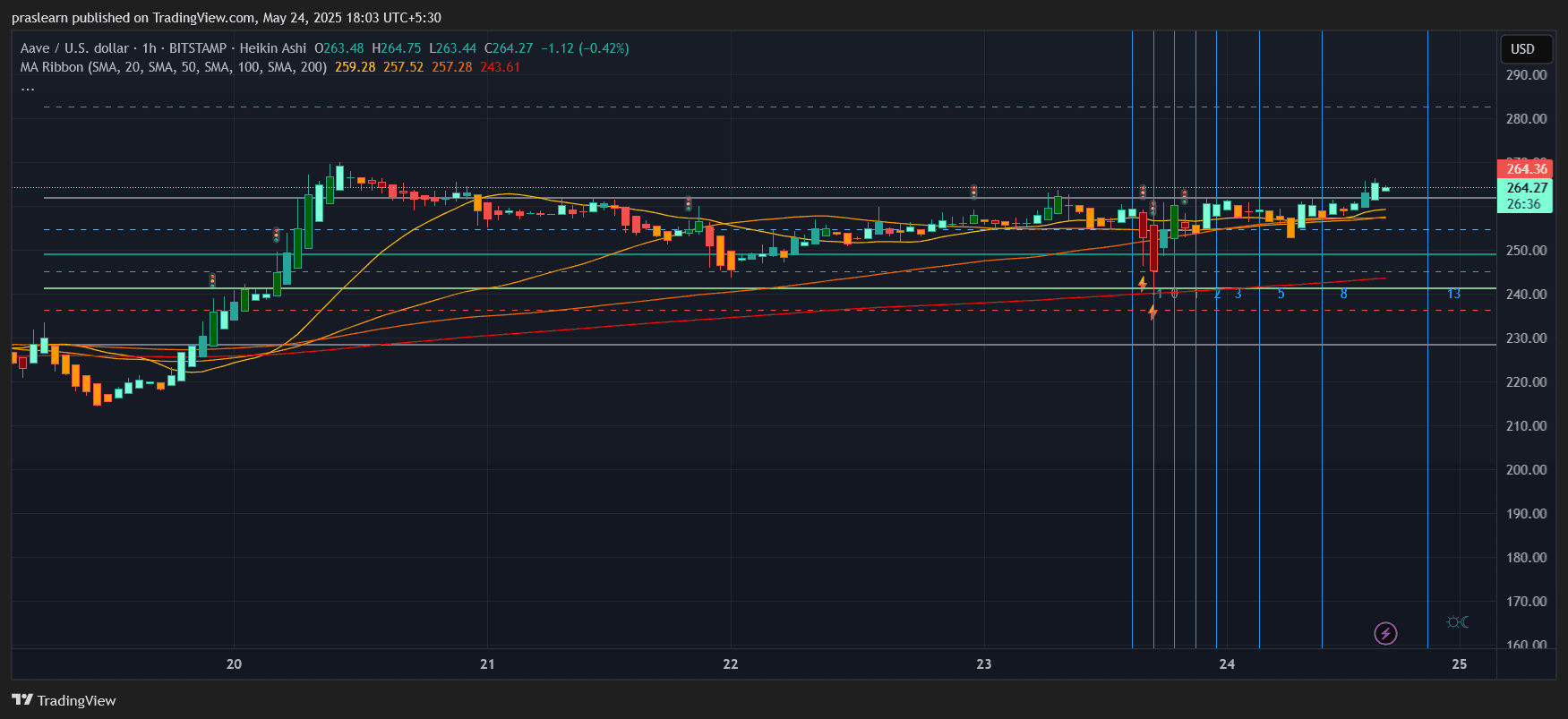

Zooming into the hourly chart, AAVE rate has been consolidating above its key fast-term give a enhance to at $257.52 (50 SMA) and $259.28 (20 SMA), forming a correct bullish flag. This consolidation, following a breakout, in total precedes yet any other upward impulse.

Label touched a high of $264.75 and has pulled abet slightly, now hovering round $264.27. If bulls organize to smash and shut above $265, the next key psychological and technical stage is $280, adopted by the $300 stamp.

The fast-term rate structure reveals better highs and better lows, a textbook bullish formation. This structure, combined with rate hugging the upper Bollinger Band and constantly sorting out resistance, confirms accumulation.

What Are the Key Ranges to Gaze?

Let’s smash down the levels the usage of Fibonacci and rate structure:

- Abet 1: $257 – Fresh SMA cluster and breakout retest zone

- Abet 2: $231 – Confluence of 200 SMA on each day

- Resistance 1: $265 – Intraday high and instantaneous breakout zone

- Resistance 2: $280 – April swing high

- Resistance 3: $300 – Fundamental psychological barrier

A rapid Fibonacci extension from the latest swing low at $165 (early April bottom) to the swing high at $264 gives a 1.618 extension purpose at $305, lining up with the psychological $300 zone.

Calculation:

$264 − $165 = $ninety nine (swing vary)

1.618 × $ninety nine = $160.68

Target = $165 + $160.68 ≈ $325 (Aggressive bull purpose)

Nonetheless conservative projection at 1.272 extension = $165 + (1.272 × $ninety nine) = $291

What’s the Aave Label Prediction for the Next 7 Days?

If Aave rate maintains its preserve above the $257–$260 vary, it’s more likely to envision $265–$270 early in the week. A breakout above $270 can plod up the pass in direction of $290–$300. The momentum is receive, nonetheless a failure to shut above $265 would possibly perhaps well perhaps perhaps also trigger a retest of $250.

Given the bullish rate action, upward-sloping transferring averages, and receive market structure, the likelihood of sorting out $300 in the next 7–10 days is high, especially if broader market sentiment stays favorable.

Closing Rob: Is Now a Staunch Time to Aquire AAVE?

AAVE rate appears to be in the early levels of a brand original bullish vogue. The each day chart breakout, bullish structure on the hourly, and rising transferring averages all suggest energy. As long as Aave rate stays above $250, the bulls are as a lot as plod.

Non permanent merchants would possibly perhaps well perhaps perhaps also purpose $280–$300, whereas long-term merchants would possibly perhaps well perhaps perhaps also quiet seek for a retest of $231 as a receive aquire-the-dip zone. A decisive each day shut above $265 would possibly perhaps well perhaps perhaps also unlock rapid upside doubtless, making now a most major time for AAVE watchers.