After experiencing a critical note decline within the past few days, the general market sentiment appears to be like to be improving. Amid this market restoration, Aave (AAVE) appears to be like bullish and is poised for a double-digit note net, reflecting its newest note action observed on the every day time body.

AAVE Technical Evaluation and Upcoming Phases

In step with skilled technical evaluation, AAVE is forming a bullish double-bottom pattern. On the replacement hand, the pattern is now not yet full. It is gaining toughen from customers, has successfully formed the 2d bottom, and has begun constructing upside momentum.

Fixed with newest note action, if AAVE holds above the 2d bottom, it can well surge by 25% to reach the neckline at $375 in due direction.

On the optimistic facet, AAVE’s Relative Energy Index (RSI) stands at 52, indicating rising buying for stress and a real likelihood that the note would possibly well fly significantly.

Bullish On-Chain Metrics

With this real bullish note action, dealer and investor participation has skyrocketed, as published by the on-chain analytics companies Coinglass and IntoTheBlock. Records on spot inflows/outflows allege that exchanges accept as true with witnessed an outflow of over $3.5 million price of AAVE tokens.

On the replacement hand, experts look for this outflow as a doable accumulation by prolonged-interval of time holders, as they transfer assets from exchanges to their wallets.

Alongside with ability accumulation by customers, intraday dealer participation has skyrocketed within the past 24 hours. Records unearths that AAVE’s originate passion (OI) has jumped by 7.5%, indicating a upward push in current originate positions as sentiment begins to shift.

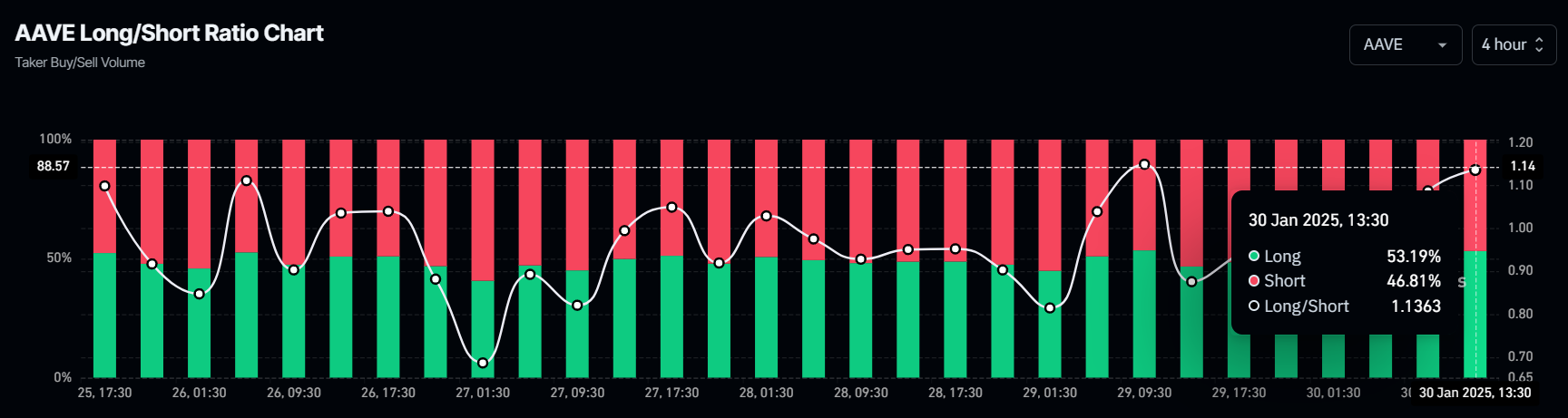

On the replacement hand, on-chain metrics further published that the massive majority of traders’ positions are on the prolonged facet, as indicated by the AAVE Prolonged/Short Ratio, which presently stands at 1.13. This ratio means that for each and each 1.13 prolonged positions, there would possibly be a single short set up apart, reflecting bullish sentiment among traders.

Modern Mark Momentum

AAVE is presently trading shut to $317 and has skilled a note surge of over 10% within the past 24 hours. Additionally, at some level of the same interval, its trading quantity jumped by 20%, indicating heightened participation from traders and customers when compared to the outdated day.