AAVE set aside continues to surge, cementing its space because the largest lending protocol in crypto with a market cap of $5.5 billion—more than all other top 10 lending protocols mixed.

The token has risen a convincing 220% this twelve months and 110% in simply the last 30 days, pushed by stable bullish momentum and rising market passion. Technical indicators such because the RSI and CMF highlight ongoing obvious dispositions, although some signs of cooling momentum counsel possible consolidation forward.

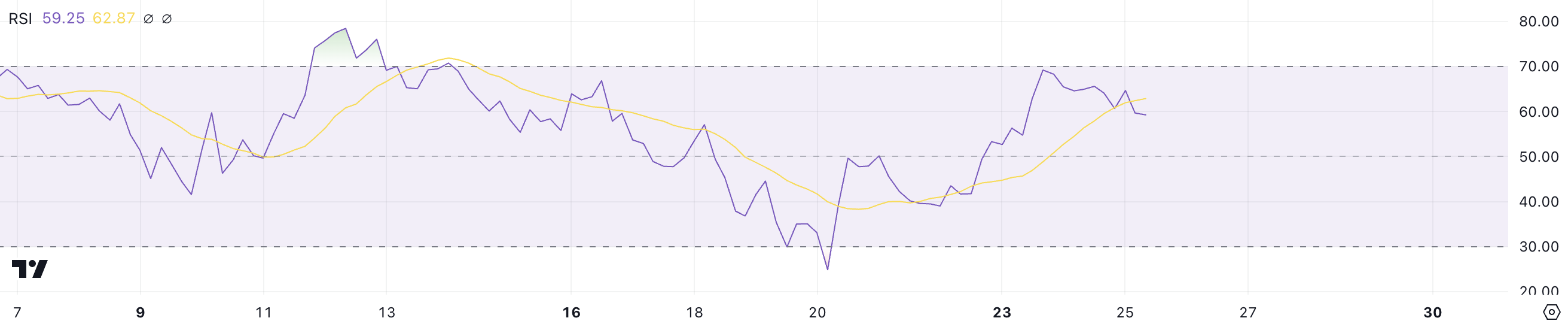

AAVE RSI Is Neutral After Virtually Reaching the Overbought Zone

AAVE Relative Energy Index (RSI) is at this time at 59.2, down from 69.19 on December 23, when its set aside peaked at $382. This decline in RSI suggests that AAVE set aside has moved a long way off from overbought territory, where heightened purchasing stress most frequently precedes a group aside correction.

Whereas the most up-to-date RSI aloof reflects barely stable momentum, the pullback indicates that the market is also stabilizing after a duration of intense purchasing narrate.

RSI is a momentum indicator that measures the tempo and magnitude of set aside movements on a scale from 0 to 100. Values above 70 blow their private horns overbought stipulations, signaling the capacity for a correction, whereas values below 30 counsel oversold stipulations, most frequently preceding a rebound.

With AAVE RSI at 59.2, the coin remains in a neutral-to-bullish fluctuate, signaling that the uptrend may possibly perhaps continue within the rapid duration of time if purchasing momentum rebuilds. Alternatively, the decline from overbought ranges also suggests that AAVE set aside may possibly perhaps consolidate, permitting the market to soak up fresh good points before deciding its next route.

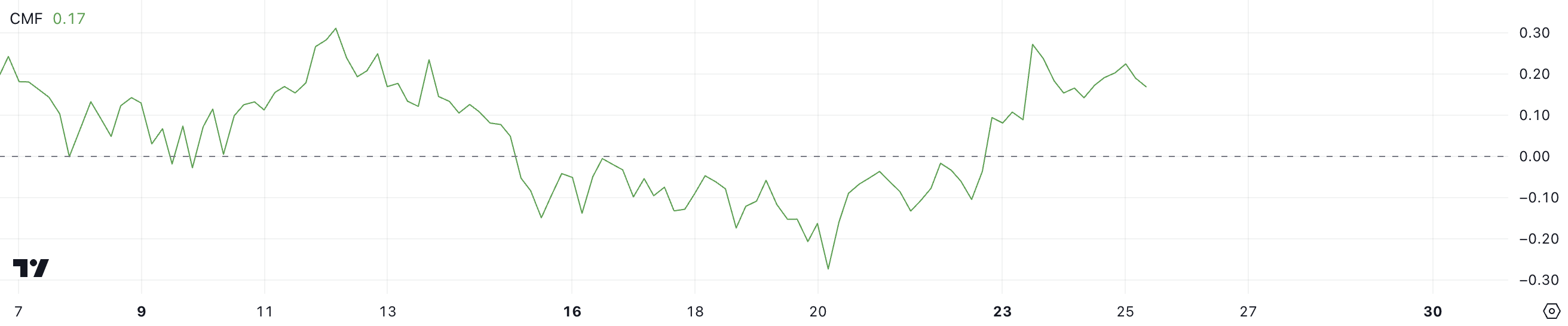

AAVE CMF Is Serene Very Certain, But Down From The Original Peak

AAVE’s Chaikin Cash Float (CMF) is at this time at 0.17, affirming a obvious fashion since December 23, when it reached a top of 0.27. This indicates that AAVE has been experiencing consistent capital inflows, reflecting stable purchasing stress available within the market.

Whereas the CMF has declined from its fresh top, the ghastly fee suggests that merchants are aloof up to the set aside, albeit with a shrimp diminished intensity.

CMF is a quantity-weighted indicator that measures the buildup or distribution of an asset over a particular duration, starting from -1 to +1. Certain CMF values blow their private horns accumulation and purchasing stress, whereas harmful values signify distribution and selling stress.

With AAVE CMF at 0.17, the continuing obvious influx suggests that the token may possibly perhaps preserve its most up-to-date set aside ranges and even safe out about extra good points within the rapid duration of time if purchasing narrate persists. Alternatively, the decline from the December 23 top indicates that momentum is also cooling, potentially ensuing in a duration of consolidation before any decisive circulation.

AAVE Note Prediction: Can AAVE Upward push to three-Yr Highs?

If the most up-to-date obvious momentum continues, AAVE set aside may possibly perhaps take a look at $400, a notable stage that would set aside its most realistic set aside since 2021. The token needs to upward thrust simply 7.5% to be triumphant on this milestone, supported by the golden corrupt formation on December 23 and EMA lines that blow their private horns the uptrend may possibly perhaps persist.

This alignment of technical indicators suggests that bullish sentiment remains stable, with merchants possible to push prices higher if the fashion holds regular.

Alternatively, as highlighted by the CMF, the energy of the uptrend has waned when compared with a few days ago, signaling the capacity for a fashion reversal. If AAVE set aside uptrend loses steam, the worth may possibly perhaps drop to examine the $355 red meat up stage.

Need to aloof this red meat up fail, AAVE may possibly perhaps safe out about extra declines, with possible targets at $297 and even $271, reflecting a notable correction.