Ethereum (ETH) is grappling with fading bullish strength as its latest are trying to surpass serious resistance zones has faltered. Shopping and selling at $3,119, the ETH token hovers right below its 100-day Easy Transferring Practical (SMA) at $3,312, caught in an excellent consolidation fragment that might perchance presumably presumably dictate its next huge switch.

One-Day Chart Analysis

Per the day-to-day chart diagnosis, a indispensable effort become as soon as made to ruin thru the $3,500 resistance degree, where key technical components converged. This included the upper boundary of a symmetrical triangle sample and the 50% Fibonacci retracement degree at $3,517. But, the push become as soon as met with stiff promoting strain, forcing a retreat and leaving bulls unable to capitalize on the momentum.

Ethereum’s failure to care for momentum above key resistance phases has published weak point in procuring strain, triggering a corrective switch to its latest degree of spherical $3,119. At latest, the $3,000 enhance degree stands as a serious line of defense, providing balance amidst mounting bearish strain.

On the opposite hand, ought to peaceable this enhance ruin, the cryptocurrency risks a additional drop toward $2,927, a pivotal Fibonacci retracement zone that might perchance presumably presumably relief as a key battleground between bulls and bears. This form of breakdown would seemingly beef up bearish sentiment, pushing the ETH token into deeper corrections and reshaping its transient market trajectory.

On the upside, the 100-day shifting average (MA) acts as a ambitious resistance, capping any bullish restoration makes an try so long as the ETH cryptocurrency trades below it. In the intervening time, the symmetrical triangle sample on the chart provides a ingredient of suspense, suggesting the probability of a appealing and decisive switch in both direction.

A breakout above $3,500 might perchance presumably presumably reignite optimism and delivery the door to greater label targets. On the opposite hand, a breach below $3,000 might perchance presumably presumably disappear promoting strain, leaving bulls on the defensive and potentially tipping the steadiness in need of bears. With the Ethereum token at a serious juncture, its next switch will seemingly define the quick market outlook, preserving traders on edge.

Profitability and Transaction Analysis

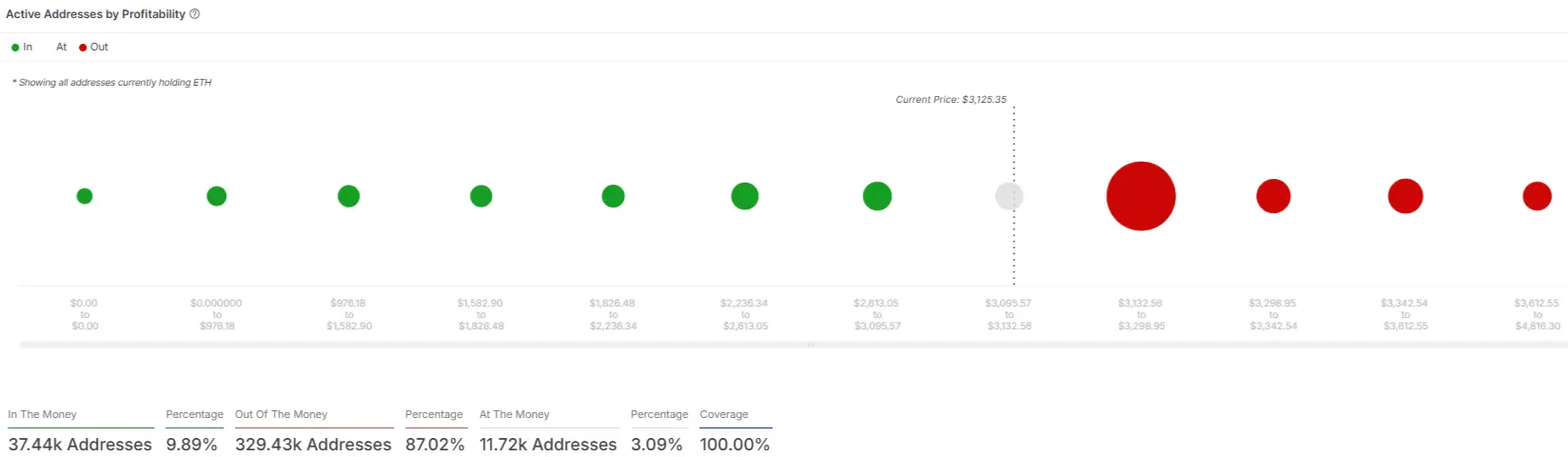

Ethereum’s latest label degree, hovering spherical $3,119, paints a elaborate portray for traders and investors. Per the profitability chart, 87.02% of addresses retaining ETH tokens are “out of the cash,” indicating that most holders are experiencing unrealized losses on the latest label.

Most efficient 9.89% of addresses are “within the cash,” signaling a steep uphill battle for bulls to gain momentum. In the intervening time, 3.09% of addresses are “on the cash,” reflecting the wonderful equilibrium within the market. This stark disparity underscores the significance of the $3,000 enhance zone, as its failure might perchance presumably presumably intensify bearish sentiment, using costs toward the next key Fibonacci retracement degree of $2,927.

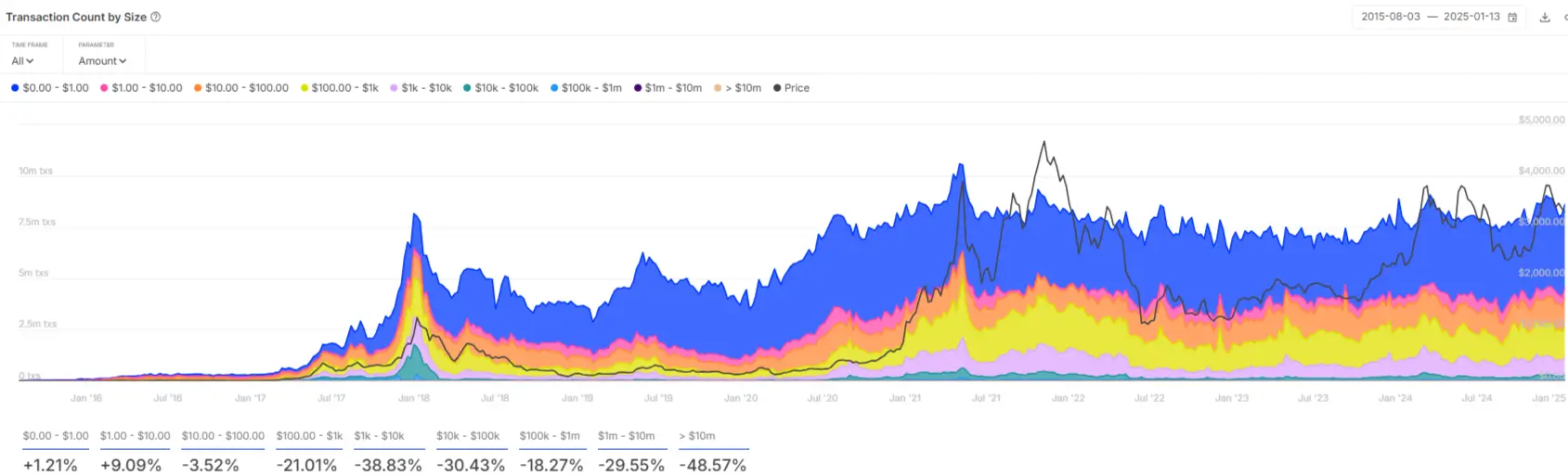

Conversely, a decisive push above the $3,132-$3,500 resistance differ would seemingly present great-indispensable reduction for struggling investors. On the diverse hand, the transaction count data by dimension unearths additional insights into market habits. Puny-scale transactions under $1,000 admire considered marginal progress, with increases of +1.21% and +9.09%, respectively, for transactions under $1 and between $1 and $10.

On the opposite hand, higher transactions are on a steep decline. As an illustration:

- Transactions between $10,000 and $100,000 admire dropped by -30.43%.

- Transactions within the $1 million-$10 million differ admire plummeted by -29.55%.

- Institutional-sized transactions exceeding $10 million admire taken the hardest hit, declining by -Forty eight.57%.

This downward pattern in wide-scale transactions suggests waning self perception amongst institutional gamers, additional weighing the cryptocurrency’s transient outlook.

Additionally Be taught: AAVE Tag Targets $400 as Whale Activity Surges