Main Takeaways

-

The increasing retail adoption, prolonged-term maintaining habits, and institutional pastime underscore Bitcoin’s evolving role as a reliable retailer of fee.

Bitcoin has rolled into 2025 having surpassed the as soon as-elusive $100,000 set apart within the final month of closing twelve months. The crypto market is silent experiencing outstanding momentum that underscores its strength and resilience. On the opposite hand, what became as soon as a big milestone simply months ago now seems like dilapidated facts, prompting questions about whether or no longer the rally shall be nearing its discontinue. No longer prolonged ago, the root of Bitcoin at $100K regarded nearly unattainable – but here we are. Where is BTC headed next?

Some accumulate it exhausting to affirm that huge additional affirm is that you would possibly perchance be in a collection apart to affirm now that the coveted milestone is done. Nevertheless is that this sentiment rooted in facts and systematic thinking, or simply in a failure of imagination? As every person is aware of all too neatly, finally, is that the boundaries of what’s that you would possibly perchance be in a collection apart to affirm are extraordinarily malleable.

A wiser stare upon key metrics beyond ticket unearths a solid image of sturdy community neatly being and exercise. These indicators affirm their own praises huge seemingly for sustained affirm, highlighting an ecosystem brimming with innovation, adoption, and prolonged-term promise. Below, we dig into the info and traits that verify Bitcoin’s enduring dominance and colossal seemingly for additional affirm.

ETF Boost, Decoupling From Stocks, Computational Energy

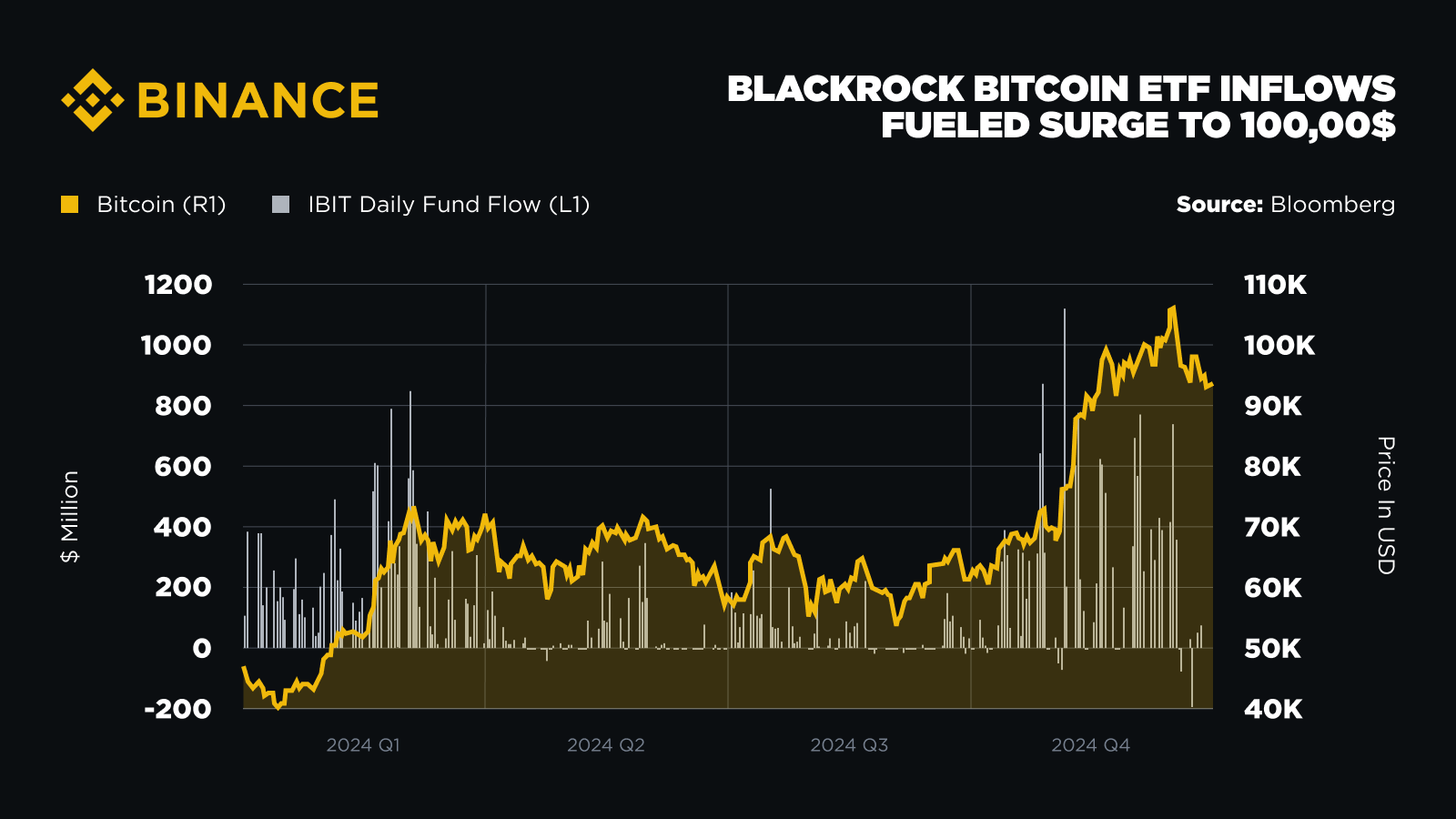

The approval of region Bitcoin ETFs in early 2024 marked a big step for the mainstream adoption of crypto resources globally. This milestone no longer only signaled a increased acceptance of cryptocurrency by old vogue finance gamers but moreover each mirrored and spurred institutional inch for food for digital resources. Over the direction of the twelve months, U.S.-traded Bitcoin ETFs experienced exponential affirm, with holdings doubling from 650,000 BTC in January 2024 to over 1,250,000 BTC by twelve months-discontinue. Leading this transformation became as soon as BlackRock’s iShares Bitcoin Have confidence (IBIT), which shattered change records by collecting over $50 billion in resources within simply 11 months, making it basically the most worthwhile ETF initiate to this point among the extra than 1,400 ETFs offered globally by BlackRock’s iShares.

This unprecedented affirm no longer only highlights Bitcoin’s increasing allure but moreover underscores the broader market’s recognition of its prolonged-term seemingly. Institutional gamers are extra and extra integrating crypto into their portfolios, additional solidifying its role in global finance.

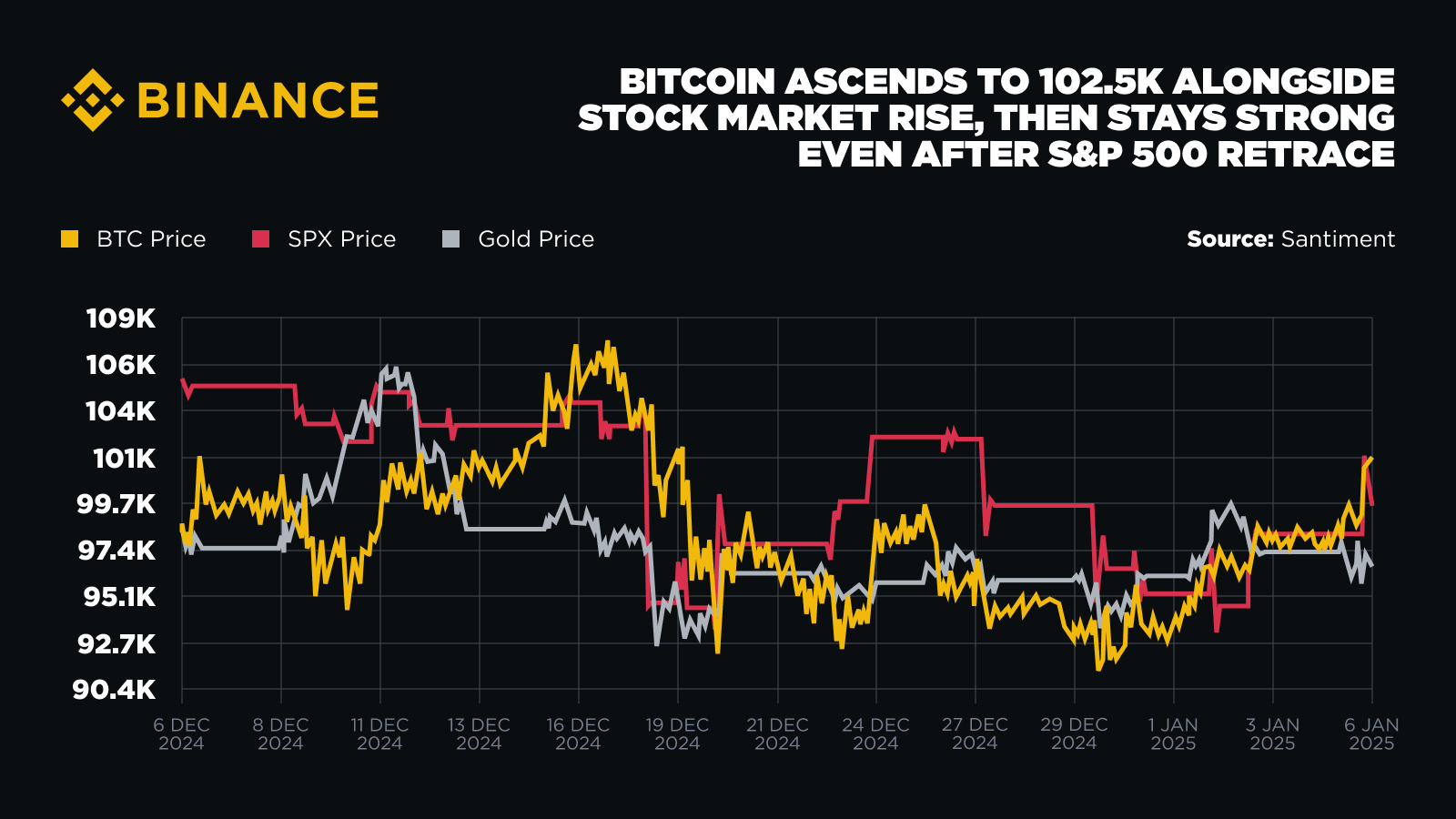

In early 2025, Bitcoin has moreover confirmed indicators of decoupling from old vogue fairness markets, outperforming the S&P 500 index and signaling a shift away from its prior habits as a “excessive-leveraged tech inventory.” This divergence reinforces Bitcoin’s set apart as a plenty of asset standing other than old vogue market traits – whereas demonstrating its seemingly to thrive within the evolving financial panorama.

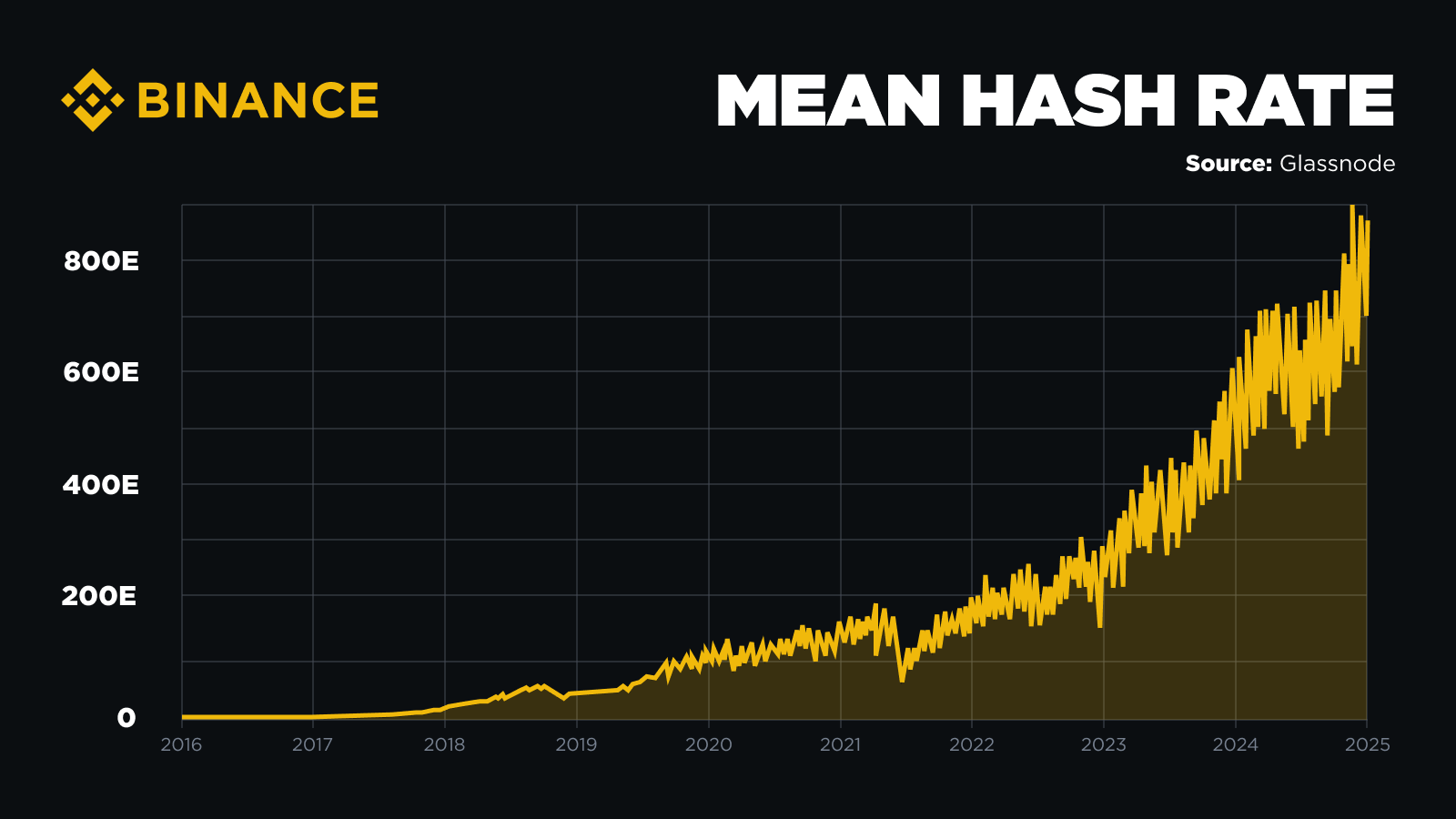

But, whereas institutions are turning into extra and extra influential with the approval of ETFs, the lawful vitality of Bitcoin stays in its decentralized building. A key reflection of this decentralization is Bitcoin’s hashrate — a in point of fact noteworthy gauge of the blockchain’s security and computational strength.

Bitcoin’s hashrate has only lately reached an all-time excessive, surpassing the combined computing vitality of tech giants such as Amazon AWS, Google Cloud, and Microsoft Azure, which together make contributions lower than 1% of Bitcoin’s total community ability. This extra special stage of decentralization showcases the outstanding coordination among miners and node operators globally. It reinforces the community’s resilience and highlights the believe it continues to originate, from early pioneers to contemporary entrants within the ecosystem.

Crossing the Chasm: Growing Retail Adoption

Crypto’s ongoing momentum has moreover caused noticeable adjustments in individual habits. These shifts highlight Bitcoin’s evolving adoption narrative, with many users maintaining BTC for the first time. The increasing shift from speculative trading to prolonged-term maintaining displays increasing believe within the crypto ecosystem and its leading gamers.

A important milestone highlighting this growth became as soon as Binance surpassing a quarter of a thousand million users on the closing day of 2024 – done by adding 50 million users in lower than six months. This outstanding fulfillment aligns with broader traits of adoption, where users extra and extra explore BTC as a retailer of wealth and a hedge against financial uncertainty. Such behavioral adjustments are solid indicators that the adoption chasm – a well-known stage within the lifecycle of any modern expertise – is being crossed. As believe deepens and extra people acknowledge Bitcoin’s intrinsic fee, the root for its mainstream adoption continues to solidify, atmosphere the stage for the following wave of affirm within the cryptocurrency ecosystem.

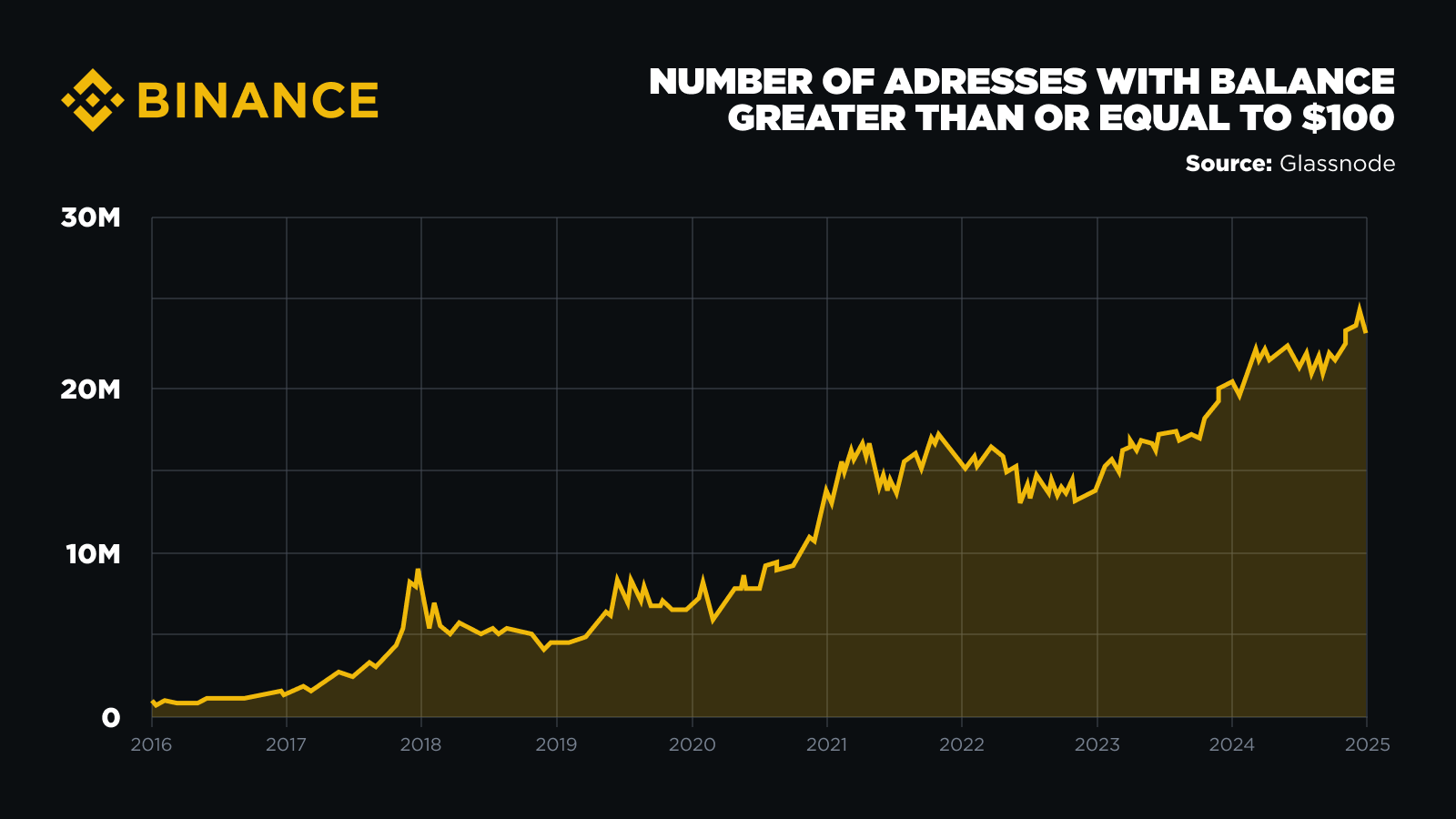

This increasing believe and recognition of Bitcoin’s fee are additional supported by on-chain facts, which unearths a surge in wallet addresses maintaining a minimal of $100 or $1,000 rate of Bitcoin, approaching all-time highs.

This vogue displays an inflow of present people into the market, signaling renewed pastime and optimism for the cryptocurrency. Whereas institutional gamers procure completely performed a important role this cycle with the ETF launches and the institution of bitcoin treasuries by assorted public corporations, the rate of particular individual investor adoption stays robust. Their increasing presence is broadening Bitcoin’s individual deplorable and solidifying its role as a cornerstone of the evolving financial panorama.

Bitcoin’s Surging Quiz

Potentially the most compelling Bitcoin narrative isn’t simply within the rate – it’s within the habits of Bitcoin investors. Over 50% of BTC in circulation has remained unmoved for the past two years, underscoring the increasing conviction of prolonged-term holders. This shift in opposition to “HODLing” displays increasing optimism and believe in Bitcoin’s future as a reliable retailer of fee.

The market sentiment stays robust, with 86% of Bitcoin at this time in circulation “in profit,” signaling resilience and contemporary self assurance among investors. Quiz momentum has surged since gradual 2024, with CryptoQuant facts showing an growth of 228,000 BTC monthly. Severely, accumulator addresses – wallets that consistently aquire Bitcoin with out promoting – procure reached a yarn trail of 495,000 BTC monthly, additional indicating a solid belief in Bitcoin’s prolonged-term seemingly.

Pause of Cycle Soon?

During the past twelve months, Bitcoin reached plenty of all-time highs. Whereas some investors wondered whether or no longer the bull market had peaked, a nearer examination of key metrics suggests that the upward trajectory is well-known from over.

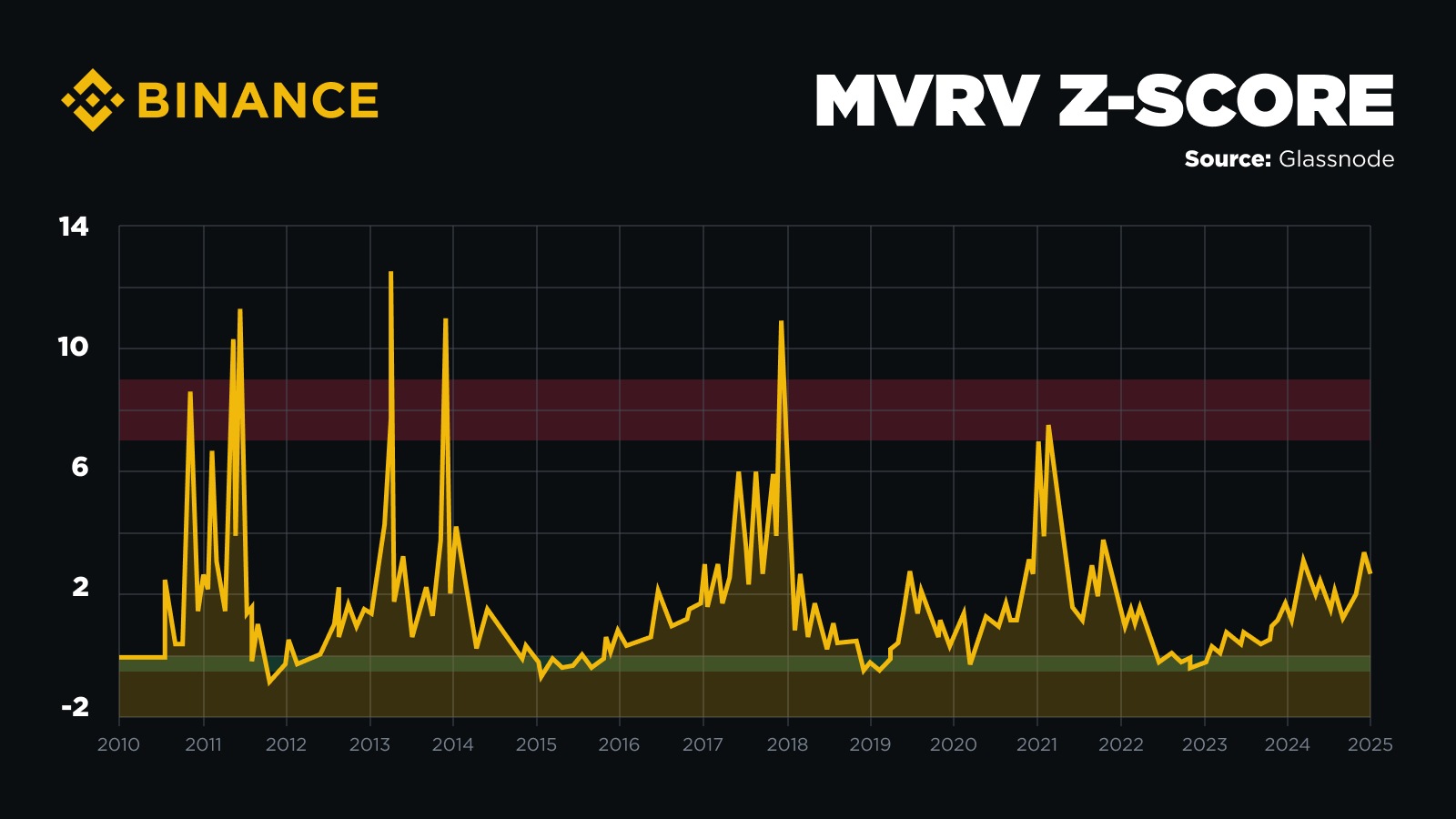

One of basically the most insightful tools in knowing Bitcoin’s future seemingly is the MVRV Z-Secure. This metric affords precious details about Bitcoin’s market valuation by evaluating the market fee to BTC’s “dazzling fee” and thus figuring out whether or no longer Bitcoin is overvalued or undervalued. At this time, Bitcoin stays some distance from the “red zone,” where overvaluation signals a market high, suggesting that it has important room for affirm.

Furthermore, Bitcoin’s dominance among prolonged-term holders is playing a important role in its sparkling outlook. The increasing accumulation is lowering market liquidity, creating a present crunch that keeps pushing costs upward. This vogue, coupled with the sure signals from the Crypto Anxiety and Greed Index, paints an optimistic image. Coming into 2025, the index reveals a healthy stage of greed with a 30-day Straightforward Curious Moderate at 75%, reflecting solid bullish “greed” sentiment with out the vulgar irrational exuberance that veritably precedes market corrections. This sustainable momentum aspects to Bitcoin’s increasing acceptance and believe.

Final Thoughts

As we whisk into 2025, Bitcoin’s seemingly looks boundless. The asset keeps breaking contemporary ground in phrases of ticket, and facts aspects to an well-known extra thrilling twelve months forward. With well-known financial institutions flocking into the crypto set apart and increasing retail adoption, Bitcoin isn’t any longer considered as a gap asset but as a true, scalable financial instrument.

With solid fundamentals, increasing adoption, and a healthy market atmosphere, Bitcoin is poised for continued success. The metrics paint a image of an asset that is extra resilient and promising than ever, with 2025 shaping as a lot as be a twelve months that would possibly perchance perchance surpass even the buzz of 2024. The steadiness between institutional involvement and Bitcoin’s decentralized vitality continues to space it apart, reinforcing its prolonged-term viability and positioning it as a transformative power within the worldwide financial gadget.

Open your Bitcoin lag with Binance on the present time!

Extra Reading

-

From Our CEO: It’s Easy Early For Crypto

-

From Bars to Bytes: Gold, Bitcoin, and the Future of Cost

-

Bitcoin Hits $100K: From Slices to Surges, the Race of a Lifetime

Disclaimer: Digital resources are discipline to excessive market possibility and rate volatility. The cost of your investment would possibly perchance simply work down or up, and also you would possibly perchance presumably presumably simply no longer salvage help the amount invested. You are fully accountable for your investment choices and Binance is no longer liable for any losses you would possibly perchance presumably presumably simply incur. Previous efficiency is no longer a reliable predictor of future efficiency. It’s good to silent only make investments in merchandise you would possibly perchance presumably presumably very neatly take into accout of and where you know the hazards. It’s good to silent carefully procure in mind your investment experience, financial instruct, investment targets and possibility tolerance and seek the suggestion of an self sustaining financial adviser earlier than making any investment. This discipline materials must silent no longer be construed as financial suggestion. For added facts, glance our Phrases of Use and Risk Warning.