Bitcoin, priced at $103,458 to $104,206 at some level of the last hour with a 24-hour trade quantity of $70.41 billion and a market valuation of $2.06 trillion, has viewed an intraday ticket vary between $102,784 and $107,245, signaling energetic market participation and distinguished volatility.

Bitcoin

Bitcoin‘s one-hour chart reveals a bearish pullback dominating the non permanent model following a rally to $107,265, with prompt give a enhance to at $103,500 and resistance at $105,000 to $106,000. Quantity diagnosis indicates declining sell rigidity, suggesting a doable non permanent exhaustion of bearish momentum. A damage under $103,500 would possibly maybe well per chance additionally result in a additional downside in the direction of $100,000, while conserving this level with a bullish pattern would possibly maybe well per chance additionally merely provide a scalping opportunity focusing on $105,500.

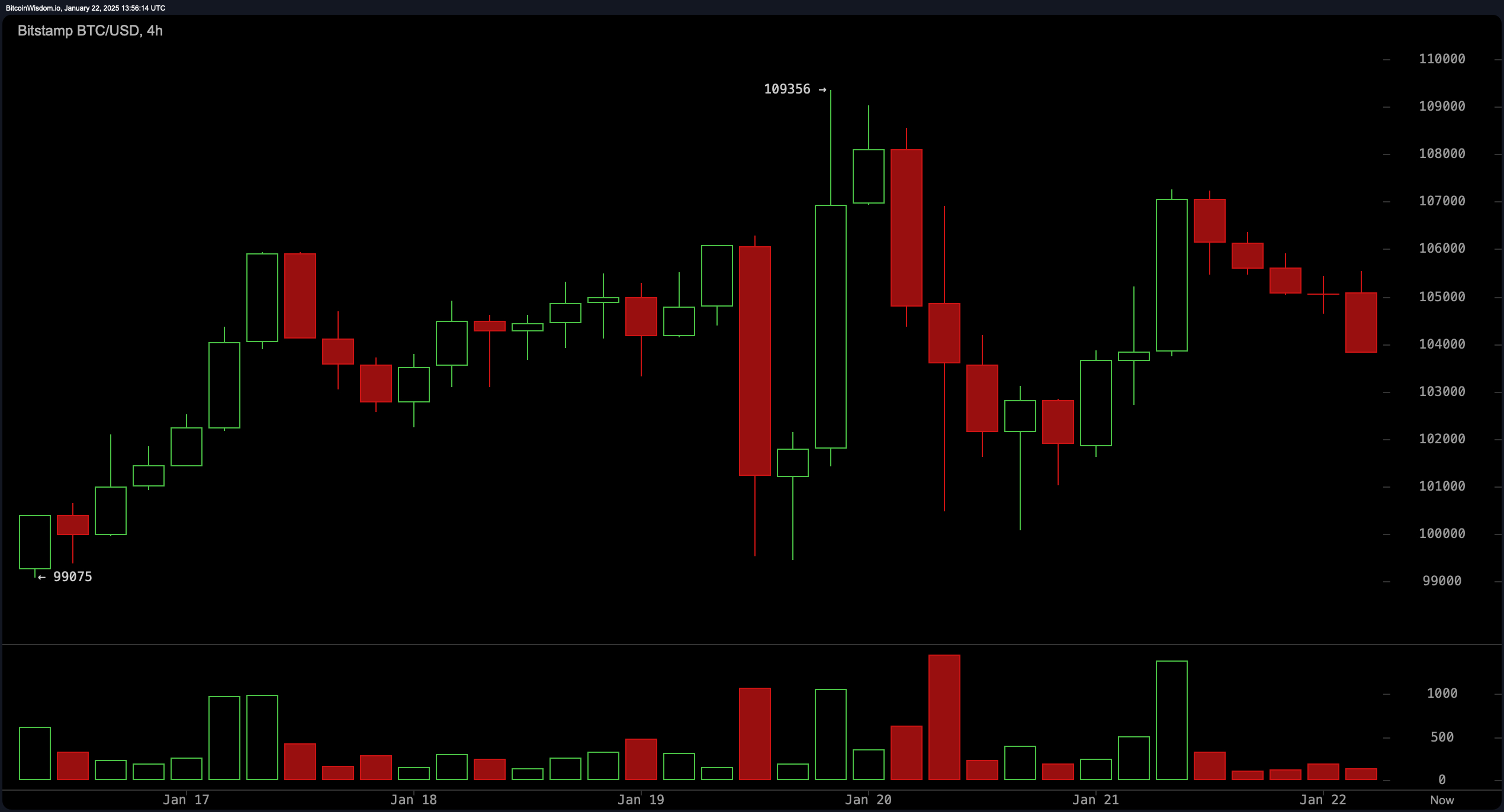

The four-hour chart highlights a retracement after peaking at $109,356, with give a enhance to near $103,000 to $104,000 and resistance at $107,000. High sell volumes around contemporary highs indicate distribution, nonetheless declining sell quantity near give a enhance to would possibly maybe well per chance additionally indicate a reversal. A ticket retain above $103,000 with bullish candlesticks would possibly maybe well per chance additionally merely give a enhance to a non permanent aquire, while a breakdown under this level would possibly maybe well per chance additionally goal $100,000.

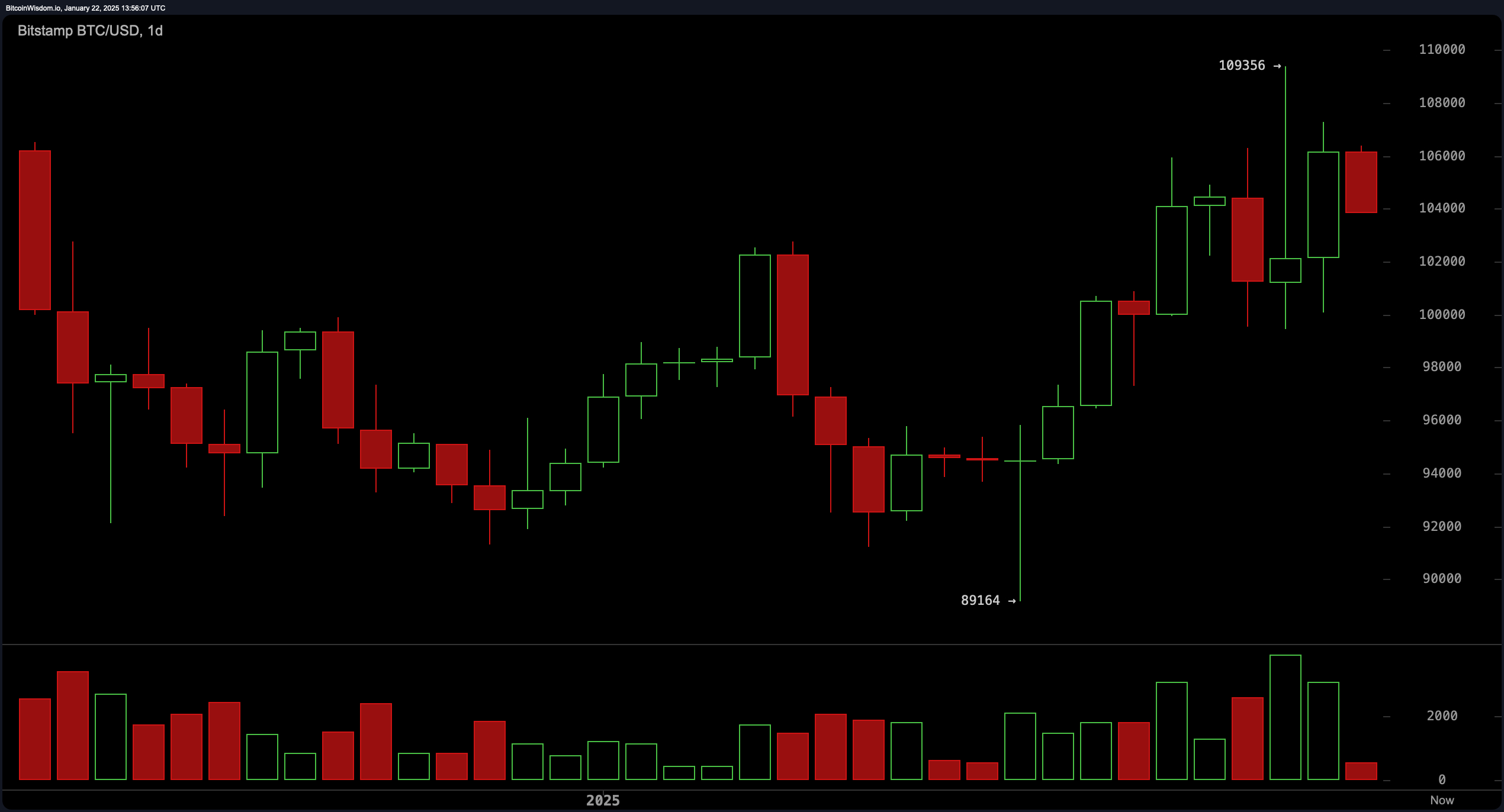

The day to day chart reflects a moderate restoration model, adopted by a retracement at resistance around $109,000 to $110,000, with give a enhance to ranges between $98,000 and $100,000. Quantity spikes near these ranges spotlight predominant vendor interest, although general declining momentum warrants caution. Merchants would possibly maybe well per chance additionally seize into story entering near $100,000 if buying for quantity strengthens or exiting around $109,000 if resistance holds.

Oscillators and shifting averages strengthen a mixed outlook, with the relative power index (RSI) impartial at 60 and stochastic %Ample impartial at 74. The shifting average convergence divergence (MACD) indicators a aquire at 1,990, while the momentum indicator at 9,549 parts to promoting rigidity. Exponential and straightforward shifting averages across all key lessons from 10 to 200 are aligned in a aquire self-discipline, reflecting a broader bullish sentiment.

Bull Verdict:

Bitcoin’s ticket motion means that bullish momentum would possibly maybe well per chance additionally prevail if severe give a enhance to ranges akin to $103,500 and $100,000 retain. A sustained ticket above $103,000 on shorter timeframes, mixed with strengthening aquire quantity and obvious indicators from shifting averages, would possibly maybe well per chance additionally merely build alternatives for upward circulate in the direction of $105,500 and even a retest of the $109,000–$110,000 resistance zone. Merchants seeking prolonged positions would possibly maybe well per chance additionally capitalize on these ranges, supplied possibility administration is prioritized.

Hold Verdict:

If bitcoin breaks under $103,500 and promoting rigidity accelerates, the price would possibly maybe well per chance additionally decline in the direction of $100,000 and even decrease. Indicators of waning momentum, such because the momentum oscillator and quantity diagnosis, counsel a doable vulnerability within the short term. A failure to retain above key give a enhance to zones, coupled with bearish formations, would possibly maybe well per chance additionally merely invite additional downside, making short positions viable for merchants ready to navigate excessive volatility.