On January 18th, Friday, the Toncoin label showed a 2.2% uptick to attain the latest buying and selling label of $5.9. This bullish momentum appears to be like to be driven by heightened market ardour surrounding Donald Trump’s upcoming presidential inauguration. On the other hand, will TON crypto capitalize on the broader market sentiment, or will issues over centralization hinder its restoration doable?

Currently, the TON label market cap stands at $13.9 Billion, while the 24-hour buying and selling quantity is at $184.2 Million.

Key Highlights:

- A descending triangle pattern drives the latest correction in Toncoin label.

- The lengthy-tail rejection candle at the $4.6-$5 label differ indicates a actual accumulation zone for crypto merchants.

- A flattish circulation 100-and-200-day exponential sharp moderate signals the broader market pattern is sideways.

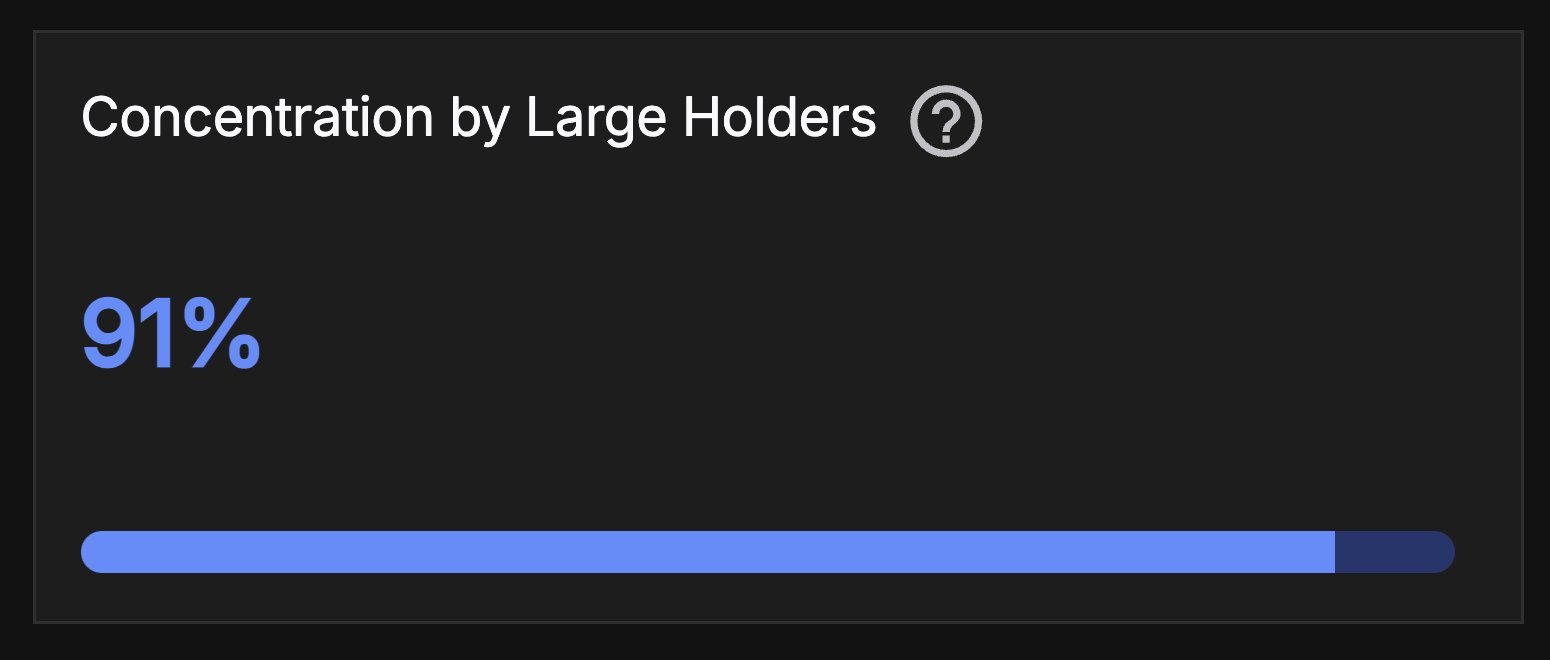

91% of TON Tokens Concentrated in Few Wallets

Most contemporary data from IntoTheBlock shows that an overwhelming 91% of TON tokens are held by a pick out few wallets, highlighting a necessary concentration of ownership throughout the ecosystem. This discovering raises questions in regards to the decentralization of the TON token community, as such centralization may per chance grant disproportionate affect to a handful of holders.

While concentrated holdings in general replicate actual self belief from considerable merchants or early adopters, they would per chance well per chance additionally latest risks, including the doable of label manipulation or market volatility if neat quantities of tokens are moved or bought.

If the Toncoin label maintains a history of no such file of considerable circulation from the affect of considerable holders, the asset may per chance protect sustained restoration and bullish market sentiment.

Toncoin Impress Eyes Main Breakout From Triangle Setup

Over the final six weeks, the Toncoin label has shown a valuable correction from $7.19 to $5.6— registering a loss of twenty-two%. This downswing when analyses within the each day chart expose a extended consolidation since April 2024 amid the formation of a descending trendline.

Theoretically, the pattern shows a downswing trendline as dynamic resistance and actual toughen at $4.6. The lengthy-wick rejection candles from the $5-$4.6 differ sign the merchants are actively defending this toughen for a doable reversal.

Amid the broader market restoration, the Toncoin label may per chance surge 8.3% to surpass the instant resistance of $6 forward of tough the pattern’s resistance. A doable breakout of the overhead trendline will intensify the trying to earn rigidity for a rally past $8, followed by $10.

On a contrary expose, the TON label may per chance lengthen the latest correction till the vendor defends the dynamic resistance.