-

Dogwifhat (WIF) might presumably well presumably hover by 50% to reach $2.71 in due route.

-

On-chain metrics point to that exchanges like witnessed an outflow of over $1.90 million worth of WIF meme coins.

-

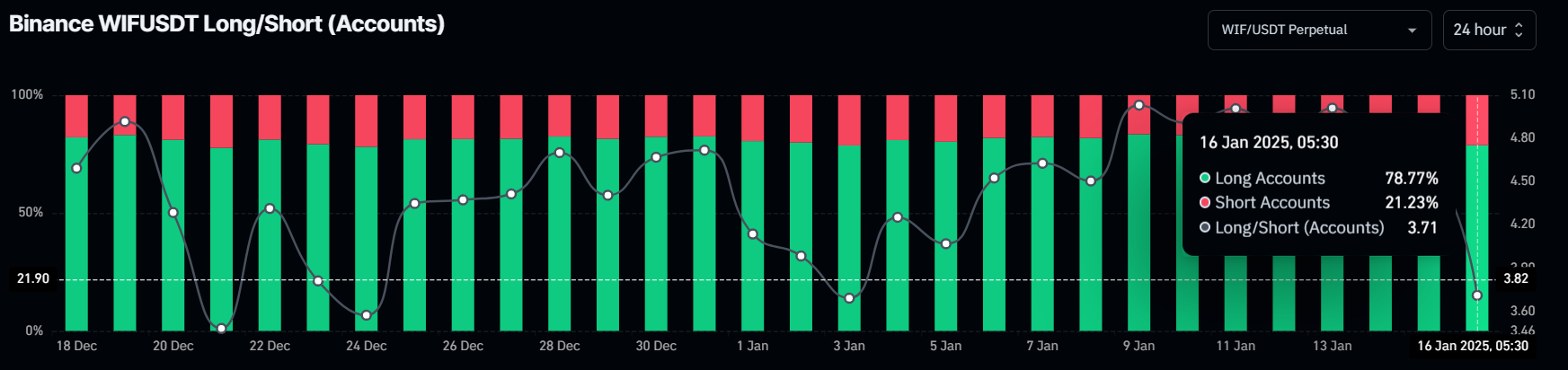

For the time being, 78.77% of high WIF merchants on Binance preserve long positions.

Dogwifhat (WIF), a most traditional Solana-primarily based meme coin, is showing indicators of reversing its prolonged downtrend, which began in December 2024. After experiencing a fall of over 60%, WIF has shaped a bullish mark action sample on its each day time body and is poised for a huge upside rally.

Donald Trump’s Influence on Crypto Market

Following Donald Trump’s pro-crypto stance and his election victory in November 2024, WIF noticed an explosive 154% mark surge. On the opposite hand, since then, it has experienced a actual decline, losing all its gains and falling from $4.82 to a extraordinarily fundamental pork up stage of $1.50.

At this pork up stage, WIF has been in solid consolidation for over a week. Now, it has formally damaged out from that zone, clearing its route for big upside momentum.

Dogwifhat (WIF) Technical Evaluation and Upcoming Level

In step with expert technical evaluation, WIF has efficiently damaged out of its consolidation phase but faces immediate resistance at $1.80.

In step with most modern mark action, if the meme coin breaches this resistance and closes a each day candle above $1.83, there is a solid possibility it might most likely presumably well presumably hover by 50% to reach $2.71 in due route.

On the lumber facet, WIF’s Relative Strength Index (RSI) is strategy the oversold dwelling, suggesting a attainable upside rally and an very excellent procuring different. On the opposite hand, WIF is trading below the 200 Exponential Inviting Moderate (EMA) on the each day time body, indicating that it remains in a downtrend.

Bullish On-Chain Metrics

While analyzing this bullish mark action, long-time frame holders and merchants are taking a gape to place bets on the upside, in step with the on-chain analytics firm CoinGlass. Files from put influx/outflow unearths that exchanges like witnessed an outflow of over $1.90 million worth of WIF.

Within the cryptocurrency panorama, outflow refers back to the circulate of sources from exchanges to wallets, indicating ability accumulation. This will likely create procuring stress and contribute to a mark surge.

Meanwhile, merchants on Binance seem like making a wager on the long facet. CoinGlass’s Binance WIF/USDT long/short ratio at the second stands at 3.71, indicating solid bullish market sentiment amongst merchants.

For the time being, 78.77% of high WIF merchants on Binance preserve long positions, whereas 21.33% preserve short positions.

Most contemporary Price Momentum

When combining these on-chain metrics with technical evaluation, it appears that the bulls are at the second dominating the asset and might presumably well presumably pork up the meme coin in its upcoming rally.

For the time being, WIF is trading strategy $1.75 and has experienced a mark rally of over 7.80% within the past 24 hours. Throughout the identical duration, its trading volume surged by 92%, indicating elevated participation from merchants and investors.