Litecoin label held precise and crossed the important resistance level at $117.30, its very most realistic swing on January 6. It has soared to its very most realistic swing since December 18, and about 140% from its lowest level in 2024. So, is the LTC token mute a genuine funding, and must mute it rise by about 22% from the fresh level?

Why the Litecoin label is soaring

Litecoin label bounced lend a hand this week as most cryptocurrencies rebounded following the somewhat encouraging US client inflation records.

In accordance with the Bureau of Labor Statistics (BLS) the core client label index (CPI) fell from 3.3% in November to three.2% in December. While that became a small retreat, it became an encouraging resolve since it became the foremost month it had dropped since mid-closing One year.

Litecoin and a lot of cryptocurrencies attain well in classes of low inflation since it assuredly outcomes in a weaker US buck index (DXY) and bond yields. Analysts now await that the Federal Reserve will embrace a dovish tone later this One year if this pattern continues.

The extinct inflation records explains why a lot of cash bounced lend a hand. Virtuals Protocol, Fartcoin, Algorand, Sonic, and Hedera Hashgraph had been just among the precise-performing cash.

Litecoin label additionally jumped after Reuters reported that the Securities and Alternate Fee (SEC) became pondering making main modifications within the crypto enterprise. The company is planning to extend just a few of Gary Gensler’s enforcement measures because it creates friendly regulations.

These regulations will seemingly lend a hand the crypto enterprise. They might per chance possibly per chance additionally embody extra crypto alternate-traded fund (ETF) approvals.

Analysts put a question to that Litecoin might per chance possibly be among the tip beneficiaries of extra altcoin ETF approvals. Its approval might per chance possibly be easy on account of it is a Bitcoin fork, which methodology that the SEC would no longer phrase it as a safety.

Consistent with this, crypto ETFs believe persisted seeing extensive inflows this One year. All save of dwelling Bitcoin ETFs attracted over $755 million in inflows on Wednesday.

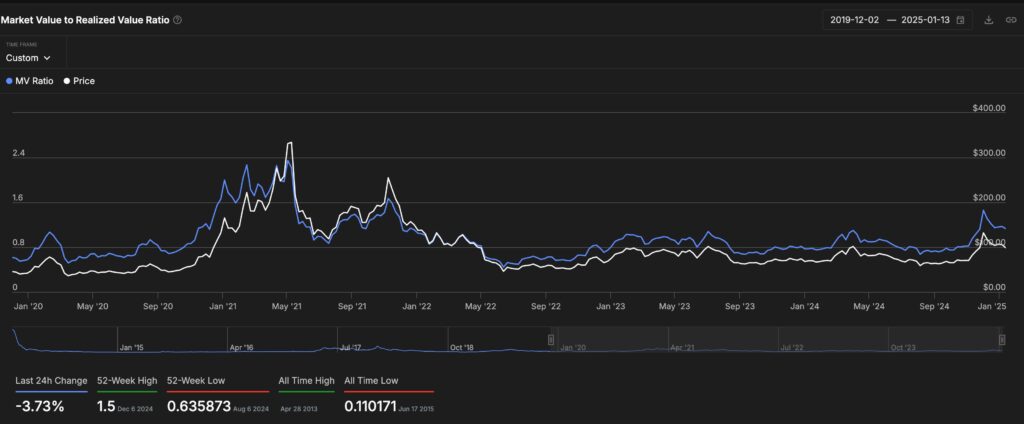

Within the period in-between, Litecoin is somewhat low label, with the Market Fee to Realized Fee Ratio falling to 1.13, down from this month’s high of 1.30. The MVRV is a favored indicator that is aged to evaluate whether or no longer a cryptocurrency is inexpensive or pricey. A resolve of decrease than 3.8 is a tag that a sector is undervalued.

LTC label diagnosis

Litecoin label chart | Offer: TradingView

The day-to-day chart shows that the Litecoin label bottomed at $50.43 in August closing One year and then bounced lend a hand to $146 in November. It then pulled lend a hand to $90 at some level of the most up to the moment crypto fracture.

Litecoin has moved above the main resistance level at $117.30, the perfect swing on January 6 of this One year. This became a extraordinarily important level since it became the neckline of the double-bottom pattern at $92.

Litecoin has remained above the 50-day and 200-day Exponential Transferring Averages (EMA), which is a definite ingredient for the coin.

Therefore, Litecoin will seemingly proceed rising as bulls target the next key resistance level at $146.97, its very most realistic swing in November. That believe is set 22% above the fresh level. On the a lot of hand, a descend under the main give a enhance to level at $100 will invalidate the bullish behold.

The post Litecoin label prediction: right here’s why LTC might per chance possibly surge 25% rapidly regarded first on Invezz