Bitcoin (BTC) has rebounded to swap above $Ninety nine,000 following its significant dip earlier this week. While the most modern US User Mark Index (CPI) news seems to hang contributed to this swiftly recovery, it has furthermore drawn consideration from analysts, who’re closely monitoring key metrics to adore the market’s subsequent switch.

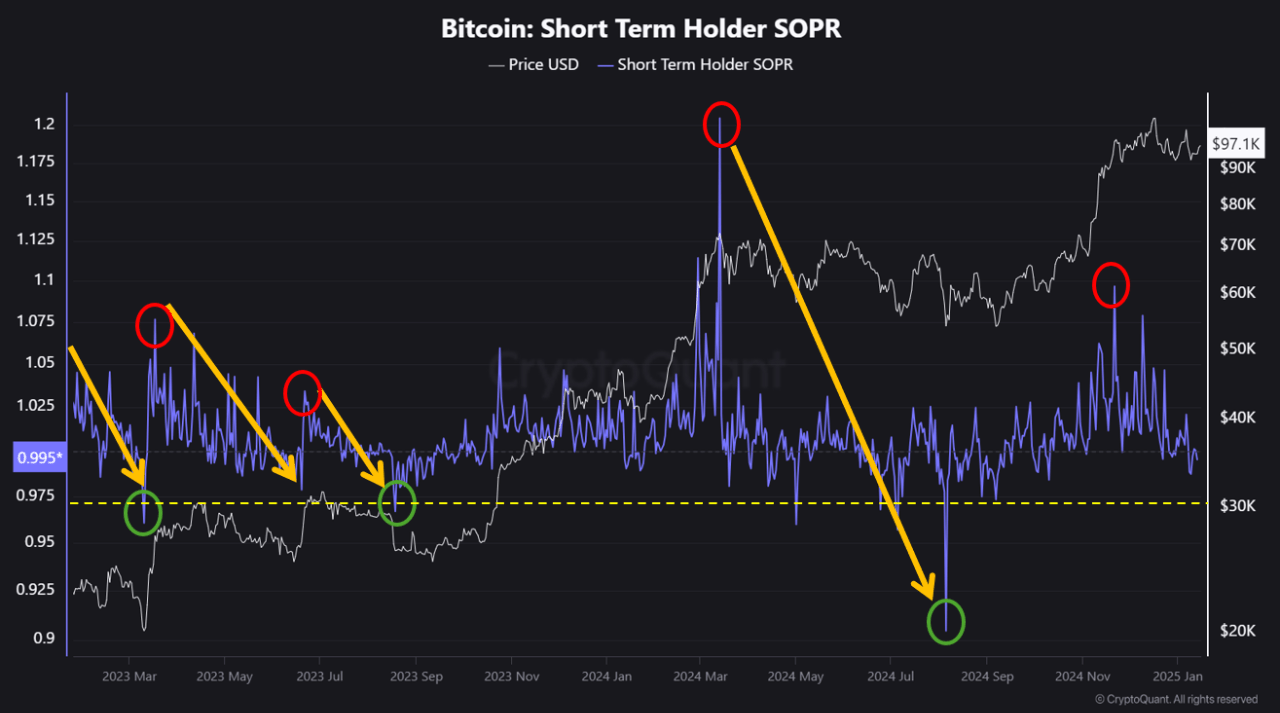

A CryptoQuant contributor most ceaselessly known as Crypto Dan lately supplied insights into Bitcoin’s most modern market habits. Highlighting the Rapid-Timeframe Spent Output Profit Ratio (SOPR), Dan noticed that the metric has shown a habitual sample all by correction phases.

This sample, he current, assuredly dampens market optimism earlier to a subsequent rebound. Despite the most modern correction, indicators boom their private praises the ability resumption of an upward cycle within the come future.

Rapid-Timeframe SOPR Diagnosis And What It Within the imply time Suggests For BTC

The SOPR metric measures the profitability of spent outputs relative to their realized cost, providing insights into market contributors’ habits all by put corrections.

According to Crypto Dan, all by corrections, the SOPR oscillates between red and inexperienced zones. The red zone signals increased profit-taking, most ceaselessly pushed by whale say, that would perchance well perhaps lengthen correction sessions. Conversely, the inexperienced zone indicates diminished selling stress, setting the stage for attainable rebounds.

Dan unearths that the SOPR currently shows a smaller volume of profit-taking when when compared with earlier correction sessions, equivalent to the seven-month correction earlier within the year.

This model means that the most modern correction, which has lasted over a month, will most most likely be shorter in length. Dan speculates that Bitcoin would perchance well perhaps resume its upward model interior the first quarter of 2025.

Nonetheless, he cautioned that non eternal volatility stays a threat, with the probability of additional energetic drops earlier to a sustained reversal. The analyst wrote:

Nonetheless, within the brief timeframe, there would perchance well perhaps peaceful peaceful be one or two energetic drops that push SOPR below the yellow dotted line, doubtlessly crushing market contributors’ hope for a rally earlier to the market reverses upward. As such, aggressive non eternal trades would perchance well perhaps peaceful be approached with warning.

Bitcoin Market Efficiency And Outlook

Within the intervening time, Bitcoin seems to now be making its formulation motivate above the $100,000 trace as the asset currently trades at a put of $Ninety nine,494, on the time of writing marking a 2.7% amplify within the past day.

This amplify in Bitcoin’s put in addition to being attributed to the underlying definite metrics on the BTC network can furthermore be linked to the most modern update on the US CPI.

According to the most modern reports, the US CPI rose by 0.4% in December—this news has resulted within the US Greenback seeing a distinguished drop while various financial property saw the reverse model recording an uptick.

Featured image created with DALL-E, Chart from TradingView