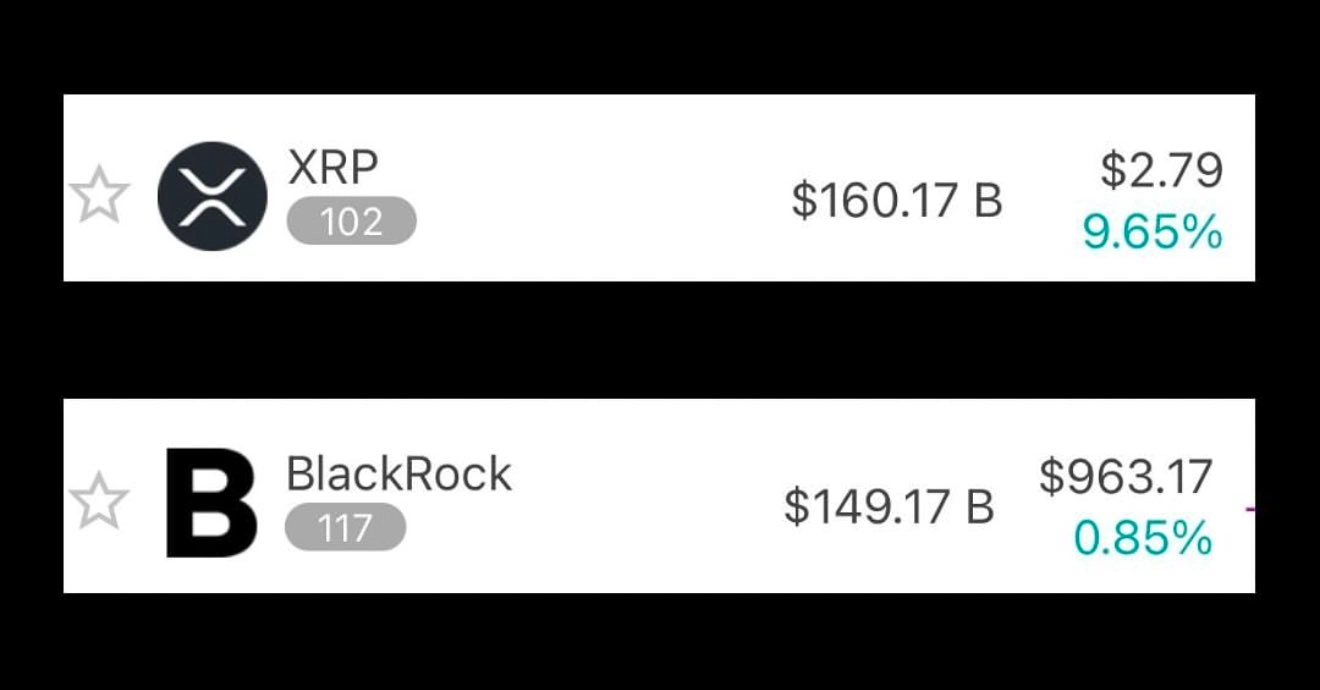

Ripple’s XRP has won over crypto and is now taking on worn finance corporations. In accordance with on-chain info, XRP has overtaken BlackRock, the sphere’s perfect asset manager, in market capitalization.

As of January 15, 2025, XRP’s market cap sits at $162 billion, surpassing BlackRock’s $154 billion. This market milestone also locations it earlier than globally known brands love Coca-Cola, Disney, and Nike.

Crypto money absorb trigger off on a Trump rally earlier than his inauguration on January 20, 2025. Ripple’s market cap now looks to be a beneficiary of the surge in rate.

On-chain info reveals the coin has hit $2.8 for the most indispensable time since December 17, 2024. Within the closing 24 hours, XRP has recorded a 9% spike, whereas its weekly and monthly growth sits at 21.54% and 18.67%, respectively.

XRP’s rate has risen from a low of round $2 to with regards to $2.9 within the past two weeks. The asset’s market cap has also elevated to approximately $31.6 billion.

XRP market task surges and the outlook turns bullish

Info shared by Santiment, an on-chain analytical platform, reveals necessary accumulation task. Currently, wallets holding 1M to 10M XRP absorb elevated their holdings by over 37% within the past two months.

This represents an addition of approximately $3.8 billion in XRP since their accumulation began on November 12, 2024.

🐳📈 XRP merchants are happy to peek the #3 market cap asset reach $2.69 this day for the most indispensable time since December 17, 2024. Here is being supported by continued colossal accumulation from wallets holding 1M-10M XRP, who possess over 37% extra money than they did 2 months ago… pic.twitter.com/G3a3N5iSAS

— Santiment (@santimentfeed) January 14, 2025

XRP’s market behavior reveals a bullish constructing on lower timeframes, characterised by higher highs and low lows.

In addition, solid procuring task reach the 0.5-0.618 Fibonacci retracement ranges has contributed to its recent upward rate spikes.

Nonetheless, despite the in vogue Trump rally, the coin sees glum trading ranges between $2 and $3. Now, analysts are emphasizing the need for a breakout to confirm a brand recent development.

A value proceed towards $3 might per chance well further validate a continuation of the bullish development merchants absorb viewed since November. Without this form of breakout, analysts quiz a consolidation within the most up-to-date differ to stay at a standstill.

Crypto analyst Bobby A illustrious on X that XRP.D, which measures Ripple’s market cap dominance, is focusing on approximately 14% dominance. Here is at its 4.236 Fibonacci extension.

In accordance with the trading chart analyst, with the total crypto market capitalization at the moment at $3.3 trillion, gaining 14% dominance would wreck bigger XRP’s value above $7.80.

BlackRock maintains a bullish crypto stance

Robbie Mitchnick, head of digital assets at BlackRock, lately shared the asset administration firm’s insights into the evolving characteristic of cryptocurrencies. Talking to Bloomberg, Mitchnick described Bitcoin as a scarce, world, and decentralized non-sovereign asset, free from particular country dangers or worn counterparty considerations.

Appears to be like to be like love Satoshi Nakamoto carried out the goal he had 16 years ago.

Mitchnick also spoke about the crypto’s market adoption. He asserts that the relationship between institutional merchants and BTC is quiet in its early levels. Mitchnick also most ceaselessly known as the efficiency of BlackRock’s IBIT characteristic Bitcoin ETF in 2024 spectacular.

He believes extra institutions and wealth advisors will seemingly be taking a look to usher in further inflows this one year.

Nonetheless, Mitchnick emphasized that BlackRock doesn’t settle on to be when compared with MicroStrategy when it involves Bitcoin investments. No longer like MicroStrategy, which is known for its aggressive, leverage-essentially based Bitcoin accumulation strategy, BlackRock is leaning towards a extra conservative and investor-focused potential.

“We’re now not procuring and selling Bitcoin for ourselves. Here is for our merchants,” reiterated Mitchnick, “We don’t need a 3-times levered Bitcoin ETF. The asset’s bought ample volatility without it.”

From Zero to Web3 Expert: Your 90-Day Occupation Open Opinion