SPX6900 (SPX) mark has surged 27% in the last 24 hours, getting greater the $1 billion market cap threshold and securing its space as the Tenth ideal meme coin, correct before FARTCOIN.

While the cost displays most likely to rise to $1.64, key resistance and toughen ranges remain obligatory in figuring out the subsequent switch. If momentum falters, SPX would possibly per chance take into chronicle a inviting correction, maybe attempting out $0.93, $0.81, or at the same time as small as $0.61.

SPX Ichimoku Cloud Reveals a Mixed Setup

The Ichimoku Cloud chart for SPX displays a combined setup, with the cost at the moment shopping and selling near the fairway Kumo (cloud). The cloud, formed by the Senkou Span A (green line) and Senkou Span B (red line), reflects a neutral-to-bullish outlook as Span A is a small bit above Span B.

This configuration signifies a most likely shift in momentum, nevertheless the cloud’s thin nature suggests puny toughen or resistance energy, making the cost prone to volatility.

The blue Kijun-Sen (baseline) is now below the cost, signaling an improved rapid-term momentum, whereas the orange Tenkan-Sen (conversion line) shall be trending upward, extra confirming this momentum shift.

The lagging span (green line), nonetheless, is aloof trailing below the cost and cloud, highlighting that SPX is no longer yet in fully bullish territory. For a stronger bullish signal, the cost would want to smash above the red cloud fully, aligning all Ichimoku traces in a more supportive configuration.

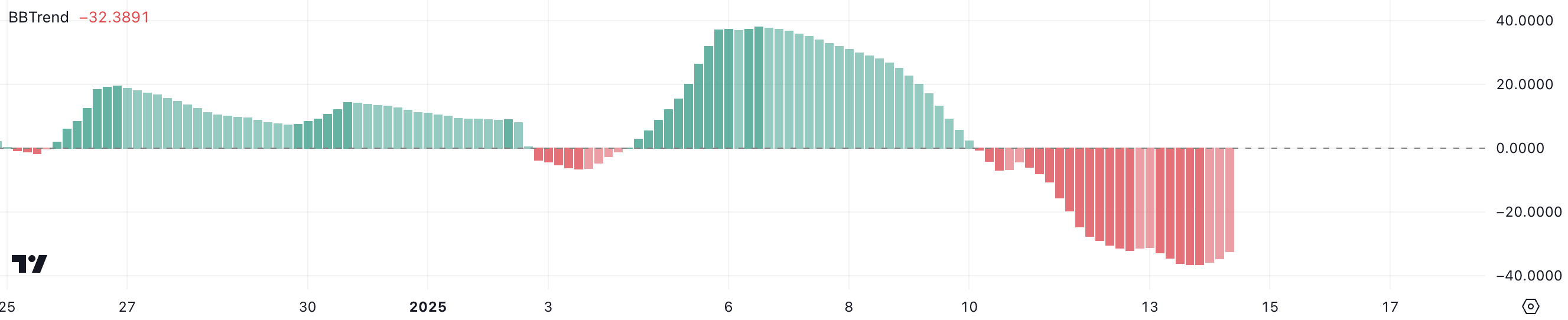

SPX BBTrend Has Been Strongly Negative For The Previous 2 Days

SPX’s BBTrend is at the moment at -32.3 and has remained in negative territory since January 10, staying below -30 for the past two days. This extended negative BBTrend reflects bearish momentum, at the same time as SPX has skilled a inviting mark magnify of nearly 27% in the last 24 hours, placing it as the Tenth ideal meme coin.

The negative reading means that the broader style remains extinct despite the contemporary rally, suggesting caution for merchants attempting to search out sustained upward movement.

The BBTrend, or Bollinger Band Model, measures mark deviations relative to its Bollinger Bands, providing insights into style energy and direction. Negative values generally veil bearish stipulations, whereas certain values indicate bullish trends. With SPX’s BBTrend at -32.3, the hottest reading emphasizes that the asset is aloof in a bearish zone.

This means that, despite the contemporary mark surge, the market lacks obtain underlying momentum to ascertain a lasting style reversal, and SPX would possibly per chance face most likely pullbacks if shopping rigidity diminishes.

SPX Mark Prediction: Will SPX Drop Under $1 Quickly?

If the uptrend continues, SPX mark would possibly per chance rise to $1.64, offering a most likely 37.8% upside. That will be driven if the story around meme money recovers its energy. This target aligns with the bullish momentum viewed in contemporary mark movement. On the opposite hand, sustaining this style would require stronger confirmation from key indicators.

On the opposite hand, the Ichimoku Cloud and BBTrend every indicate that the hottest uptrend would possibly per chance no longer be fully sustainable, signaling caution for merchants banking on extra features.

If the uptrend reverses, SPX would possibly per chance retest the toughen at $0.93, a crucial stage that has been held in outdated lessons.

Would possibly maybe well well also aloof this stage fail, the cost would possibly per chance topple extra to $0.81, maybe making SPX lose its space amongst the ideal meme money to FARTCOIN. A deeper correction would possibly per chance maybe lift SPX appropriate down to $0.61, representing a 48.7% decline from hottest ranges.