AI16Z tag is up a ambitious 36% within the final 24 hours, pushing its market cap to $1.4 billion and solidifying its predicament because the 2nd-biggest crypto AI brokers coin, factual slack VIRTUAL. This surge has attracted consideration as technical indicators point out both alternatives and risks for its tag trajectory.

Whereas the RSI aspects to getting better momentum and the DMI hints at a most likely uptrend, EMA lines reward that bullish affirmation is peaceable within the making. The impending sessions will resolve whether AI16Z can preserve this momentum and recount key resistance ranges or face a most likely pullback.

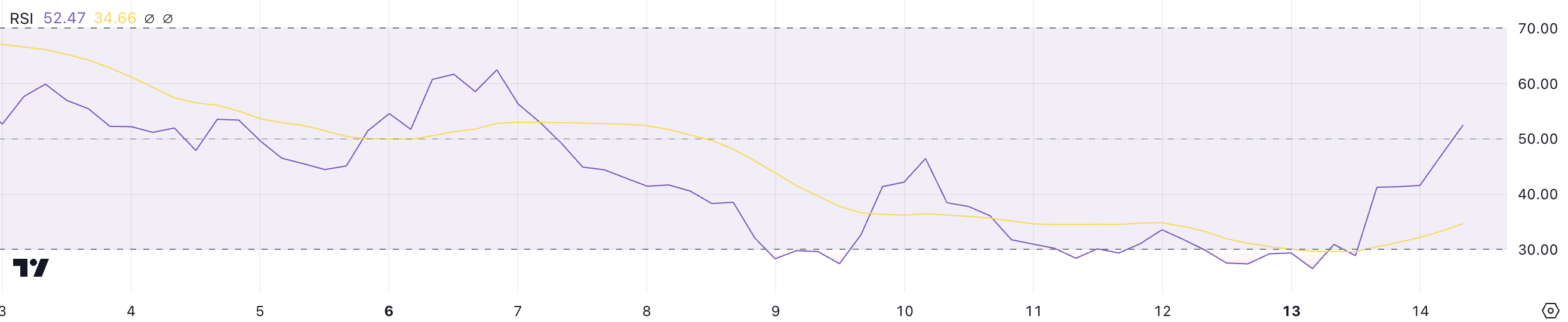

AI16Z RSI Is Recuperating from Oversold Phases

AI16Z RSI has climbed sharply to 52.4 from 28.8 in only in some unspecified time in the future, indicating a indispensable shift in momentum from oversold to neutral territory. This rapid increase highlights increasing buying hobby after a length of heavy selling, suggesting that bearish strain is easing.

The unusual RSI level reflects a balanced market, the build neither customers nor sellers dominate, nonetheless the upward trajectory aspects to strengthening bullish sentiment.

The RSI, or Relative Strength Index, measures the tempo and magnitude of tag movements, starting from 0 to 100. Phases below 30 reward oversold stipulations, continuously signaling skill tag rebounds, while ranges above 70 point out overbought stipulations, the build a pullback might happen.

With AI16Z RSI at 52.4, the asset is in a neutral zone, leaning honest a miniature bullish. This would additionally mean extra tag recovery is that you potentially can take into accout, nonetheless sustained momentum can be indispensable to transitioning accurate into a stronger bullish segment. Conversely, a failure to retain upward momentum might additionally result in consolidation or renewed selling strain.

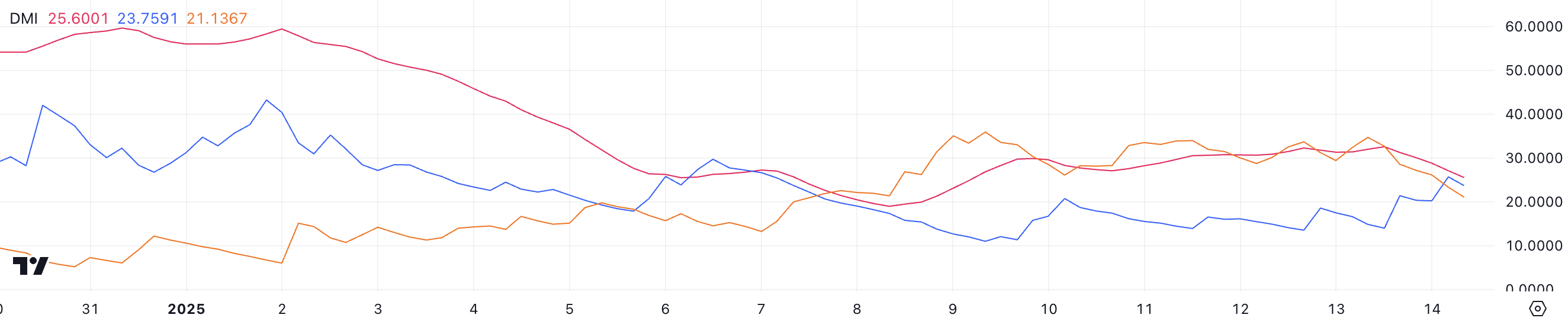

DMI Chart Reveals an Uptrend Is Making an strive to Emerge for AI16Z

AI16Z DMI chart reveals its ADX has dropped to 25.6 from 32.5 the day old to this, signaling a decline in overall fashion energy. Whereas an ADX above 25 assuredly indicates a trending market, the decrease suggests the unusual fashion is losing momentum.

Nonetheless, the ADX stays above the necessary threshold, which implies a fashion is peaceable contemporary, albeit weaker than forward of.

The ADX, or Moderate Directional Index, measures fashion energy without indicating its direction. Values below 20 point out a frail or non-existent fashion, while values above 25 reward a robust fashion. In AI16Z’s case, the +DI, representing bullish strain, has risen from 14 to 23.7, reflecting increasing buying momentum as man made intelligence coins strive to win better potentially the most up-to-date fundamental corrections.

Meanwhile, the -DI, representing bearish strain, has dropped very a lot from 34.7 to 21, exhibiting easing selling strain. This shift implies that customers are gaining alter, and if the ADX stabilizes or will increase, AI16Z tag might additionally order an uptrend. Nonetheless, if the ADX continues to pronounce no, it can most likely additionally reward consolidation moderately than a robust upward meander.

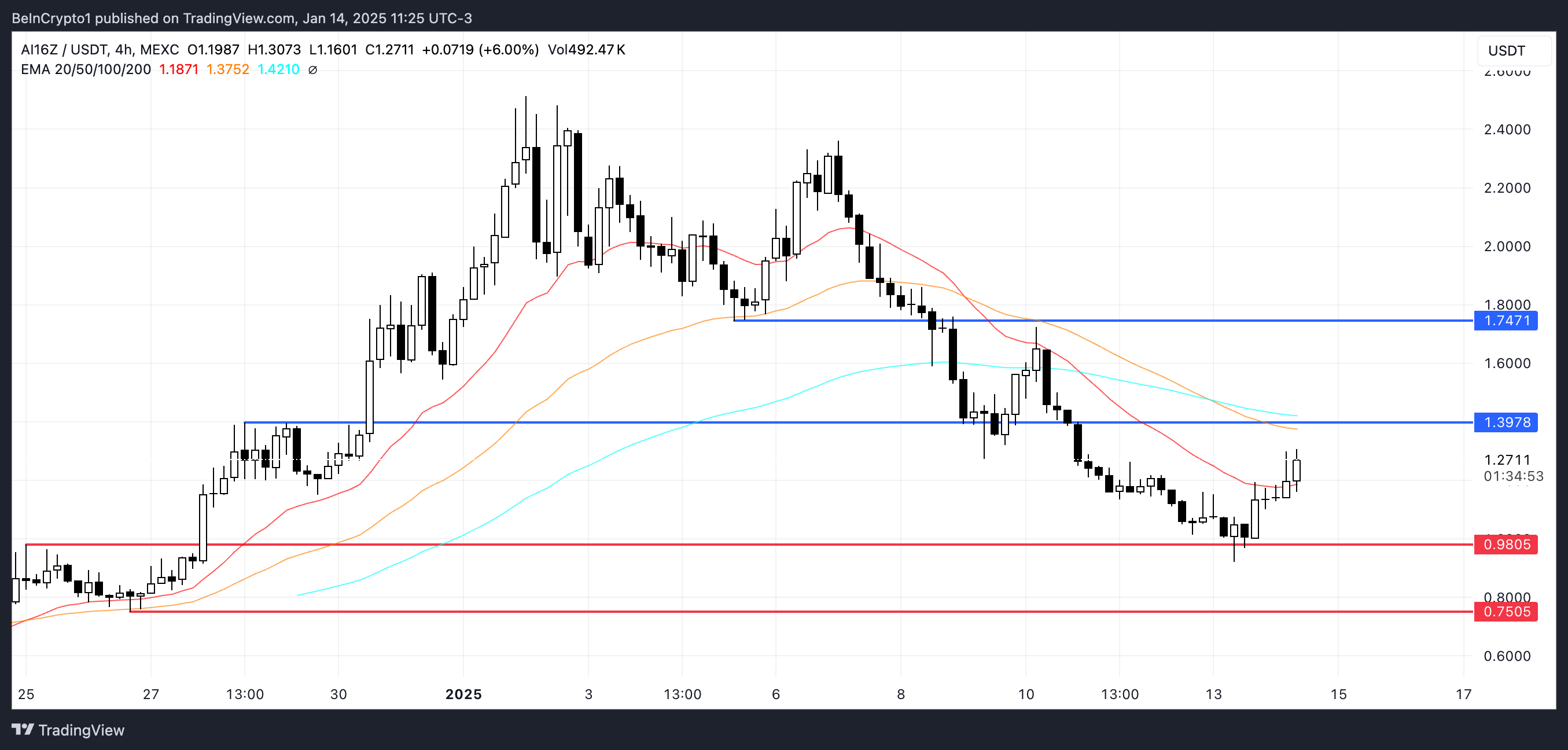

AI16Z Ticket Prediction: EMA Traces Could per chance well per chance Point out The Next Steps

AI16Z tag chart reveals its short-term EMA lines remain below the long-term ones, which assuredly signals bearish momentum. Nonetheless, the upward motion of those lines suggests an are trying and gather an uptrend.

If this uptrend materializes, AI16Z tag might additionally test the following resistance at $1.39. A successful break above this level might additionally open the door for added positive aspects, potentially pushing the associated rate as a lot as $1.74. That scenario might additionally happen soon because the account around crypto AI brokers recovers.

On the flip side, if the uptrend fails to place itself, AI16Z tag might retrace to ascertain the reinforce at $0.98.

If this reinforce level is breached, the associated rate might additionally tumble to $0.75, main to a deeper decline.