SPX6900 (SPX) mark has skilled fascinating movements, rising 25% in the closing seven days however shedding 15% in the previous 24 hours amid a broader meme coin market correction.

The correction follows a period of overbought conditions, with technical indicators suggesting skill further downside or a that you’d imagine reversal if procuring for momentum returns. The impending days would perchance be principal in determining whether or now not SPX mark can win its bullish pattern or face deeper corrections.

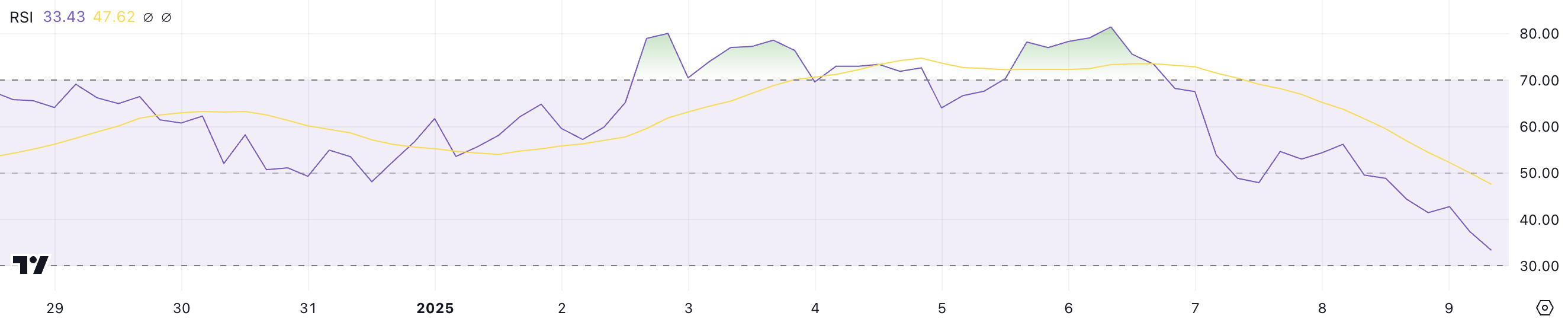

SPX RSI Dropped For Its Lowest Level In 20 Days

SPX Relative Energy Index (RSI) has sharply dropped to 33.4, a predominant decline from its overbought level of 81.4 true three days up to now. RSI is a momentum indicator that measures the inch and magnitude of mark movements on a scale of 0 to 100.

Readings above 70 typically show overbought conditions, suggesting a possible for a mark pullback, while values below 30 point out oversold conditions, in general signaling the opportunity of a rebound. At 33.4, SPX’s RSI hovers true above the oversold threshold, marking its lowest level since December 20.

This steep decline in RSI highlights heavy selling pressure and weakening momentum for SPX. Whereas the most modern level suggests that bearish sentiment is dominant, it additionally signals that SPX mark would possibly perchance well well be drawing shut oversold conditions.

If the RSI drops further or stabilizes near 30, it can well well invent conditions for a mark recovery as procuring for ardour would possibly perchance well well return. On the opposite hand, with out a solid shift in market sentiment, SPX mark would possibly perchance well well additionally just proceed to consolidate or decline in the near time-frame, like other meme coins.

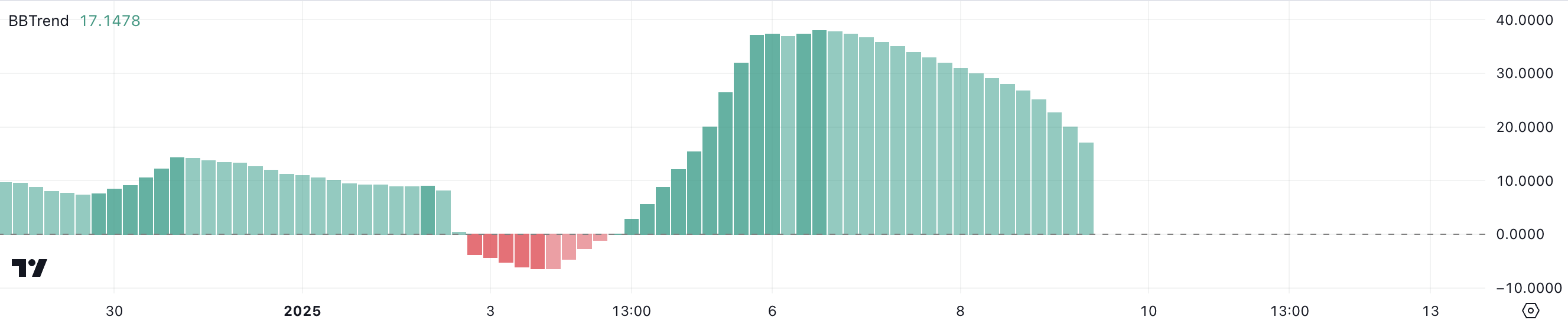

SPX BBTrend Is Declining

SPX BBTrend stays certain at 17.1 despite a typical decline from its recent height of 38 on January 6. Derived from Bollinger Bands, BBTrend measures the strength and path of a mark pattern. Optimistic values show bullish momentum, while damaging values point out bearish conditions.

At its most modern level of 17.1, SPX BBTrend suggests that while the hot correction of virtually 15% in the closing 24 hours has dampened upward momentum, the coin retains some underlying bullish sentiment. On the opposite hand, the usual decline in BBTrend indicates that the threat of further downside persists unless procuring for inform increases to stabilize the price.

A continuation of the most modern trajectory would possibly perchance well well outcome in consolidation or further corrections. Clean, a recovery in BBTrend would possibly perchance well well signal a resurgence of bullish momentum, keeping SPX in the cease 10 ranking among the many very most moving meme coins.

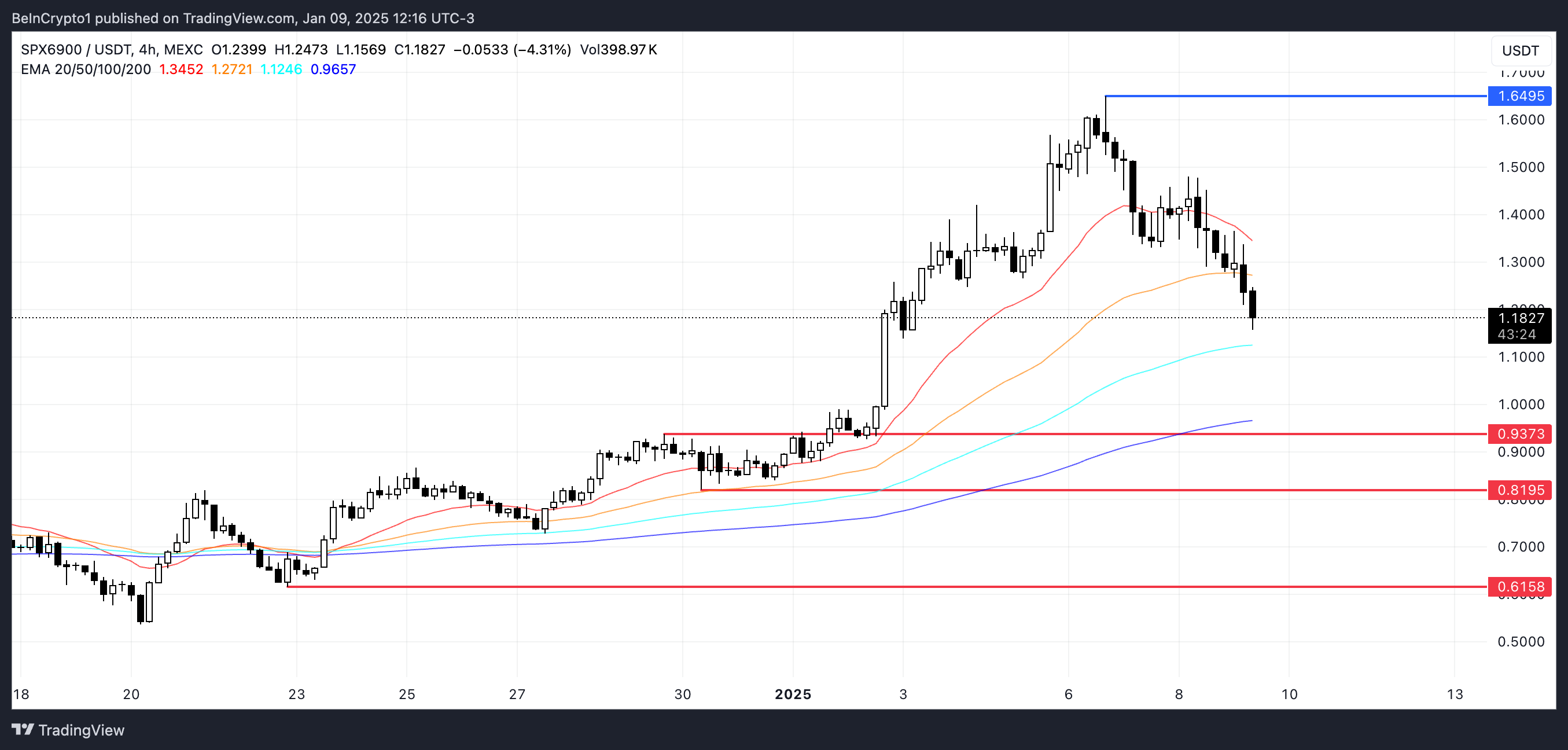

SPX Designate Prediction: A Further forty eight% Correction?

SPX’s EMA traces quiet retain a bullish setup, with non permanent EMAs positioned above long-time-frame ones. On the opposite hand, the non permanent traces are trending downward, elevating the opportunity of a loss of life infamous — where non permanent EMAs infamous below the long-time-frame ones.

This bearish signal would possibly perchance well well exacerbate SPX mark recent correction, main the price to check the pork up at $0.937.

If this vital level is lost, the meme coin would possibly perchance well well additionally just face further declines, doubtlessly shedding to $0.819 or even $0.615, marking a predominant forty eight% correction from most modern stages.

Conversely, renewed enthusiasm around meme coins would possibly perchance well present SPX mark with the momentum desired to reverse its most modern pattern. In this kind of position, the coin would possibly perchance well well rise to sigh its nearest resistance at $1.64.