LINK’s ticket has declined 10% within the past 24 hours, mirroring the broader cryptocurrency market downturn. This ticket tumble follows Ripple’s integration of the Chainlink Unparalleled to attend insist its fresh RLUSD stablecoin on-chain.

At press time, LINK trades at $20.77. Its technical and on-chain setup confirms the opportunity of additional declines, and this diagnosis explains how.

Chainlink Faces Double-Digit Fall as Bearish Sentiment Intensifies

On Tuesday, digital charge provider provider Ripple confirmed its partnership with Chainlink. The collaboration targets to originate stable and proper ticket files for RLUSD transactions on Ethereum and the XRP Ledger.

On the opposite hand, the tips of this integration has did now not have an effect on LINK’s ticket positively. Previously 24 hours, its payment has dropped by 10%.

Furthermore, LINK’s double-digit ticket decline has been accompanied by a surge in its buying and selling quantity, forming a unfavorable divergence. All the diagram in which by technique of the final 24 hours, the token’s buying and selling quantity has totaled $1.06 billion, rising by 28%.

When an asset’s buying and selling quantity surges during a ticket decline, it indicates heightened market activity as more participants sell, perchance pushed by panic or profit-taking. This alerts a extraordinary bearish sentiment and hints at a probable continuation of the downtrend.

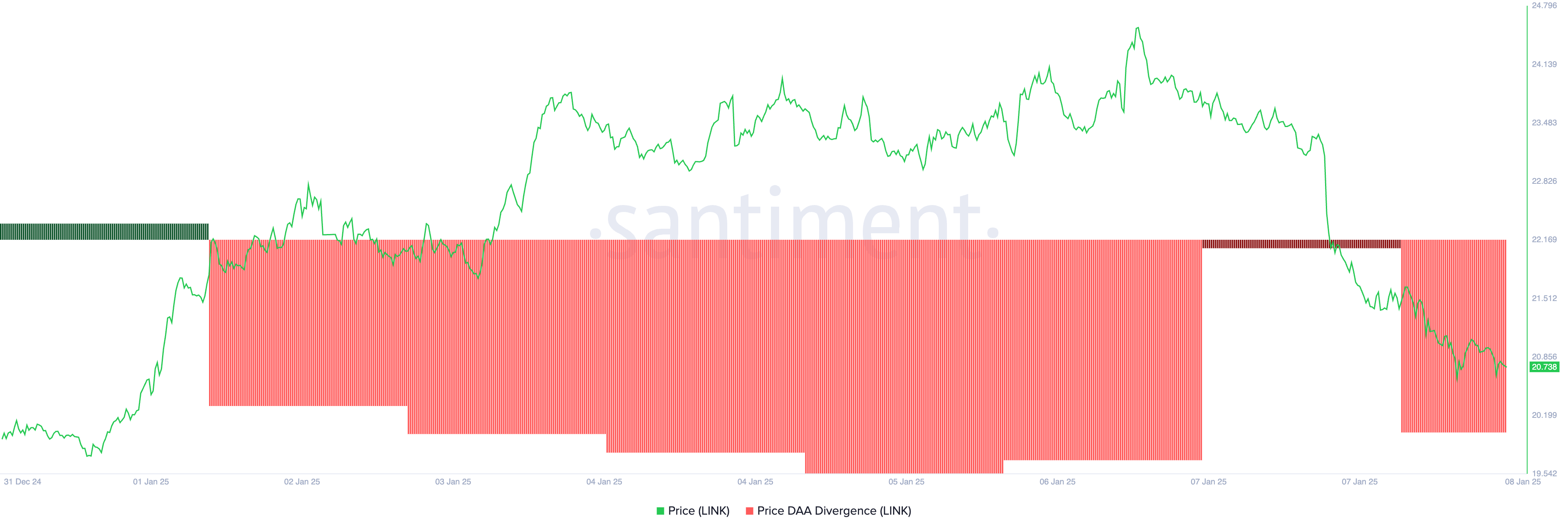

Additionally, the unfavorable readings from LINK’s ticket day-to-day lively take care of (DAA) divergence highlight the low save a question to of for the altcoin. At press time, right here’s -56.61%.

This metric measures an asset’s ticket actions with the changes in its number of day-to-day lively addresses. When its payment is unfavorable during a ticket decline, it suggests weakening on-chain activity alongside the bearish ticket movement. This capability diminished ardour or utility for the asset, reinforcing the downward trend.

LINK Label Prediction: A Decline Below $20 or a Rally Above $30?

LINK trades a little of above the toughen fashioned at $18.53 on the day-to-day chart. If its contemporary downward trend persists, this toughen stage shall be tested. If it fails to withhold, LINK’s ticket would possibly perchance well well tumble extra to $15.81.

On the opposite hand, if the broader market sentiment improves and LINK accumulation resumes, it would possibly perchance perchance well well power its ticket above $22.54 and in opposition to the $30 ticket zone.