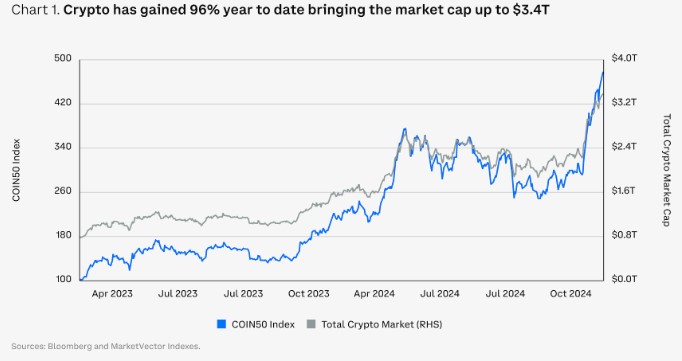

The previous year has been a testament to crypto’s resilience, with markets adjusting to regulatory crackdowns and the financial affect of curiosity price hikes. No matter these challenges, the asset class has emerged extra strong, gaining huge ground in institutional adoption.

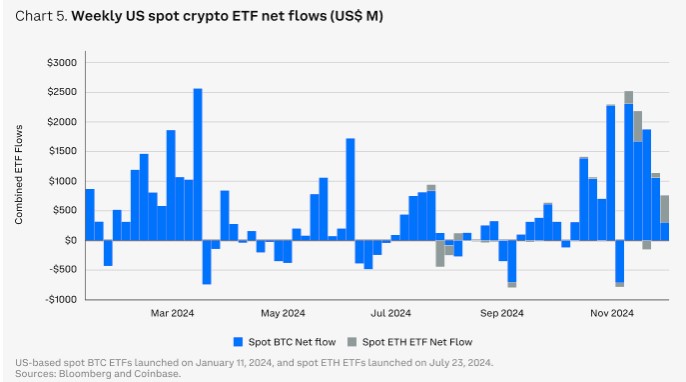

Particularly, in 2024, discipline ETFs had been authorized within the US. Bitcoin’s market dominance surged tremendously as ETFs attracted big institutional inflows, cementing crypto’s discipline as a extreme replacement asset class, Coinbase’s 2025 Crypto Market Outlook highlighted.

Then but again, the bound up to now hasn’t been without its struggles. The frenzy for law has been leisurely, however the US is at last seeing a shift toward readability.

Regulatory Acceptance

The upcoming legislative sessions are expected to win crypto-pleasant legal pointers a actuality. Potential developments embody the Strategic Bitcoin Reserve, which also can behold states admire Pennsylvania allocating public funds to crypto-based fully mostly property.

In accordance to the file, this wave of regulatory acceptance is now not restricted to the US, and world markets are additionally poised to introduce frameworks that give a increase to crypto, along side the European Union’s Markets in Crypto-Sources (MiCA) law and identical efforts within the UK, UAE, and Asia.

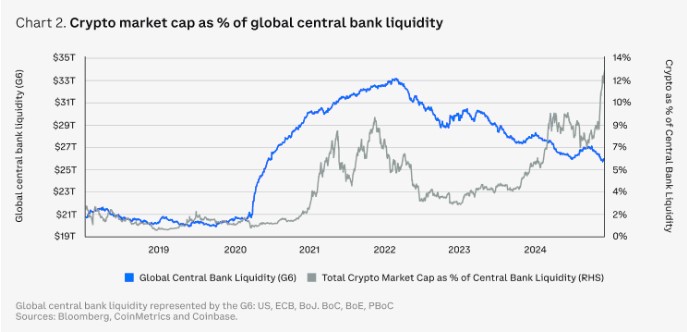

The introduction of Bitcoin and Ether alternate-traded merchandise (ETPs and ETFs) has reshaped the crypto landscape. These vehicles, which allow more straightforward win admission to to crypto investments for institutional gamers, occupy pushed huge capital inflows, $30.7 billion into bitcoin ETFs on my own.

In consequence, Bitcoin’s dominance surged from 52% to start out with of 2024 to over 62% by November. A spread of institutional traders, from pension funds to hedge funds, are now actively conserving these crypto property, signaling a lengthy-time period shift within the market structure.

The rising feature of ETFs in institutional portfolios signals an ongoing shift from speculative narratives to a extra fundamentals-pushed manner in crypto investing. The way in which ahead for crypto is in total marked by endured innovations in decentralized finance (DeFi) and tokenization. These applied sciences occupy the aptitude to disrupt primitive monetary programs, from asset issuance to cost processing.

As we mosey into 2025, all eyes will be on how regulatory frameworks and technological advancements continue to shape the crypto market. The lickety-split increase of stablecoins in 2024 has laid the root for a transformative 2025 within the crypto discipline.

With stablecoin market capitalization reaching $193 billion by December 1 and projections of up to $3 trillion within the next five years, the field is reportedly dominating in capital flows and commerce.

Past monetary applications, stablecoins are additionally drawing political attention for their skill to deal with components admire the US debt burden. In 2024, stablecoins experienced a surge in transaction volumes, reaching $27.1 trillion by November, almost tripling the outdated year’s numbers.

Importance of Stablecoins

This increase highlights the increasing adoption of stablecoins for various use instances, from admire-to-admire (P2P) transfers to defective-border industry-to-industry (B2B) payments. Tokenized precise-world property (RWAs), equivalent to authorities securities, private credit, and commodities, increased by over 60%, reaching a market dimension of $13.5 billion by December 1.

The tokenization of property is expected to develop to $2 trillion to $30 trillion within the next five years, pushed by institutional gamers admire BlackRock and Franklin Templeton embracing blockchain for defective-border settlements and 24/7 procuring and selling.

Decentralized finance (DeFi) is additionally poised for a comeback in 2025, pushed by a shift toward extra sustainable monetary practices. After the unsustainable yields and risks of the outdated cycle, DeFi protocols are now incorporating precise-world use instances and transparent governance.

Past stablecoins and tokenization, Telegram procuring and selling bots occupy reportedly emerged as a highly winning sector within crypto in 2024. These bots, which allow users to alternate tokens straight thru chat-based fully mostly interfaces, occupy obtained significant popularity, critically for meme money.

Man made Intelligence

In 2024, Man made intelligence (AI) has changed into a vital point of focal point in each primitive and crypto markets. Within the crypto world, AI’s skill applications differ from improving blockchain security and recordsdata veracity to enabling decentralized AI training networks.

No matter the uncertainty, AI has already began to persuade the market. From AI-pushed reveal creation instruments to independent AI agents that manage crypto wallets and social media interactions, the technology continues to evolve.