Virtuals Protocol (VIRTUAL) has been on an outstanding uptrend, setting a couple of all-time highs (ATH) in the end of December. The altcoin reached yet one more ATH in the final 24 hours, climbing to $4.14.

On the opposite hand, this grand efficiency could well face challenges, as historical patterns suggest ability tag drawdowns following fundamental rallies.

Virtuals Protocol Faces Promoting

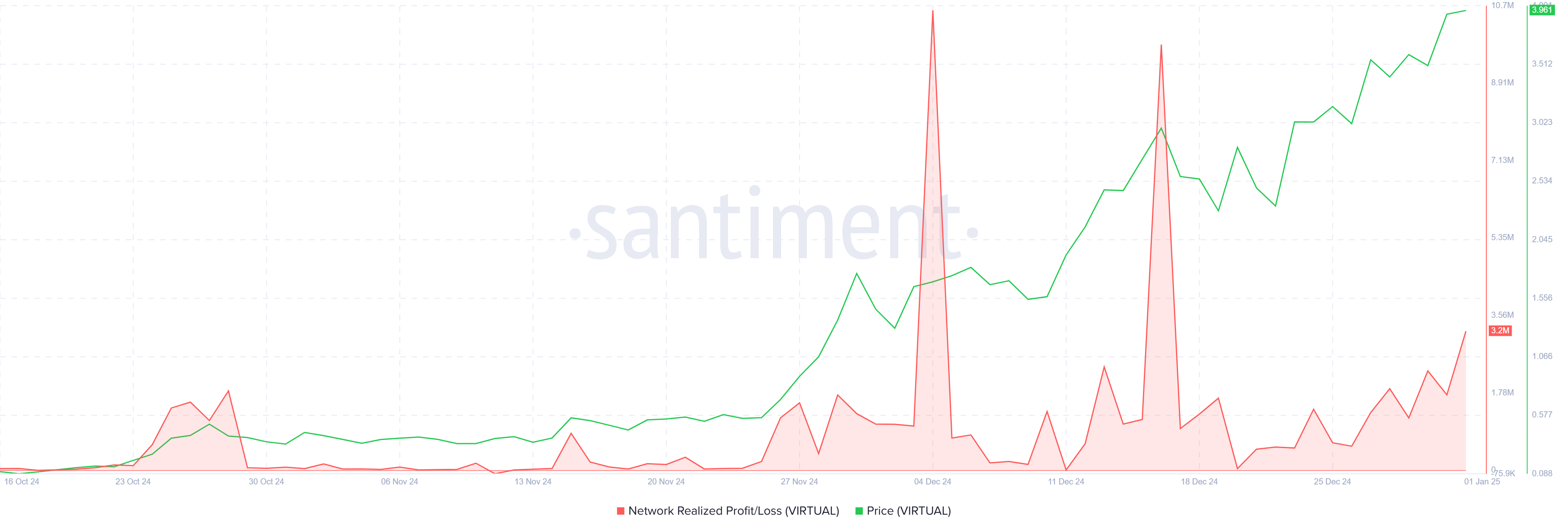

Realized earnings for VIRTUAL holders comprise spiked, indicating that merchants are actively securing their gains. This habits continually follows a tag surge as holders capitalize on earnings. Whereas this indicators market confidence, it additionally raises the possibility of a drawdown, as promoting rigidity tends to weaken the asset’s momentum.

The new uptrend has inspired many VIRTUAL holders to take earnings, a sample viewed in the end of earlier tag rallies. If this pattern persists, the chance of a tag pullback will enhance in the impending days. On the opposite hand, the magnitude of the drawdown will rely on broader market cases and investor sentiment.

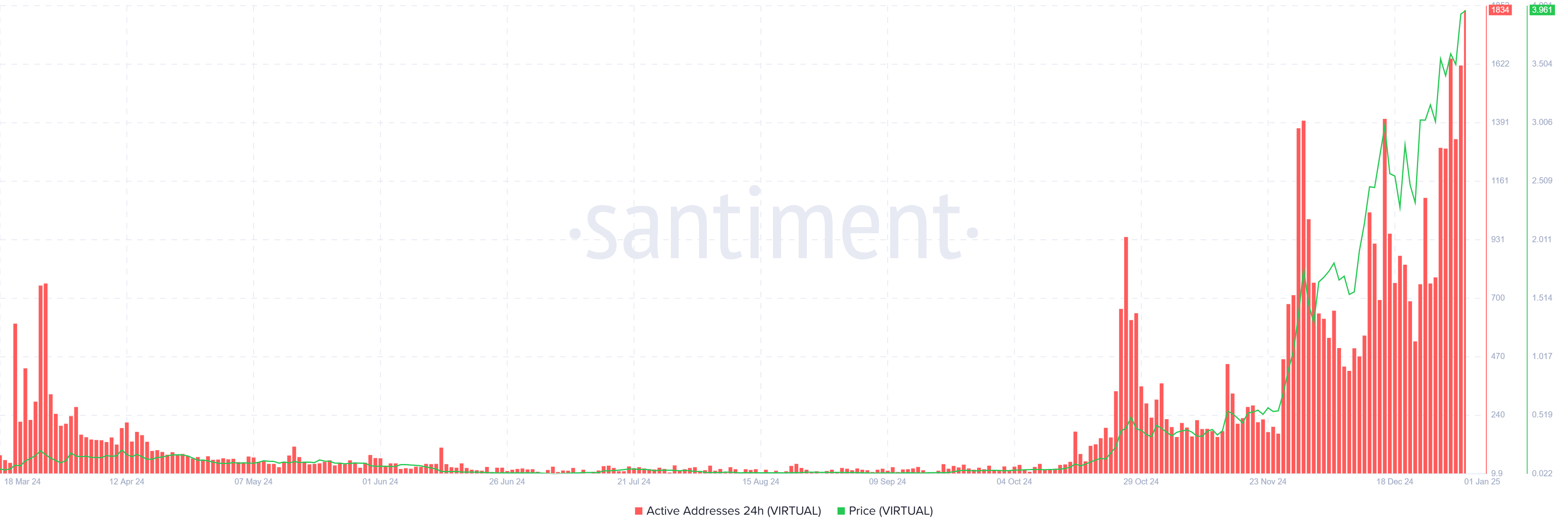

VIRTUAL’s intriguing addresses comprise reached an all-time excessive, reflecting remarkable participation in the community. The altcoin’s most novel ATH has drawn fundamental attention, leading to elevated teach among merchants. This heightened engagement highlights the rising hobby in VIRTUAL and its ability for extra boost.

Increased participation could well counteract just a number of the selling rigidity, as grand investor hobby supports tag stability. The sustained teach in the protocol highlights its rising adoption, that would also abet mitigate the possibility of a racy drawdown. On the opposite hand, persisted momentum will rely on balancing unique rely on with revenue-taking habits.

VIRTUAL Designate Prediction: One more ATH Inbound

VIRTUAL is currently trading at $3.94, appropriate under its ATH of $4.14, finished after a 17% upward push in the final 24 hours. This ascent has positioned VIRTUAL as no doubt one of many standout performers available in the market, however combined indicators suggest caution in the short period of time.

The interplay of promoting rigidity and elevated participation could well consequence in a brief period of consolidation. VIRTUAL’s tag can even stabilize above $3.26 while struggling to surpass $4.14. This vary could well abet as a baseline for its next transfer, looking on market cases.

Would possibly additionally peaceable bullish momentum enhance, VIRTUAL could well destroy previous its ATH and continue its upward trajectory. On the opposite hand, if revenue-taking dominates, the price could well fall under $3.26, potentially declining to $2.00 or lower. This place of dwelling would invalidate the bullish outlook and shift sentiment in direction of caution.