Sunday has been a rollercoaster for bitcoin prices, with the head crypto asset dipping to a low of $92,941 per coin. The total crypto market took a hit, dropping by 1.61%, while BTC itself lost 1.42% in the final 24 hours.

Cryptoquant Data Reveals Bitcoin’s Promote-Aspect Liquidity Plunged to 6.6 Months

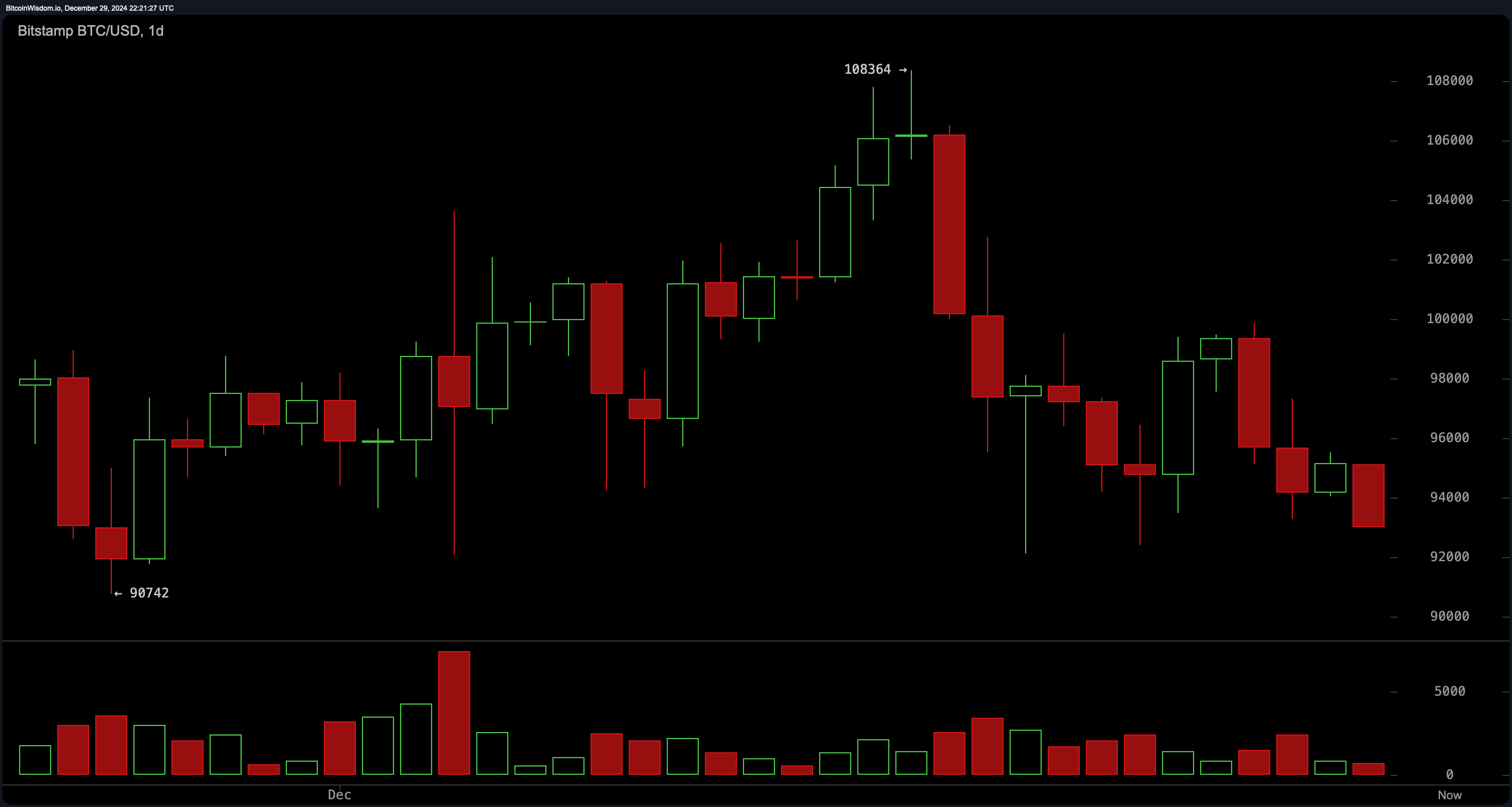

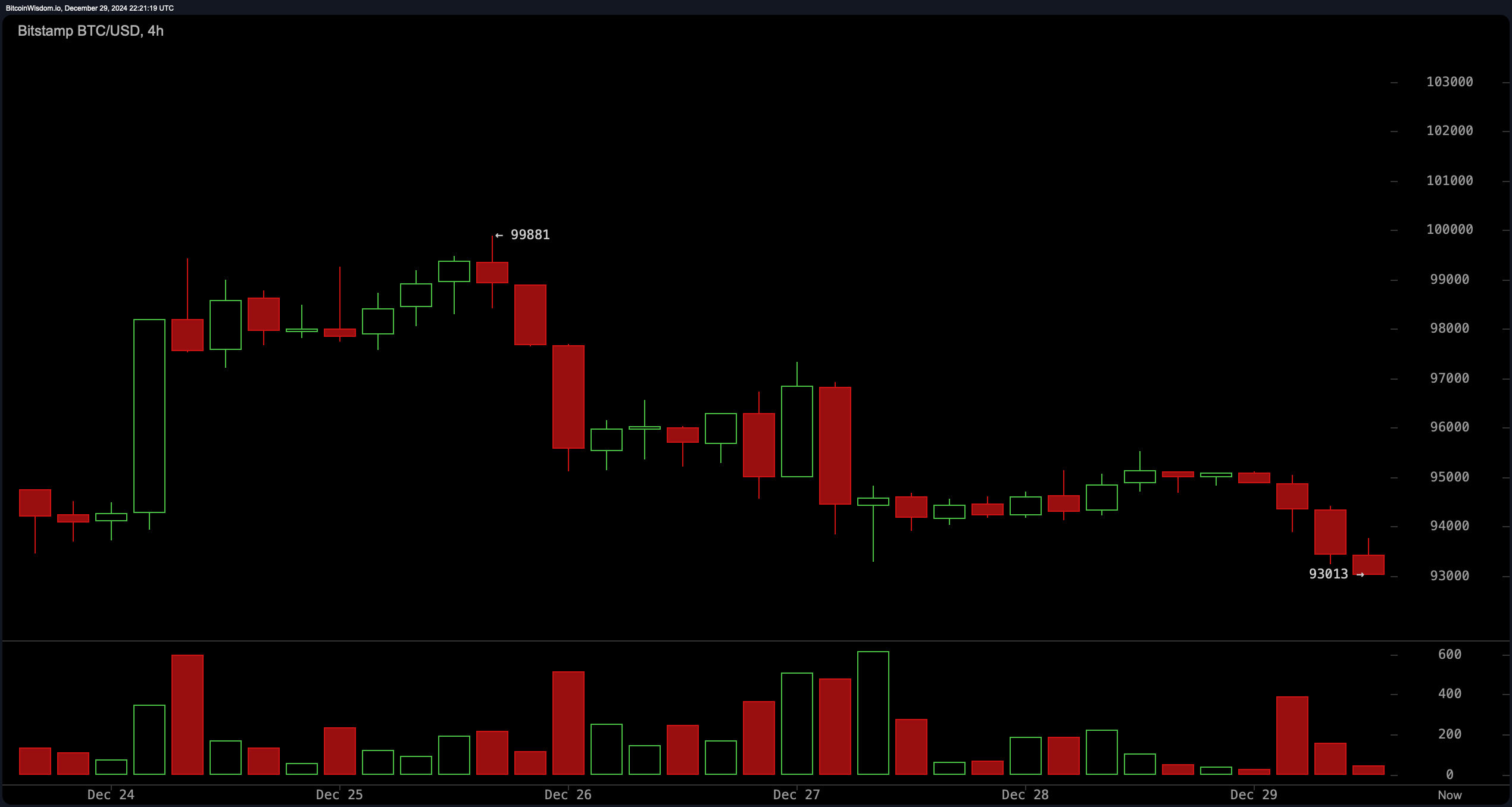

Bitcoin hit a low of $92,941 by 5:30 p.m. ET on Sunday, and after the drop, it tried to leap attend above $93,000 per coin. The day earlier than, at 5 p.m. ET on Saturday, BTC was floating comfortably above $95,000, precisely at $95,529 per unit. With the holidays, BTC’s buying and selling volume has been significantly quiet, clocking in at $26.18 billion in the final day. On the 1-day BTC/USD chart, key oscillators savor the relative energy index (RSI) at 43, Stochastic at 14, and the frequent directional index at 26 are all chilling in fair territory.

Taking a perceive at the transferring averages (MAs) on the each day chart, the easy transferring averages (SMAs) and exponential transferring averages (EMAs) from 10 to 50 days are flashing bearish signs. On the opposite hand, all of the longer-timeframe MAs are quiet sending out bullish vibes. Trading volume has been on the low aspect, and the vacation week has seen more sellers than patrons, likely holding prices on this dip and consolidated vary till the contemporary year.

Cryptoquant.com data presentations that the Coinbase premium gap is in the period in-between negative $169.18, signaling lukewarm U.S. curiosity, maybe as a result of vacation lull. Over in South Korea, the scandalous ‘Kimchi premium’ persists however has decreased from final week’s 3.38% premium on Dec. 25 to a most modern 1.3%.

Attention-grabbing data shared by Cryptoquant‘s head of compare Julio Moreno, signifies that it’s determined that bitcoin’s promote-aspect liquidity is on the decline. Moreno’s data finds that the Liquidity Inventory Ratio dropped from 41 months in October to upright 6.6 months, aligning with market rallies in Q1 and Q4 2024, suggesting that promoting stress could well soon ease up.

This weekend, tether (USDT) leads as bitcoin’s high buying and selling pair, followed by the U.S. dollar, FDUSD, USDC, and the Korean received. The received makes up 2.09% of all bitcoin trades this weekend. Your total crypto market is in the period in-between valued at $3.27 trillion, down 1.61% from the day earlier than this day. While BTC lost 1.42% in opposition to the dollar, other main cash took bigger hits: XRP dropped over 3%, BNB fell 4.27%, and DOGE dipped 2.25%. FARTCOIN was the day’s biggest loser, plummeting by 15.27%.

Bitget’s BGB token decreased by 12.62%, and the newly minted PENGU dropped 10.90%. On the brighter aspect, Phala Network (PHA) was the day’s star, gaining 18.26%. Oddly adequate, FTX Token (FTT), linked to the now-defunct FTX substitute, jumped by 12.77% in opposition to the U.S. dollar. Within the derivatives market, the downturn resulted in $126.39 million in liquidations, with $90.64 million coming from long positions on Sunday.