FARTCOIN mark reached a fresh all-time high on December 20, with its market cap surging to $1.2 billion. Nonetheless, the token has since skilled a pointy correction, with its market cap now sitting at $882 million after a 30% decline over the remaining four days. Nonetheless, it began to recuperate its model, rising 33% in the remaining 24 hours.

Irrespective of the pullback, technical indicators such as RSI and BBTrend highlight a mix of indicators, suggesting every bearish stress and the aptitude for a rebound. As FARTCOIN mark approaches key resistance and offers a preserve cease to ranges, its next switch will depend upon whether or now not merchants gather preserve watch over or if the downtrend persists.

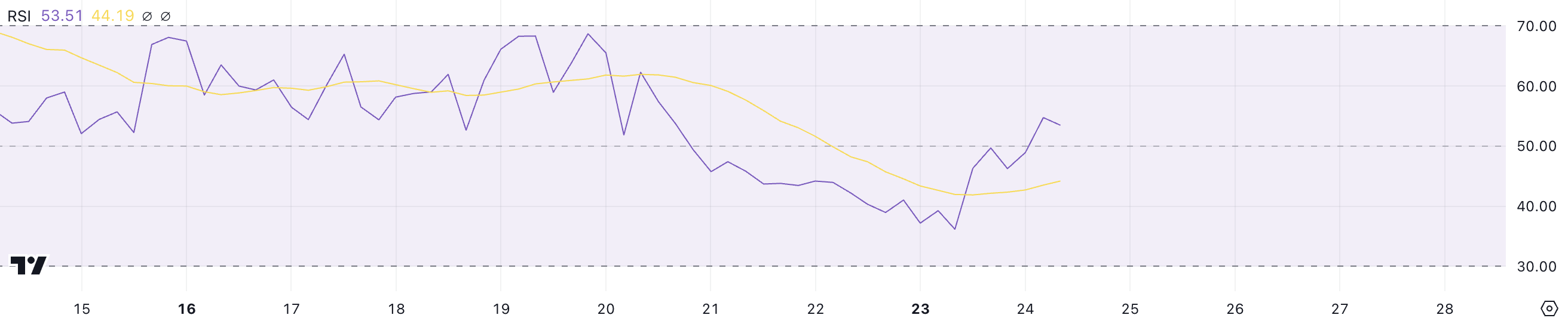

FARTCOIN RSI Is Currently Neutral

FARTCOIN’s Relative Strength Index (RSI) is at instruct at fifty three.5, up tremendously from 36 merely a day ago. This quick elevate signifies a proper surge in attempting to get momentum, as the token transitions from an oversold or frail market position into a extra impartial zone.

The shift suggests that merchants absorb re-entered the market aggressively. This motion might possibly possibly potentially reverse fresh bearish sentiment and atmosphere the stage for a extra balanced or bullish outlook.

RSI is a momentum oscillator that measures the price and magnitude of mark adjustments on a scale from 0 to 100. An RSI above 70 on occasion signifies an overbought condition, signaling the aptitude for a mark correction, whereas an RSI beneath 30 suggests an oversold condition, repeatedly preceding a rebound.

With FARTCOIN RSI at fifty three.5, it is miles in a impartial differ, indicating that the token is neither overbought nor oversold. Within the short term, this skill room for added upward motion if attempting to get momentum persists. Nonetheless, the market might possibly possibly merely stabilize because it approaches greater RSI thresholds nearer to 70.

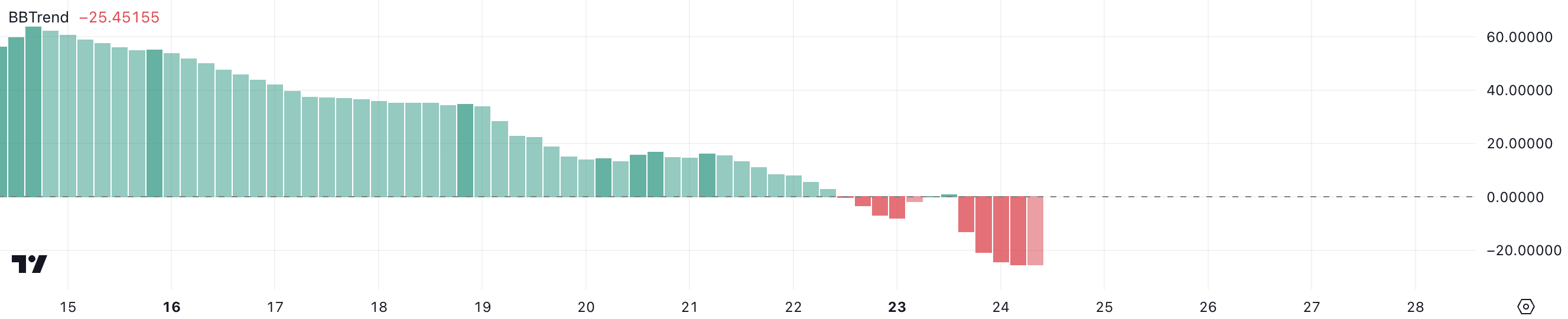

FARTCOIN BBTrend Is Currently Very Detrimental

FARTCOIN’s BBTrend is at instruct at -25.forty five, marking its lowest stage since December 7, which signifies important bearish momentum. This deep negative value suggests that promoting stress has intensified, pushing the coin into a strongly bearish bid.

Such low BBTrend ranges deem market prerequisites dominated by sellers, with limited evidence of quick bullish exercise to counteract the downtrend.

BBTrend, or Bollinger Band Pattern, is a momentum indicator derived from Bollinger Bands that measures the relationship between an asset’s mark and the midpoint of its bands. Certain BBTrend values instruct bullish momentum, whereas negative values highlight bearish prerequisites.

With FARTCOIN BBTrend at -25.forty five, the token is firmly in a bearish zone, suggesting that downward stress is seemingly to persist in the short term. Nonetheless, if this model begins to stabilize or reverse, it can most likely possibly instruct the delivery up of a recovery, but till then, bearish sentiment is anticipated to dominate.

FARTCOIN Set up Prediction: Can FARTCOIN Return to $1 Ranges Soon?

FARTCOIN faces a proper resistance at $0.92, which serves as a important stage for its transient mark trajectory. If this resistance is broken, it can most likely possibly signal a shift in market sentiment. This would allow FARTCOIN mark to rally extra and take a look at the following important stage at $1.299.

This scenario represents a most likely 50% upside from fresh ranges, highlighting the aptitude for sizable features if bullish momentum intensifies. This would proceed FARTCOIN momentum as one in every of basically the most relevant meme coins in the remaining days.

On the completely different hand, technical indicators admire BBTrend and RSI imply that the hot downtrend might possibly possibly merely persist.

If bearish stress continues, FARTCOIN mark might possibly possibly journey a pointy correction, losing to its nearest proper give a preserve cease to at $0.55. This would describe a most likely 36% decline.