Fleshy Penguins (PENGU) imprint has surged approximately 30% in the final 24 hours, rebounding sharply after reaching its lowest stage on December 20.

This dramatic recovery has been accompanied by bullish momentum, as key indicators adore RSI and CMF hit all-time highs, reflecting stable purchasing for stress and renewed investor self belief.

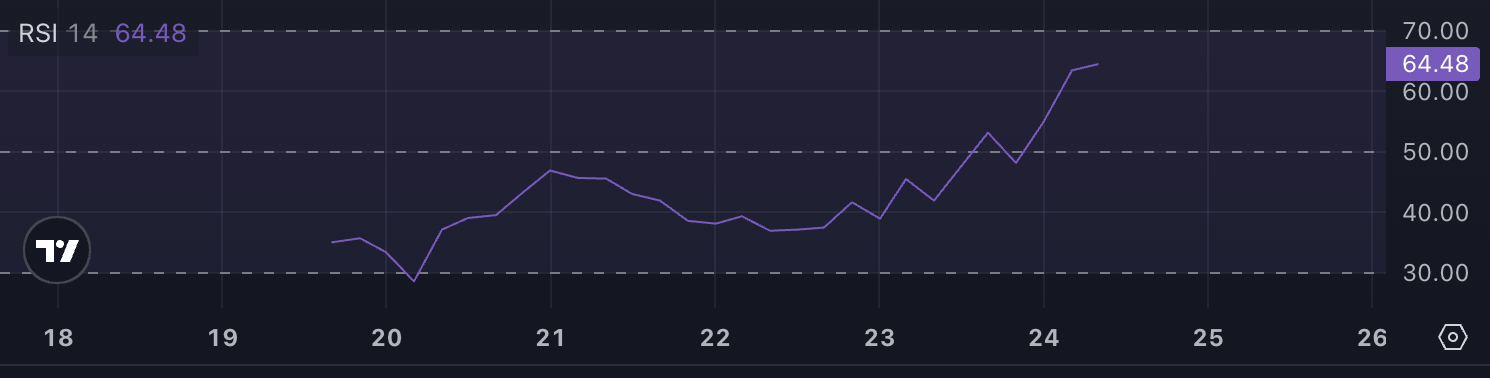

PENGU RSI Is At an All-Time High

PENGU Relative Energy Index (RSI) in the intervening time stands at 64.4, the supreme imprint since its launch. This elevated RSI indicates stable purchasing for momentum, suggesting that the token has been experiencing predominant upward stress.

While it is miles now not but in overbought territory, which is mostly opinion to be an RSI above 70, this stage reflects increasing market enthusiasm and doable bullish sentiment.

RSI, a favored momentum indicator, measures the tempo and magnitude of imprint actions on a scale from 0 to 100. Values above 70 counsel an overbought condition that would result in a imprint correction, while values below 30 allege an oversold condition, most ceaselessly previous a rebound.

With PENGU RSI at 64.4, it is nearing the overbought zone, signaling that its imprint may perchance per chance proceed mountain climbing in the brief term if purchasing for momentum persists. This would make PENGU one in every of the top-performing altcoins in the last few days.

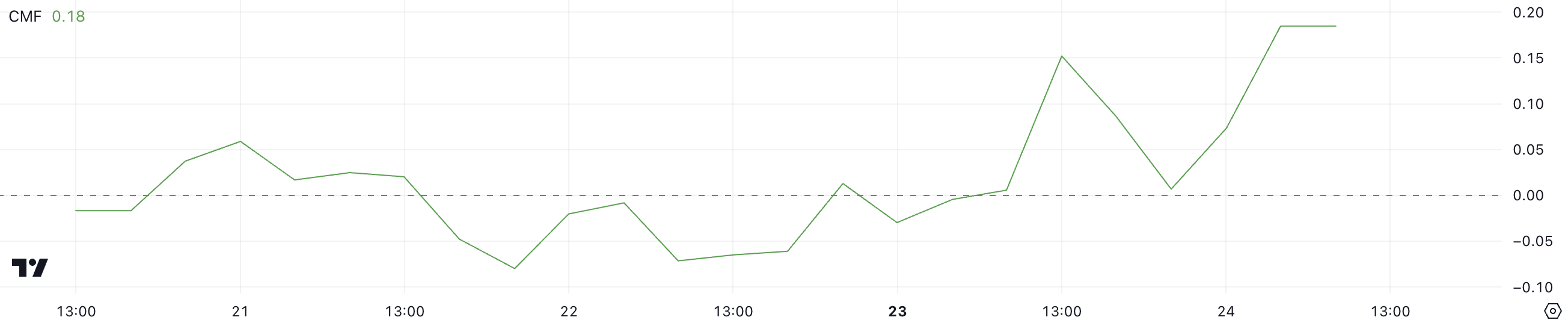

PENGU CMF Has Jumped In The Final Day

PENGU’s Chaikin Money Circulation (CMF) is in the intervening time at 0.18, a predominant magnify from 0.01 staunch a day in the past, marking its top stage since the token’s launch. This intriguing upward thrust indicates a basically in depth influx of capital, reflecting stable purchasing for stress and growing investor self belief in the altcoin.

A CMF at this stage suggests that shoppers are dominating the market, which can perchance per chance toughen endured imprint will increase in the brief term.

CMF is a quantity-weighted indicator that measures the buildup or distribution of an asset over a given length, ranging between -1 and +1. Obvious values allege accumulation and purchasing for stress, while detrimental values counsel distribution and selling stress.

With PENGU’s CMF at 0.18, the present market sentiment is decisively bullish, implying that the token may perchance per chance protect upward momentum if the inflows persist. On the opposite hand, such elevated ranges may perchance per chance result in a length of consolidation as merchants lock in earnings, making it predominant to display screen whether the purchasing for pattern sustains or begins to wane.

PENGU Label Prediction: Can PENGU Attain $0.045 In December?

If the uptrend persists, PENGU may perchance per chance manner a current all-time excessive of around $0.039.

Breaking via this resistance may perchance per chance pave the manner for extra positive aspects, with doable targets at $0.040 and $0.045, representing an approximate 20% upside.

On the opposite hand, if the RSI enters the overbought zone, signaling excessive purchasing for stress, a imprint correction may perchance per chance order. In this kind of case, PENGU imprint may perchance per chance take a look at $0.030 as its first key stage.

If this toughen fails, PENGU imprint may perchance per chance decline extra to $0.0229, marking a stable correction.