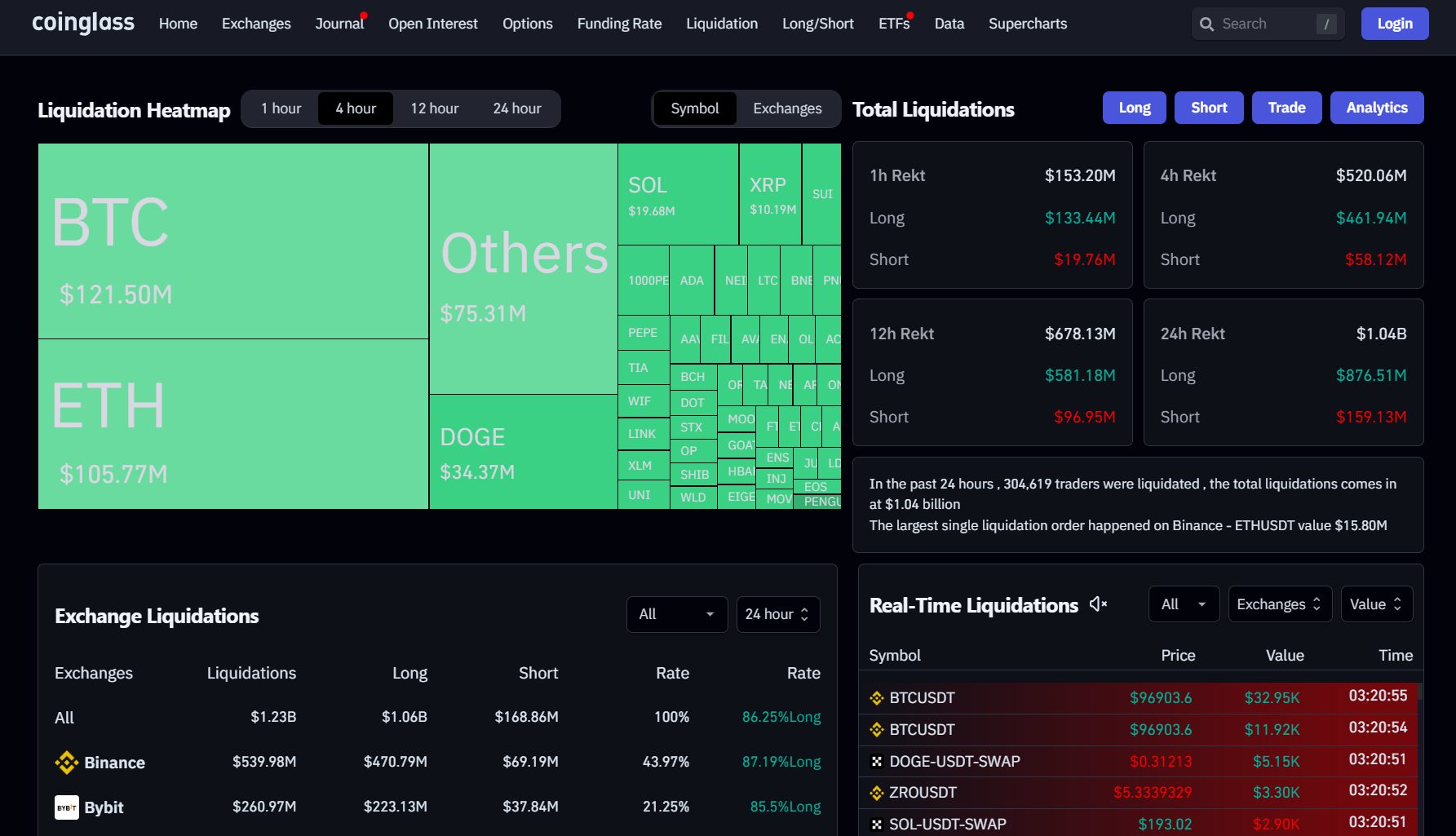

Leveraged liquidations all the method via crypto belongings surged to $1 billion following a brutal promote-off that despatched Bitcoin tumbling underneath $96,000 on Thursday, in step with Coinglass knowledge.

Long positions accounted for the overwhelming majority of losses at roughly $878 million, compared with $160 million for brief positions.

Bitcoin rebounded above $97,000 at press time but stays underneath its on day by day foundation high of $102,000, CoinGecko knowledge reveals.

It change into as soon as now not stunning Bitcoin; most crypto belongings moreover declined in fee. The total crypto market cap dipped 9.5% to $3.4 trillion at the time of reporting.

Ether lost 8%, Ripple shed 5%, and Solana and Dogecoin experienced even sharper double-digit losses all the method via the last 24 hours. Smaller-cap belongings had been seriously hit robust, with simplest Circulation (MOVE) paring its losses.

Fed’s hawkish stance

Markets likely reacted in turmoil to the Fed’s suddenly hawkish messages following the rate decrease resolution. The Fed on Wednesday delivered a 25-foundation-point rate slice price, but signaled fewer cuts in 2025.

Uncertainties in the economy, seriously with the incoming administration, precipitated the central financial institution to adopt a extra cautious stance. Fed Chair Jerome Powell mentioned that it’s prudent to “leisurely down” when the financial outlook is unclear.

Inflation has cooled from its high of around 9% in June 2022, but it’s tranquil stubbornly above the Fed’s goal. Reducing hobby rates can stimulate financial progress by making borrowing more cost-effective, but it goes to moreover make a contribution to larger inflation.

There are worries on Wall Avenue that Trump’s proposed financial policies, at the side of tariffs, could presumably maybe exacerbate inflation, despite the proven fact that they’d presumably even boost financial progress in the brief length of time.

Bitcoin ETF performance

In other locations in the Bitcoin ETF market, emerging indicators counsel a attainable shift in sentiment.

Even if US dilemma Bitcoin ETFs possess maintained a 14-day sure inflow creep, contemporary win inflows had been disproportionately concentrated within BlackRock’s IBIT. Totally different ETFs possess reported either zero win flows or win outflows.

Knowledge reveals that Grayscale’s low-discover Bitcoin ETF shed around $188 million on Thursday, its narrative low since initiate, whereas Grayscale’s Bitcoin Belief saw roughly $88 million in win outflows.

Further knowledge launched later nowadays will provide a extra comprehensive evaluation of ETF performance.

Wholesome correction?

No topic the promote-off, Bitcoin has obtained roughly 130% this yr. MicroStrategy, which owns almost 2% of Bitcoin’s provide, continues its acquisition approach. The firm has purchased $3 billion price of Bitcoin up to now this month.

Many crypto merchants survey the contemporary pullback as a healthy correction.

“It’s the same memoir each time, and it never adjustments. Markets aren’t designed for nearly all to ranking. Corrections are a natural fragment of bull markets,” neatly-liked analyst ‘Titan of Crypto’ mentioned.

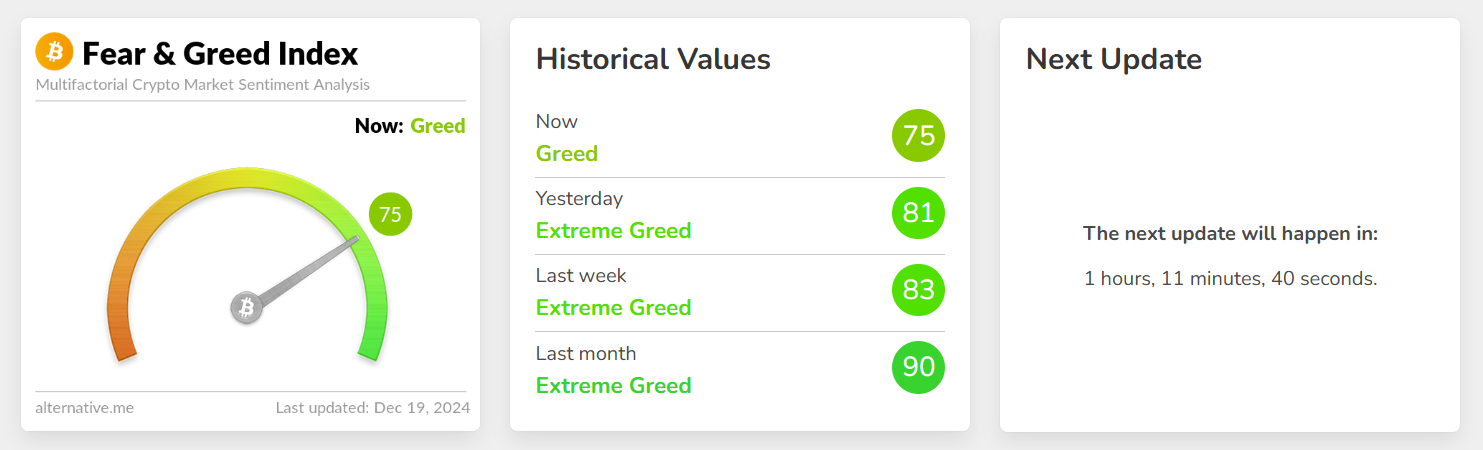

The Crypto Fear and Greed Index, which measures the emotional recount of the crypto market, for the time being sits at 75, indicating a sentiment of greed among crypto shoppers despite contemporary market volatility and fee corrections.