PEPE’s heed has dropped nearly about 8% within the past 24 hours, days after reaching its all-time excessive on December 9. Momentum indicators, together with the RSI at 33.3, display that PEPE is nearing oversold territory but has no longer yet hit the serious threshold of 30, leaving room for extra correction.

Moreover, the 7D MVRV Ratio at -9.3% aspects to necessary non eternal holder losses, with historical knowledge indicating a doable downside toward -12% to -15% sooner than a rebound. Whether PEPE holds its key toughen at $0.0000188 or breaks decrease will seemingly define its subsequent necessary heed toddle.

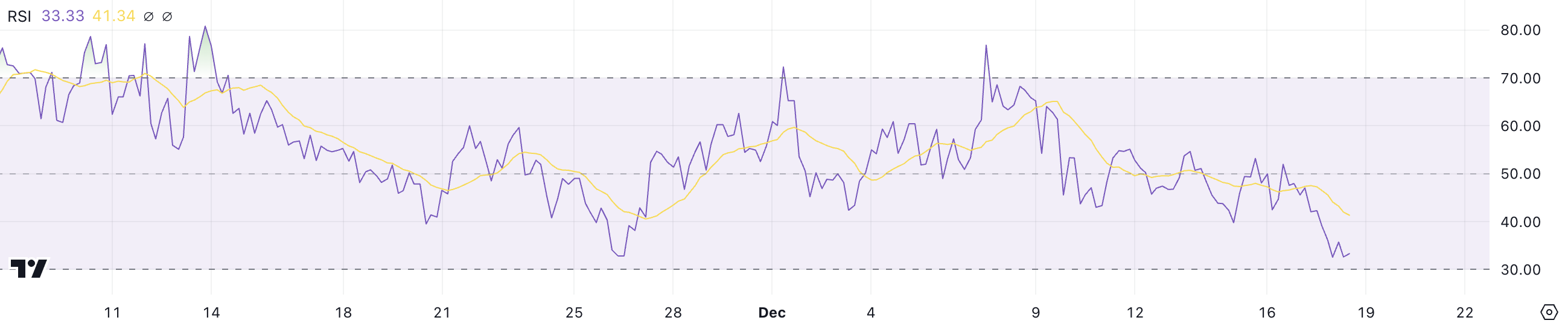

PEPE RSI Isn’t In The Oversold Zone But

PEPE RSI is currently at 33.3, reflecting a bright decline since December 16. This implies that the meme coin is drawing reach oversold territory, as its RSI nears the serious threshold of 30.

The heavy drop in RSI, blended with the continuing 8% correction within the remainder 24 hours, suggests increased selling strain and bearish sentiment within the rapid term.

The RSI (Relative Strength Index) measures the poke and magnitude of heed changes to assessment whether an asset is overbought or oversold. RSI values above 70 heed overbought conditions, on the final signaling a doable pullback, while values beneath 30 counsel oversold conditions, which might maybe maybe maybe maybe precede a rebound.

With PEPE RSI at 33.3 and nearing oversold phases, the rate might maybe maybe maybe also fair proceed to face downward strain, but a doable soar might maybe maybe maybe happen if investors step in at these decrease phases.

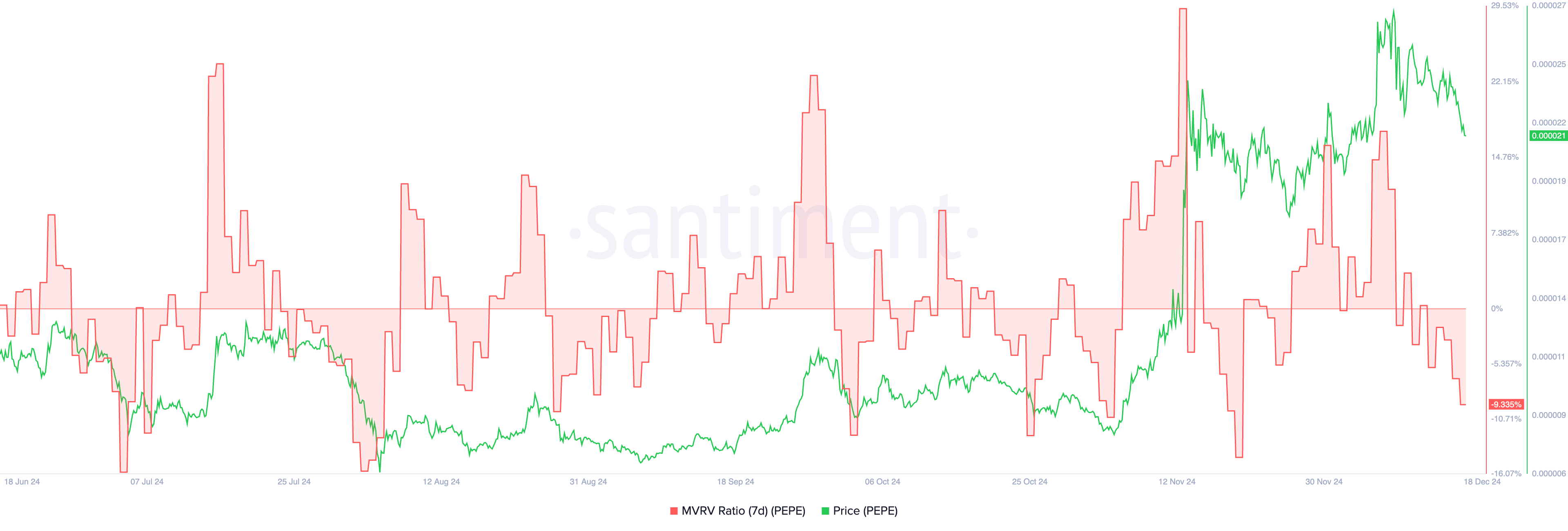

MVRV Ratio Shows The Correction Would possibly well maybe Continue

PEPE 7D MVRV Ratio is currently at -9.3%, a bright decline from 17% on December 8 when its heed hit a unique all-time excessive. This negative MVRV implies that, on moderate, non eternal holders are now at an unrealized loss. The most modern drop reflects increased selling strain, suggesting that the most modern correction might maybe maybe maybe persist within the rapid term.

The 7D MVRV Ratio measures the moderate income or lack of tokens moved within the remainder seven days relative to their most modern market price. Historical knowledge reveals that PEPE’s 7D MVRV on the final reaches phases around -12% to -15% sooner than heed recoveries happen.

If this pattern continues, the most modern -9.3% means that extra downside is doable sooner than PEPE finds a bottom and begins to rebound.

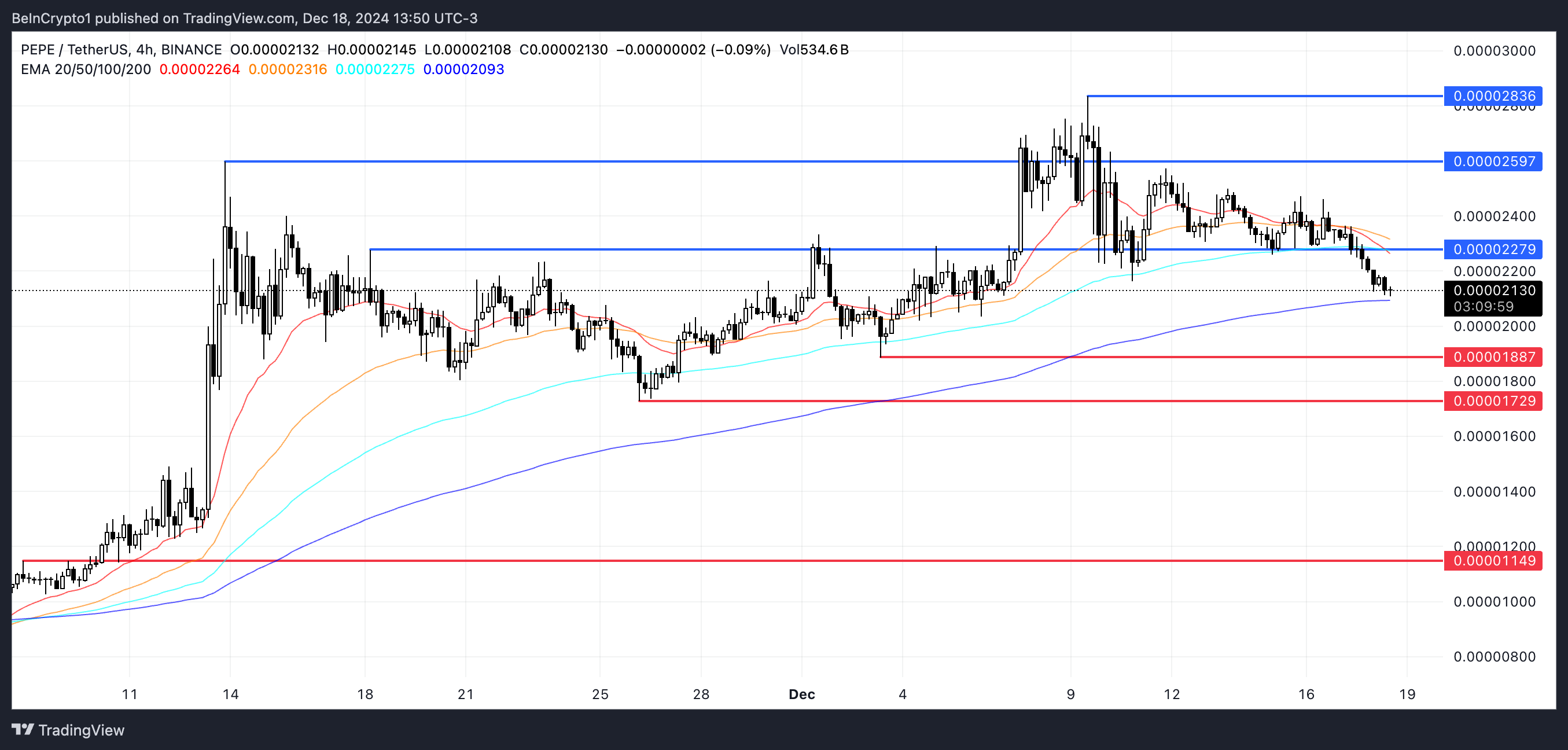

PEPE Mark Prediction: A Attainable 47% Correction Quickly?

The toughen at $0.0000188 is a serious stage for PEPE heed, as a breakdown beneath it might maybe maybe maybe maybe maybe also lead to extra declines. If this toughen fails, PEPE might maybe maybe maybe also fair test $0.000017, with the functionality to drop as low as $0.000011, representing a 47% correction from most modern phases.

This bearish outlook is bolstered by its EMA traces, which hold fashioned a dying inappropriate as non eternal EMAs inappropriate beneath long-term EMAs, signaling persevered downside momentum.

On the choice hand, if PEPE heed can gather definite momentum, it might maybe maybe maybe maybe maybe arena the resistance at $0.0000227.

A breakout above this stage might maybe maybe maybe start the door to extra good points, with targets at $0.0000259 and doubtlessly $0.000028 if the uptrend strengthens.