A referring to model has emerged amongst younger UK consumers who are making essential financial choices at an alarming accelerate, with two-thirds finalizing essential investment picks in lower than 24 hours.

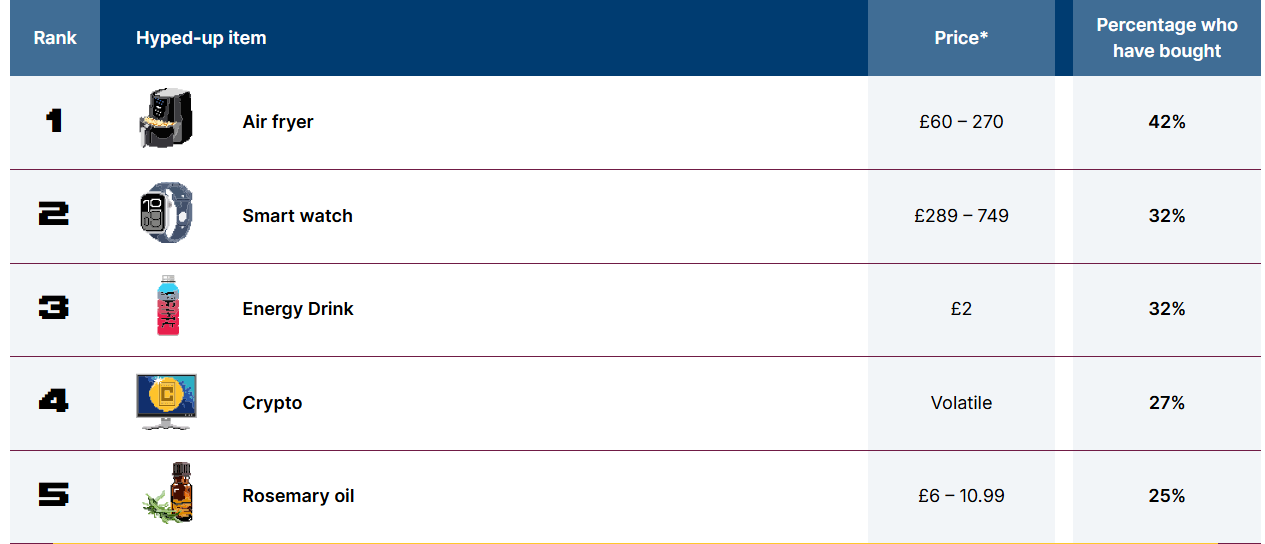

Furthermore, in step with the nation’s market watchdog, they fail to envision the distinction between buying a hyped air fryer or smartwatch and attempting to acquire Bitcoin or another trading product.

Younger Traders Urge Investment Selections, FCA Leer Warns

The Financial Conduct Authority’s (FCA’s) survey of two,000 UK consumers extinct 18-40 reveals a inserting pattern of speedy-fireplace investment choices. A essential 14% of respondents create investment picks in below an hour, whereas simplest 11% rob extra than per week to judge opportunities.

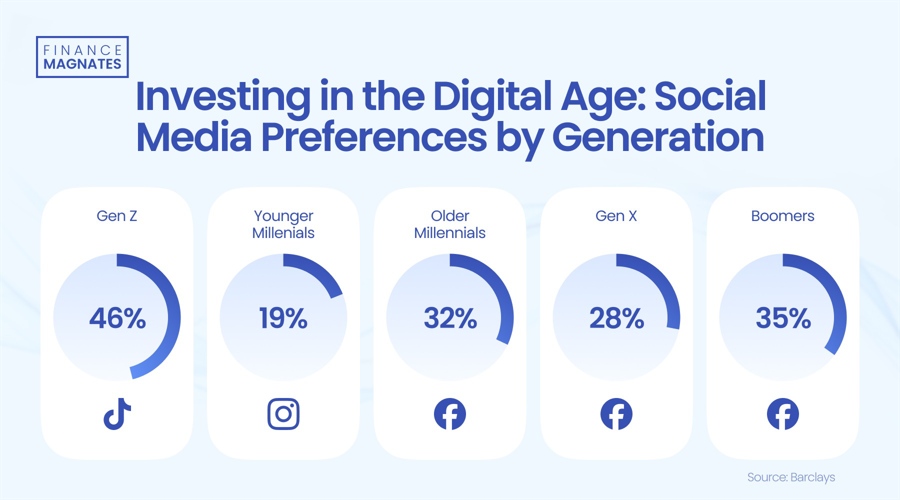

The digital panorama intently influences current investment habits. An awesome 85% of younger consumers acknowledge the essential impact of platforms like Instagram, TikTok, and YouTube on their investment choices. Extra notably, 43% rely on these platforms as their predominant examine tool.

“Whenever you’re pondering investing, the very first investment you must always aloof create is just a few of your contain time,” Lucy Castledine, Director of User Investments on the FCA, commented. “It will most likely be essential to ogle previous the hype, especially on social media, and originate your examine to make obvious what you’re investing in suits along with your financial objectives. Strive our 5 tricks to InvestSmart.”

Finfluencers Became Contemporary Investment Advisers

A present explore by Barclays confirms the FCA findings that nearly 50% of UK consumers counting on social media for financial steering. On the more than a few hand, they would possibly furthermore honest be exposing themselves to risk by neglecting to envision the credibility of financial influencers, veritably veritably called “finfluencers.”

“As extra people flip to social media for investment steering, there would possibly be a undeniable inquire of of for platforms to enhance transparency around finfluencers’ credentials,” commented Sasha Wiggins, CEO at Barclays Non-public Financial institution and Wealth Administration. “Here’s essential in tackling the specter of investment scams and combating people from acting on mistaken advice.”

These findings align with previous studies on the growing reliance on social media for investment choices. In April, CMC Markets reported that one in three retail traders belief financial influencers extra than their very contain family or guests.

Similarly, a explore in Germany published that over half of younger consumers purchased trading merchandise thru influencer links, prioritizing social media personas over skilled financial advisors.

User Psychology

The terror of missing out drives 51% of younger consumers to invest extra than on the foundation planned. The frequent exhaust on hyped investment merchandise reaches £550, with 40% of consumers later expressing remorse over their choices.

“This essential and timely examine illustrates the caring influence that hype and on-line traits are having on people’s resolution making,” added Steve Martin, a behavioral scientist at Columbia Enterprise College and the CEO of Impression At Work, added.

“Playing to people’s fright of missing out (FOMO) is a deliberate ploy designed to elongate the great thing about a product. Less of an subject if the item is a low-designate client product. However spontaneous and rapid choices about financial investments are referring to attributable to the probability of most likely regrettable and lengthy-length of time implications.”

Investment patterns mirror viral client habits, with cryptocurrency ranking fourth amongst trending purchases at 27%, following air fryers (42%), pleasing watches (32%), and vitality drinks (32%).