Bitcoin and Ethereum whales are taking a search to capitalize on the market-huge downturn as the leading sources are trading at a reduction.

Bitcoin (BTC) fell 1.4% within the past 24 hours and is trading at $97,300 on the time of writing. The flagship cryptocurrency touched an all-time excessive of $103,700 supreme week.

Ethereum (ETH) dropped 3.3% and is at expose altering fingers at $3,750 — the leading altcoin broke the $4,000 note on Dec. 6 for the predominant time in nine months.

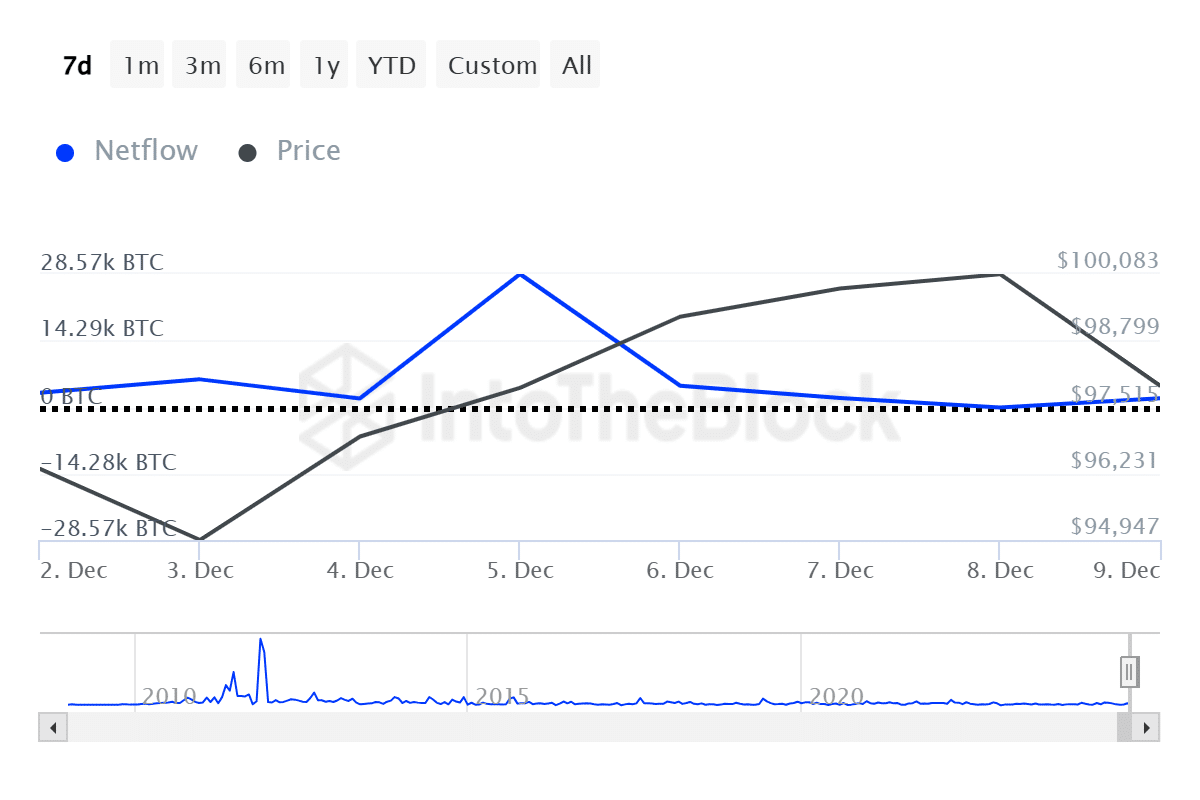

As both of the leading sources witnessed discover drops, whales started to glean. Primarily based on data from the market analytics platform IntoTheBlock, colossal Bitcoin holders registered a win inflow of 1,900 BTC on Monday after seeing constant declines since Dec. 5.

The Bitcoin whale transactions, value as a minimum $100,000, increased by 116% to $93 billion the day long gone by.

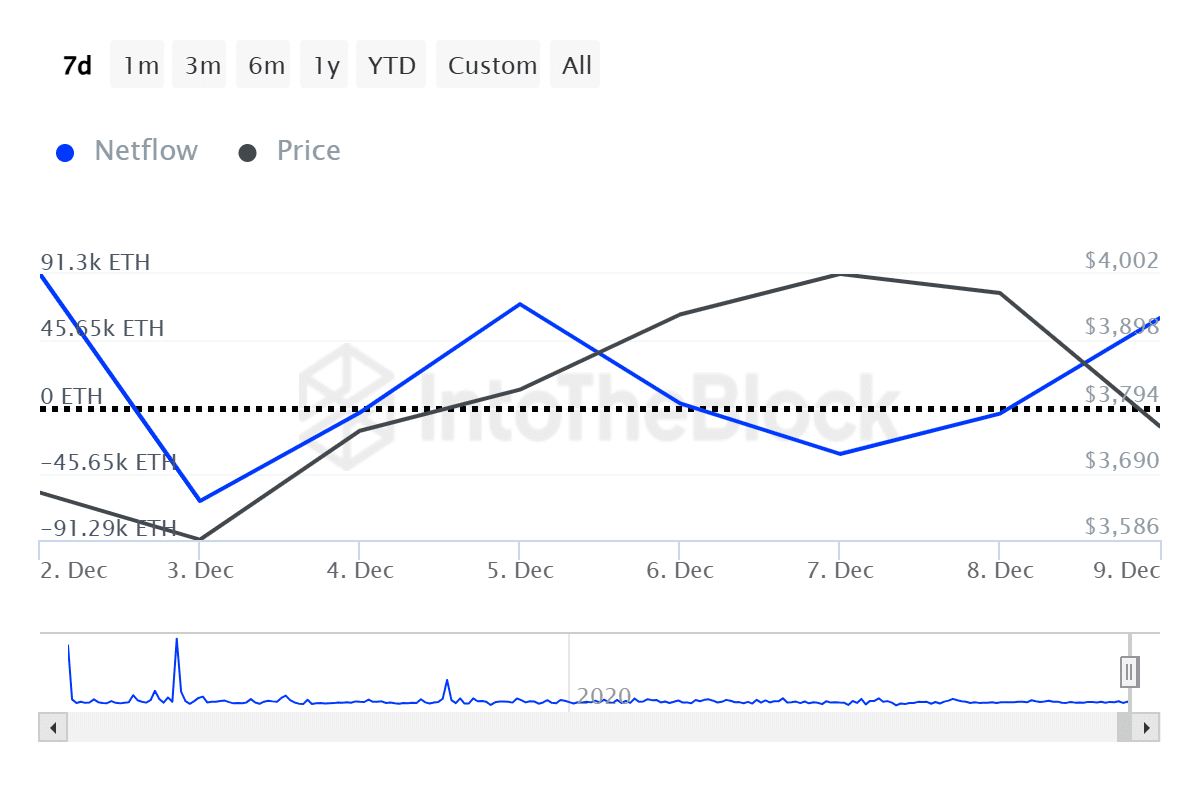

Ethereum whales recorded a identical motion with a win inflow of 61,000 ETH on Dec. 9, per ITB data. The spikes in BTC and ETH colossal holder win flows got here as quickly as the prices started to claim no.

The quantity of colossal Ethereum transactions moreover surged 127% to $10.9 billion on Monday.

Surprising sure shifts in whale voice might presumably well presumably potentially trigger FOMO (apprehension of lacking out) among retail investors to as a consequence push the prices again.

ITB data displays that over $200 million in USDT entered centralized exchanges on Dec. 9. Usually, the crypto market registers bullish momentum as investors aquire Bitcoin and altcoins the usage of the greatest stablecoin.

At this time, the worldwide crypto market cap is down 6% within the supreme 24 hours and is hovering at $3.65 trillion, in step with data from CoinGecko. The daily trading volume, nonetheless, surged from $247 billion to $475 billion all the absolute top design by the last day.

Surely one of many predominant causes on the aid of the market-huge cooldown might presumably well presumably be the expectations of the U.S. Client Designate Index, scheduled for the next day to come, and the following FOMC assembly, scheduled for Dec. 17 and 18.

If these macro events level to bullish indicators, the crypto market will likely stare one other phase of upward momentum.

Disclosure: This article does now no longer signify funding recommendation. The verbalize material and affords featured on this web page are for academic capabilities greatest.