Who would possess thought we’d behold Bitcoin shoot via the roof this snappy, hovering past $100K, albeit taking flight a exiguous at expose?

As we transfer ahead into 2025, the first inquire of on our minds is: what lies ahead? Is Bitcoin (BTC) a bubble about to burst, or are we now not astray for $150,000–$200,000 quickly? Are there any rational instruments to foretell its trajectory, or are we left to unswerving play guessing video games?

From what I’ve seen, the fog starts to carry in case you watch on-chain and technical indicators, while also factoring within the macro perspective. Let’s layer these three forms of evaluation in this text to behold what image emerges for Bitcoin’s next transfer.

Desk of Contents

Crude greed, rising energetic addresses, and document hash rate

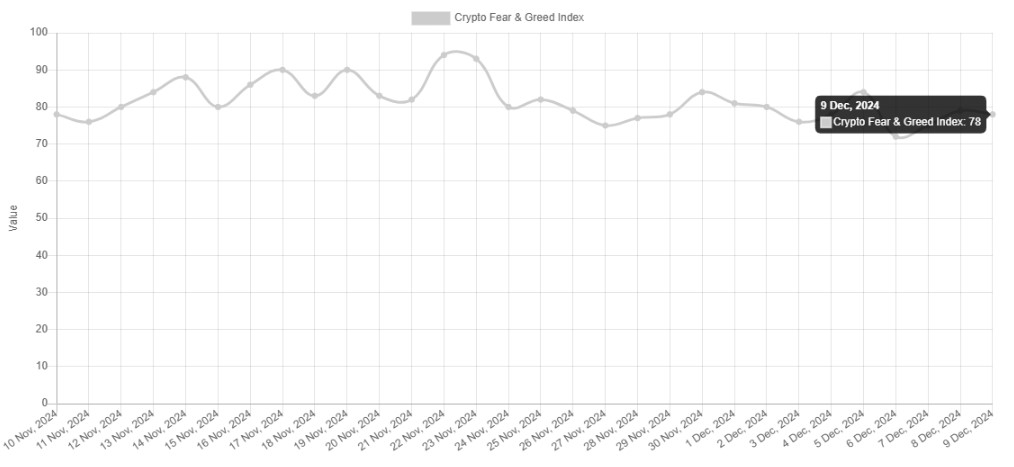

The Crypto Concern and Greed Index is currently at 78, indicating Crude Greed, which most ceaselessly signals possible tops within the quick term. Nevertheless, sustained stages of impolite greed all the plan via bull markets most ceaselessly align with parabolic heed increases before remaining peaks.

This most ceaselessly precedes non permanent pullbacks attributable to market exuberance, which appears to be like to be to be what we’re witnessing now as Bitcoin’s heed hovers around the $100K stage.

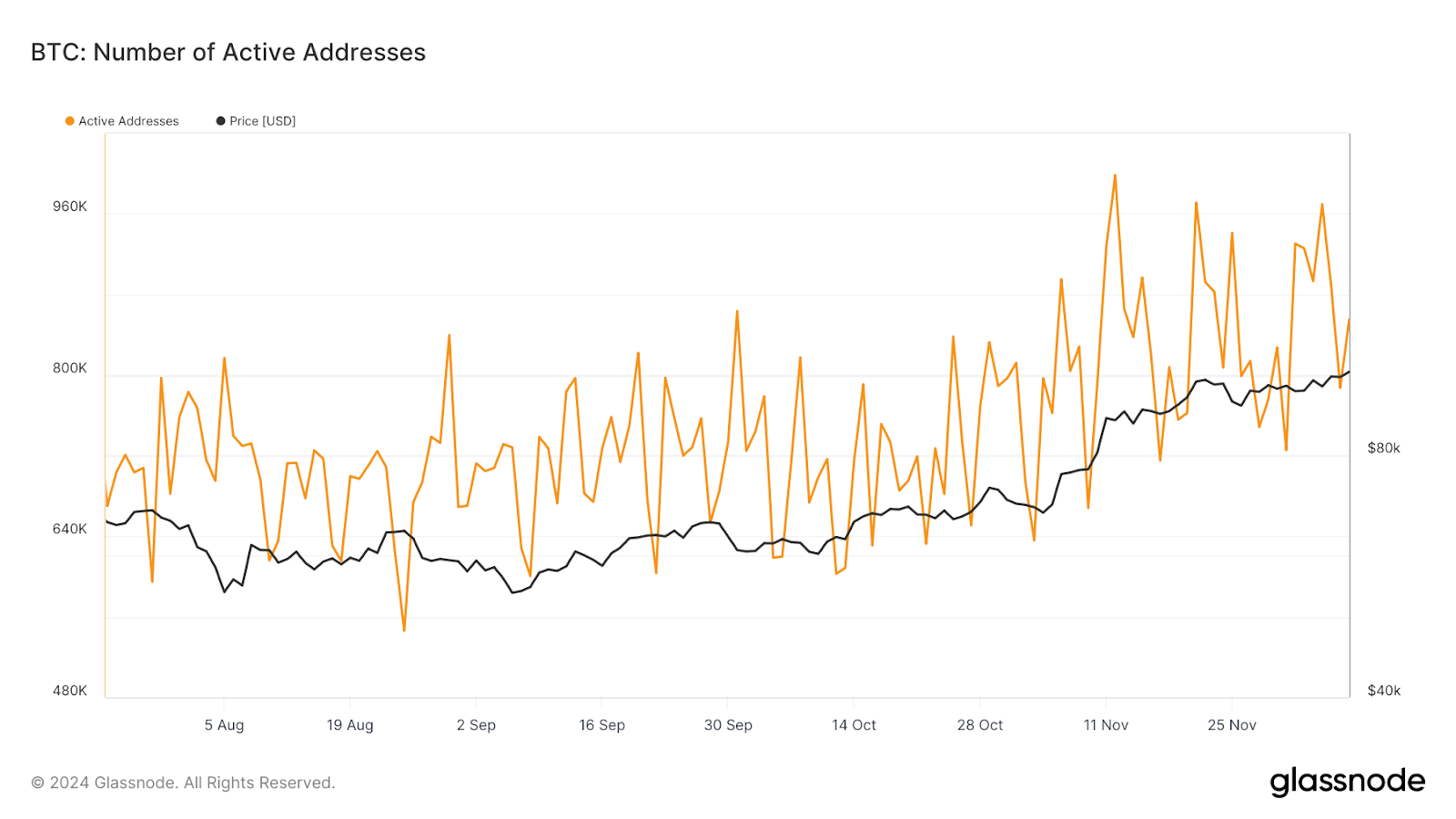

The preference of energetic addresses is increasing and, as of Dec. 8, stands at 855,153, suggesting heightened hobby and usage of the Bitcoin network.

As of Dec. 9, 2024, Bitcoin’s hash rate is approximately 850.70 EH/s, reflecting a valuable restoration from most fresh fluctuations nonetheless remaining beneath its all-time high of 949.98 EH/s, recorded on Nov. 26, 2024. While the present hash rate hasn’t but reclaimed the ATH, this sustained energy shows miner self perception and network security—long-term bullish signals. Bitcoin’s heed tends to seem on the hash rate; the extra assured miners are about heed appreciation, the less seemingly they are to promote.

BTC hash rate | Offer: CoinWarz

Weekly Golden Imperfect signals bull market with $150K-$250K possible

The weekly Golden Imperfect, the do the 50-week inviting average crosses above the 200-week MA, is a extremely valuable signal for long-term merchants because it always marks the launch of important bull markets and the conclusion of prolonged bearish phases.

The old occasion of this signal occurred when Bitcoin recovered from the 2018 endure market and at final surged to an all-time high of $69,000 in 2021.

Mirroring its behavior in old bull cycles, this signal reappeared in early 2024 and preceded Bitcoin’s parabolic upward thrust to its most fresh all-time high of $103,647. Earlier bull cycles following weekly Golden Crosses possess ended in gains of 300%–600%.

If this pattern holds, Bitcoin also can doubtlessly attain $150,000 to $250,000 before the following important cycle correction. Within the intervening time, the following Golden Imperfect is now not going till 2026 or 2027, assuming Bitcoin undergoes a full cycle of heed appreciation, correction, and consolidation.

RSI signals overbought stipulations, hints at pullback or consolidation

On the weekly timeframe, the Relative Strength Index is at 74.47, per overbought stipulations. Nevertheless, this does not imply a model reversal accurate now nonetheless rather shows the different of a non permanent pullback or a duration of sideways heed motion.

Within the past, many bull cycles seen identical RSI readings, adopted by non permanent pullbacks that had been then succeeded by renewed rallies to bigger highs.

Within the 2021 bull cycle, the RSI reached identical stages a pair of cases before peaking above 90, after which Bitcoin experienced a valuable correction. Assuming Bitcoin stays within the most most fresh consolidation vary around $100K and the RSI retraces assist to a extra healthy vary of 60–65, the following leg upward also can occur.

A healthy correction of 10%–20% or a sideways duration would enable the markets to reset before experiencing sustained divulge. For reference, a 10% correction from the all-time high of $103,647 would bring Bitcoin’s heed to approximately $93,282.

Fibonacci stages and Bollinger Bands signal key toughen and possible cooling

Fibonacci retracement stages, aged in technical evaluation to title possible toughen and resistance zones, wait on display conceal the do a heed also can retrace before continuing its model. According to the chart beneath:

Key Levels:

- $71,858 (0.618): Fundamental retracement stage, performing as a solid toughen zone (a 30.67% pullback from the all-time high of $103,647).

- $103,135 (0.786): Foremost resistance zone, attain the all-time high.

Bitcoin’s heed is currently buying and selling simply beneath the larger Bollinger Band, signaling solid bullish momentum. Nevertheless, this impart also indicates possible overextension, as prices most ceaselessly retrace or consolidate when deviating tremendously from the midline (20-week straightforward inviting average, currently at $71,858).

A pullback to $71,858 or additional consolidation attain the present heed of $ninety 9,249 would signify a common cooling-off duration all the plan via the Bollinger Band framework and prepare the marketplace for possible additional gains.

Visualizing Bitcoin’s market behavior via key indicators

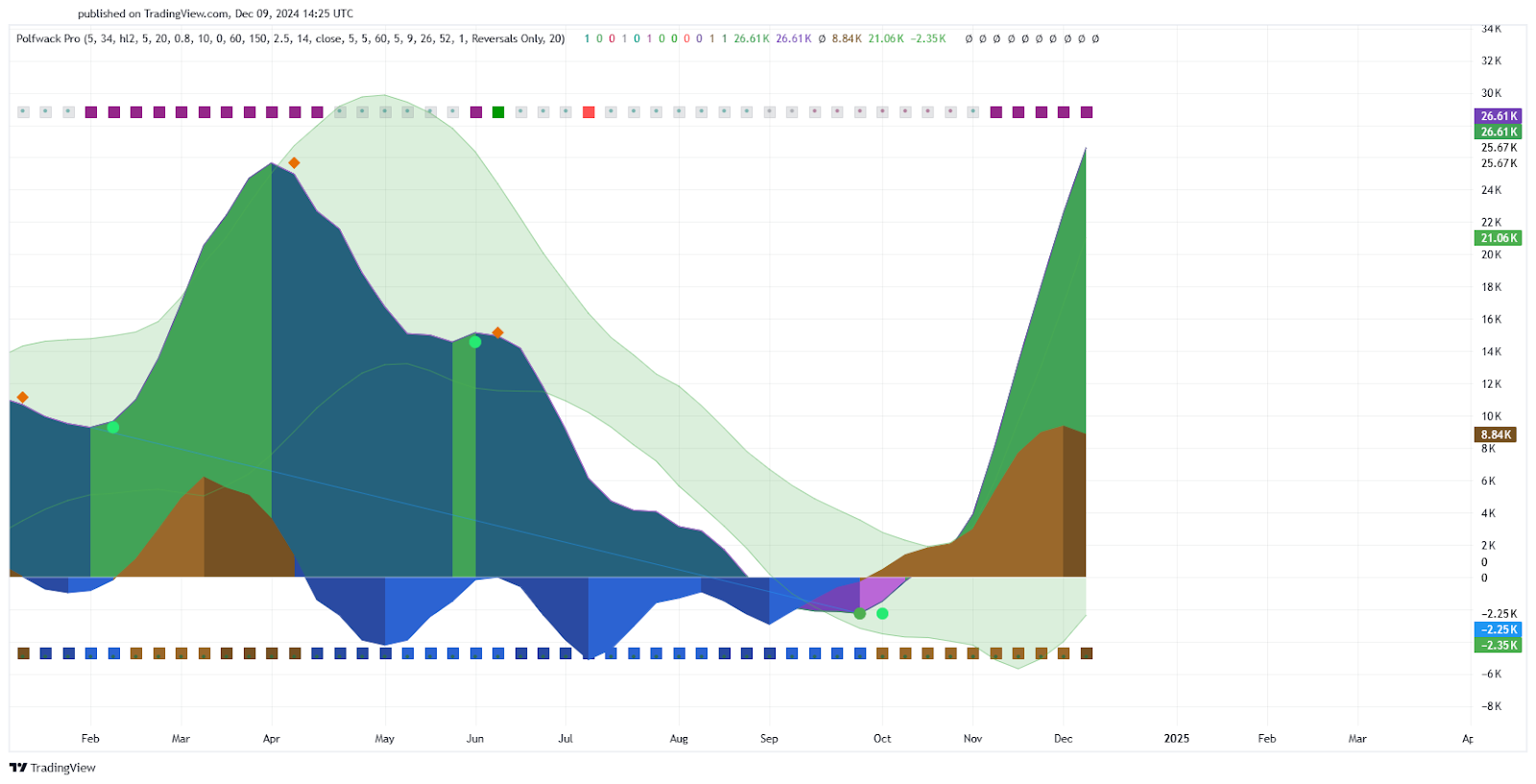

To additional visually signify Bitcoin’s market behavior, let’s look for at this colored chart beneath. It involves a coloration-coded bar on the tip that shows RSI stipulations. The currently seen purple and green coloration blocks counsel intervals of oversold or bullish divergence, reflecting bullish momentum and aligning with RSI overbought stages.

The second bar exhibits market structure trends (e.g., ranging, bullish, or bearish). From the chart, we behold green blocks that counsel the market is in a bullish piece, confirming breakout behavior.

Next, the first oscillator shows the Superior Oscillator with divergences and pivot capabilities, the do the fairway peaks above zero and brown areas beneath verify certain momentum and bullish pivots.

The secondary oscillator beneath the AO shows identical momentum indications, with certain bars (green above zero) suggesting accelerating upward momentum and a solid bullish bias.

Doable crypto house trends in 2025

Submit-halving supply shock, increasing retail and institutional participation, institutional accumulation (companies enjoy MicroStrategy and assorted company treasuries adopting Bitcoin as a strategic reserve asset) also can push question for it to unique highs.

The percentage of institutional merchants will seemingly develop, stabilizing heed movements nonetheless also making Bitcoin extra correlated with outmoded markets.

Bitcoin’s dominance (currently around 55%) also can upward thrust additional as merchants prefer its “digital gold” legend over altcoins, namely if regulatory scrutiny tightens around smaller tokens.

Bitcoin pockets divulge will proceed as adoption in emerging markets increases, with Bitcoin aged as a hedge in opposition to native forex devaluation.

Fundamental companies also can launch settling irascible-border transactions in Bitcoin, while in areas with high inflation or de-dollarization trends central banks also can accomplish bigger hobby in Bitcoin as a reserve asset.

International locations enjoy the U.S., the EU, and the UAE are inclined to finalize crypto-friendly regulations, while assorted jurisdictions also can clamp down on decentralized finance and self-custody to take care of control over monetary methods.

Closing thoughts

With a loud explosion of excitement, Bitcoin shattered the $100K barrier, an achievement deemed nothing attempting out of the ordinary. Technical indicators, at the side of the weekly Golden Imperfect and RSI, level in direction of the different of additional divulge, with projections suggesting a possible climb to $150K–$250K in this bull cycle.

Nevertheless, a healthy duration of consolidation or correction would seemingly provide a stronger foundation for future heed motion. By 2025, Bitcoin also can heed what changed into once thought to be almost impossible—setting up itself as a important player within the global monetary machine.