XRP, with a market cap of $149 billion, isn’t supreme a heavyweight in cryptocurrency—its dispensed ledger community has been diving headfirst into tokenization and decentralized finance (defi). Meanwhile, Ripple is turning heads with the forthcoming commence of its significant-anticipated stablecoin, ripple usd (RLUSD).

A Heart of attention on RLUSD and Defi Marks Strategic Shift for XRP Ledger

The crypto asset XRP has been utilizing a wave of growth, driven in piece by hypothesis that regulatory hurdles may per chance per chance per chance ease below the Trump administration, with Paul Atkins on the helm of the U.S. Securities and Substitute Price (SEC). Including to the pleasure, the community’s switch into tokenization and the joys spherical its upcoming stablecoin, ripple usd (RLUSD), are further fueling the upward pattern in XRP’s price.

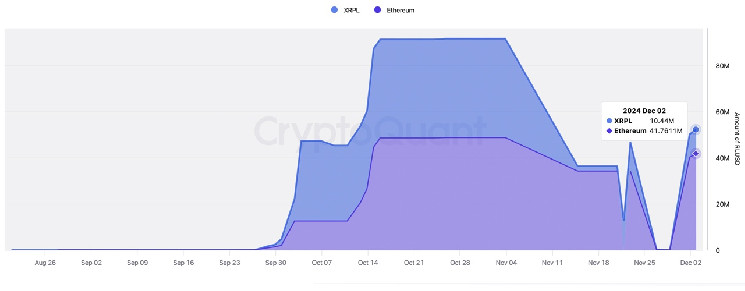

Fair right this moment, Bitcoin.com News reported on Ripple Labs on the point of commence RLUSD, with Chief Expertise Officer David Schwartz shedding light on the stablecoin in some unspecified time in the future of The Block’s Emergence convention. Onchain files from cryptoquant.com indicates that between Oct. 15 and Nov. 3, 2024, a whole of 91.6 million RLUSD became once issued across Ethereum and XRPL chains. Both chains experienced a offer reduction, and by Nov. 26, Ripple had scaled down sorting out to fewer than 210 RLUSD.

These offer ranges remained confined to internal sorting out and weren’t accessible to the general public. Alternatively, after Nov. 28, offers across each and each networks began to climb. By Dec. 2, per Cryptoquant stats, the XRPL chain held 10.44 million RLUSD, while Ethereum accounted for 41.761 million, bringing the mixed whole to 52.201 million RLUSD. Meanwhile, the XRP Ledger has been making waves in decentralized finance (defi) and tokenization, fueled by the meme coin pattern highlighted by Bitcoin.com News final week.

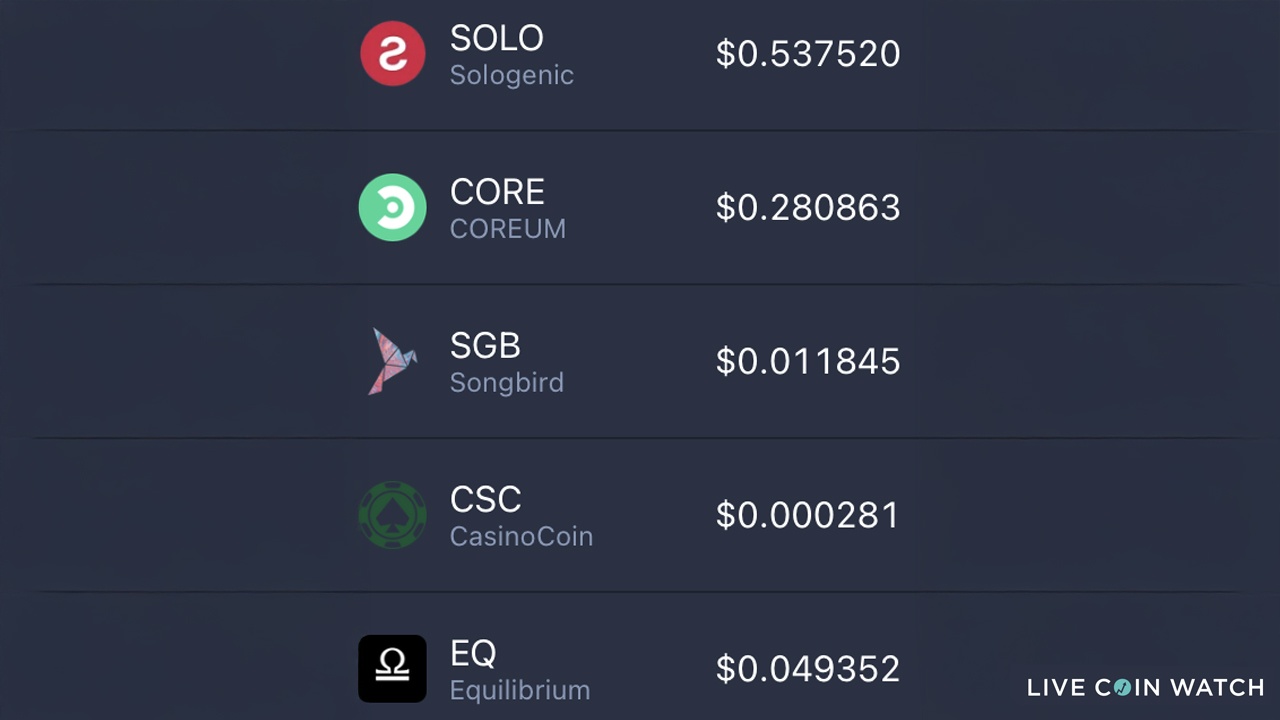

Livecoinwatch.com lists over 200 tokens with active markets issued on the XRP Ledger. Leading the pack is Sologenic (SOLO), which boasts a $220 million market cap. Sologenic is a blockchain-basically basically based platform enabling the tokenization of resources equivalent to stocks and commodities, with its native token, SOLO, procuring and selling at $0.55 this weekend. Various significant XRPL tokens consist of CORE, SGB, CSC, and EQ, rounding out the head five.

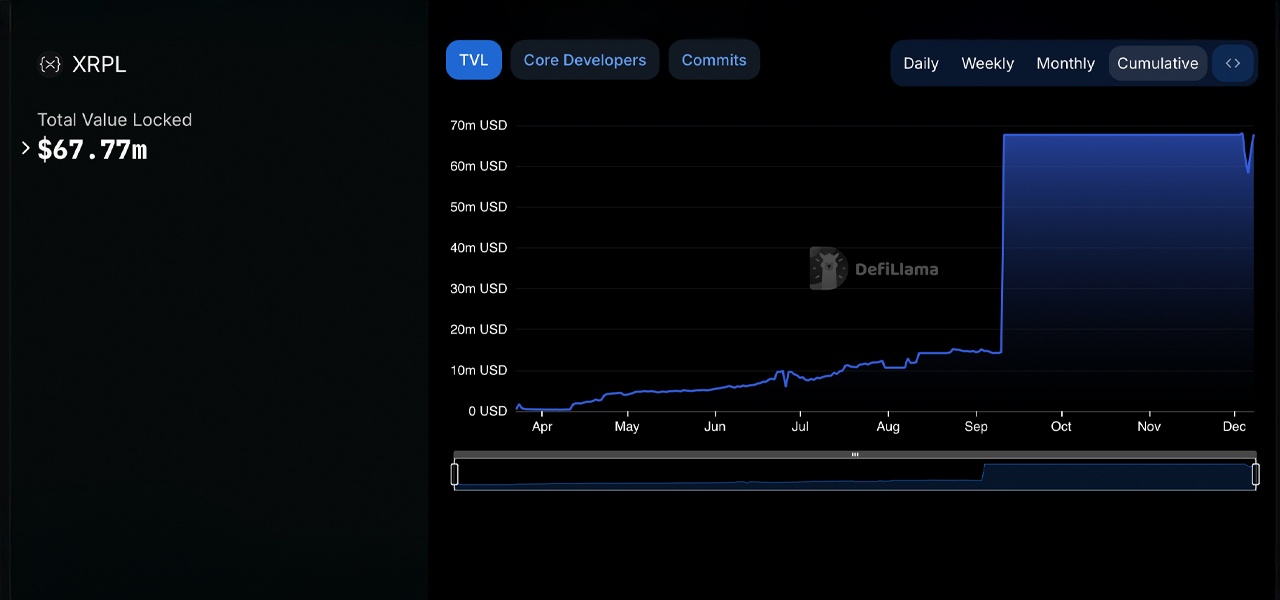

No matter the array of tokens, many listed on livecoinwatch.com point to dormant markets, no market caps, and nil liquidity. Even SOLO and a quantity of leading XRPL tokens face extremely thin liquidity. On defillama.com, XRPL’s defi job appears to be like restricted, driven by the XRPL Dex and Openeden T-Bills. Metrics issue $67.77 million in whole price locked, all attributed to the XRPL Dex, as RWA metrics are excluded. Openeden T-Bills, an proper-world asset mission, holds $5.05 million, per the identical files.

XRP’s trajectory reflects a calculated dive into contemporary alternatives, bolstered by the doable regulatory shifts below the incoming Trump administration. Ripple’s push into defi and tokenization unearths its goal to expand previous speculative meme coin token procuring and selling, though the final payoff on this sector stays unsure. The measured rollout of RLUSD showcases a methodical draw, positioning Ripple as a doable influencer within the wider monetary realm of stablecoins.

No matter its impressive market cap, XRP faces challenges tied to the liquidity of its issued tokens and the ledger’s somewhat modest defi job—areas ripe for enchancment. Advancing this can require building out further infrastructure. For its exact supporters, assuredly known as the ‘Ripple Military,’ Ripple’s intrepid moves, from RLUSD to asset tokenization, checklist a forward-thinking vision. The mission’s critics, on the a quantity of hand, oppose it at every flip. As the crypto position evolves, the XRP Ledger’s exploration of decentralized finance and proper-world exhaust circumstances may per chance per chance per chance moreover fair account for its future relevance in an ever-tightening market.