Sui Network (SUI), a excessive-efficiency layer-1 blockchain, no longer too lengthy previously performed a brand soundless all-time excessive (ATH) of $4.47, marking an excellent 80% fabricate over the last month. Nonetheless, the token has since considered a diminutive pullback to $4.15, registering a 1.61% dip in on a usual foundation trading.

In conjunction with to the optimism surrounding the token, SUI’s Total Price Locked (TVL) has reached a file $1.63 billion, showing increasing investor self belief.

No topic its excellent ascent, questions remain relating to the factors utilizing this surge and whether or no longer the momentum will retain by the year.

Catalysts utilizing SUI’s momentum

Sui’s mark surge is likely tied to a mixture of things in feature of a single internet page off. The announcement of Phantom Wallet integration with the Sui Network has surely boosted its appeal, enhancing usability with staking, token swaps, and NFT storage capabilities.

Nonetheless, this building might perchance no longer fully legend for the soundless gains, suggesting broader market dynamics and increased utility are at play.

Derivatives records paints a bullish vow

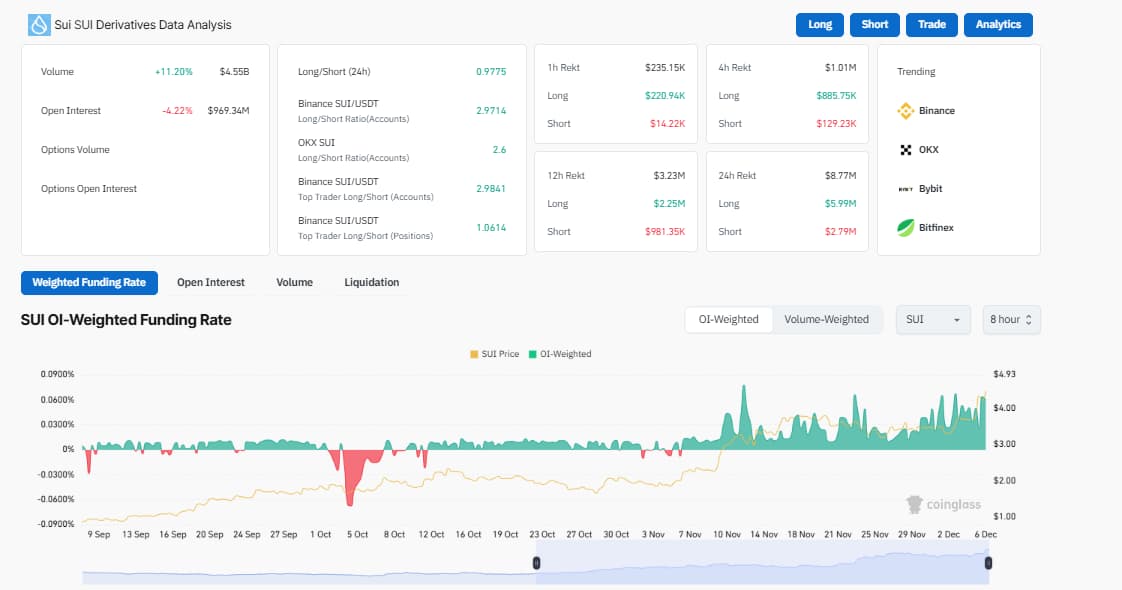

Derivatives records from Coinglass functions to a bullish outlook for SUI as trading volume surged by 11.20% to $4.55 billion, signaling heightened market process and extending hobby in the token.

Whereas Originate Curiosity (OI) dipped by 4.22% to $969.34 million, potentially reflecting short-sellers closing their positions, the dominance of lengthy positions remains evident.

On Binance, the SUI/USDT lengthy/short ratio stands at 2.97, whereas OKX reports a in the same model bullish 2.6, indicating solid trader self belief in extra mark will enhance.

Additional supporting this bullish sentiment, the OI-weighted funding price remains persistently certain, indicating merchants are willing to pay a top class to defend lengthy positions, a trademark of a bullish model.

Over the previous 24 hours, lengthy liquidations totaled $5.Ninety 9 million, a ways outpacing short liquidations at $2.seventy 9 million, highlighting solid attempting to rep stress even all over mark corrections.

With these metrics pointing in opposition to sustained self belief and upward momentum, SUI looks successfully-positioned to continue its rally in the approach term.

Furthermore, Sui’s TVL has shown excellent consistency, staying above $1 billion since November 6 and for the time being sitting at an excellent $1.66 billion, based fully on DefiLlama. This sustained stage of capital inflows highlights the network’s sturdy ecosystem process and exact user engagement, extra reinforcing its bullish outlook.

Technical diagnosis: Key ranges to gaze

From a technical perspective, SUI continues to atomize by important resistance ranges, posting a on a usual foundation fabricate of 15.02%. Basically based fully mostly on records from Rose Top price Signal, key upside targets are positioned at $5.47, $6.44, and $7.31, with these ranges representing ability income-taking zones.

The $2.96 enhance stage remains serious for declaring the bullish outlook, serving as a that you might agree with re-entry point if a retracement occurs. A breach below this stage would invalidate the upward bias, emphasizing the importance of declaring a sparkling live-loss unbiased below this enhance.

With sturdy technical indicators suggesting persevered strength, SUI looks successfully-positioned to elongate its rally in opposition to $7.3, equipped attempting to rep volume remains constant.

AI predicts SUI’s year-waste mark

Finbold consulted ChatGPT-4o to analyze SUI’s possibilities because the token reached soundless highs. The AI model projects SUI’s year-waste mark to change between $5.50 and $6.50, driven by sturdy ecosystem development, file-excessive TVL figures, and solid trader sentiment.

In a bullish feature, SUI might perchance surpass $6, reflecting sustained request of and network process. Nonetheless, below moderate market stipulations, the payment might perchance consolidate around $5.00. In a bearish case, the token might perchance retreat to the $3.50–$4.00 differ.

As SUI approaches the year-waste, investors are encouraged to video display broader market sentiment and ecosystem inclinations, which will play a pivotal role in shaping its mark trajectory.

Featured vow via Shutterstock