After a extended correct fight and market stagnation, XRP label has emerged stronger than ever, hitting a six-one year high of $2.46.

With its market cap exceeding $140 billion, analysts are asking: would possibly $10 be the subsequent milestone for Ripple’s native token?

XRP Rockets to Six-one year Excessive Amid Market Optimism

XRP’s market performance has worried investors, rallying to a six-one year high of $2.46 and surpassing a $140 billion market cap.

This milestone represents a 341% surge since November 1, driven by a mixture of correct victories, sturdy on-chain metrics, and Ripple’s strategic enhancements.

Notably, the recent $50 billion spike in market cap over correct three days highlights the overwhelming bullish momentum in the back of the token.

At model, XRP boasts a 24-hour shopping and selling volume of $28 billion, making it the fourth most-traded cryptocurrency globally. It ranks third when with the exception of stablecoins, trailing handiest Ethereum and Bitcoin in day-to-day shopping and selling activity.

The rally is fueled in portion by excitement surrounding Ripple’s upcoming stablecoin, RLUSD. The New York Division of Monetary Services and products (NYDFS) is reportedly terminate to approving RLUSD, with a decision expected as early as December 4th.

Ripple’s stablecoin is designed to integrate seamlessly into the archaic financial system, enabling banks to undertake Ripple’s instrument for transactions.

This innovation would possibly severely enhance demand for XRP as more establishments web the numerous the network.

In retaining with market observers, RLUSD would possibly disrupt the $200 billion stablecoin sector currently dominated by Tether (USDT) and Circle (USDC).

Ripple’s established presence in world funds positions RLUSD to potentially gash out a tall market portion, creating a favorable suggestions loop for XRP’s label.

Correct Readability Fuels Optimism

Ripple’s ongoing correct war with the SEC is additionally nearing resolution. SEC Chairman Gary Gensler’s announcement of his departure in January has sparked optimism that a more crypto-friendly regulatory contrivance would possibly emerge.

Correct experts, corresponding to authorized skilled Jeremy Hogan, counsel that non-fraud situations like Ripple’s would possibly quickly be dropped, potentially ensuing in a settlement.

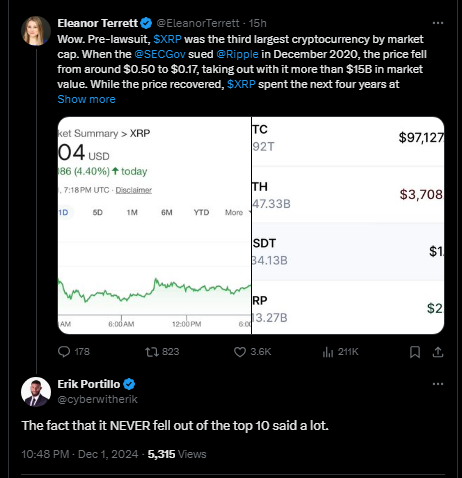

The lawsuit, which once dragged XRP’s label to a low of $0.17 in 2020, now appears to be like to have galvanized the crew.

Technical analysis extra underscores XRP’s bullish outlook. Key indicators, collectively with optimistic intelligent averages and a sturdy MACD signal, counsel persisted upward momentum. XRP’s RSI stands at 93.89, while volatility stays moderate at 7.75%.

On-chain details additionally ingredients to rising adoption. XRPScan experiences that new pockets activations on the XRP Ledger have surged tenfold over the previous three months, with nearly about 1,000 users becoming a member of every hour.

First Ledger, a key platform within the ecosystem, just recently processed $40 million in transactions in a single day.

Will XRP Model Reach $10?

Analysts stay divided on whether XRP can hit $10, but many leer this as a pragmatic lengthy-timeframe purpose. Market individuals like Edoardo Farina, CEO of Alpha Lions Academy, factor in $10 is correct the starting up, urging holders to no longer sell upfront.

“Somebody selling at $10 will regret it later,” Farina acknowledged.

As XRP trades at $2.41, its 29% day-to-day be triumphant in reflects the token’s rising dominance in the crypto market.

Whereas challenges stay, the mix of Ripple’s stablecoin ambitions, correct readability, and surging market demand would possibly web the $10 milestone bigger than correct a dream.

On the time of writing, XRP is shopping and selling at $2.24 after rallying 17% over the closing 24 hours with a shopping and selling volume of $33.55 billion.