Chainlink (LINK) tag emerges as regarded as most seemingly the most excellent gainers amongst the head 20 cryptocurrencies in the closing 24 hours, no topic unveiling blended indicators in its technical indicators.

The BBTrend indicator, though closing sure since November 25, has weakened vastly. Regardless of these contradicting indicators, LINK tag presentations potential for a 42% surge to $30 if it efficiently breaks above most sleek resistance ranges.

Chainlink Whales Are Not Gathering LINK

A predominant decline in Chainlink whale holdings over the previous two weeks indicators a doable shift in sentiment.

The factitious of wallets containing between 100,000 and 1,000,000 LINK dropped from a yearly high of 558 on November 19 to 533 for the time being, suggesting substantial investors will seemingly be taking profits or redistributing their holdings.

Tracking whale behavior is wanted as these substantial holders can vastly have an effect on tag actions and market sentiment. The lower from 558 to 533 wallets in this class signifies a distribution part the place apart higher holders are decreasing their positions.

This sustained decline in whale accumulation may perhaps well presumably impress bearish stress on LINK tag in the short term.

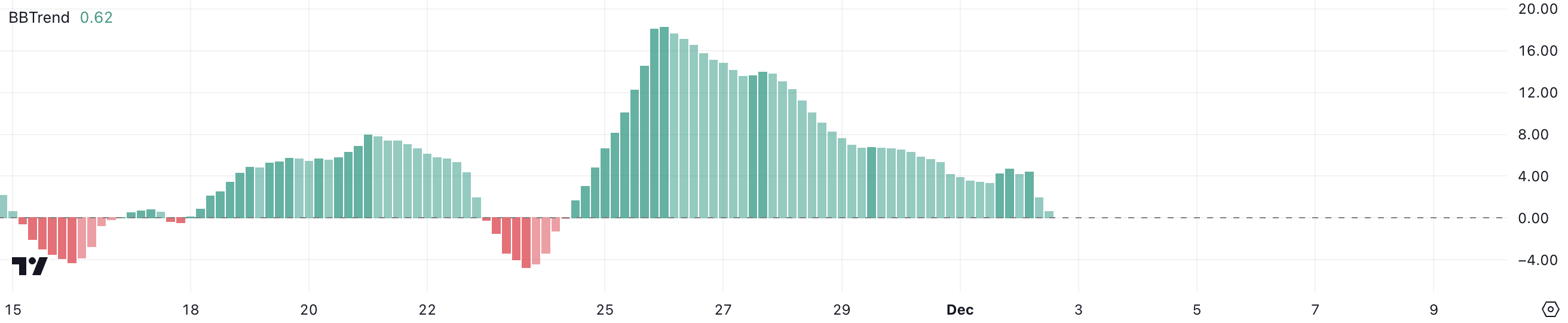

LINK BBTrend Is At Its Lowest Stage In Weeks

Chainlink BBTrend (Bollinger Bands Pattern) indicator has weakened vastly, shedding from its height of 18.2 on November 26 to tantalizing 0.44 for the time being whereas affirming sure territory since November 25.

The BBTrend helps establish pattern strength and potential reversals by measuring tag motion relative to Bollinger Bands.

A doable shift to detrimental BBTrend territory may perhaps well presumably impress a pattern reversal and elevated promoting stress for LINK.

When BBTrend turns detrimental, it most ceaselessly signifies tag motion below the center Bollinger Band, suggesting bearish momentum that would outcome in extra downside motion in LINK’s tag.

LINK Tag Prediction: A Attainable 42% Contemporary Surge

LINK recent strive to breach $22, a level unseen since 2022, suggests potential for predominant upward motion.

If winning on its subsequent strive, the cryptocurrency may perhaps well presumably target $25 sooner than advancing against $30, which would signify its top doubtless tag since 2021 and translate to a mighty 42% tag development from most sleek ranges.

Conversely, failure to preserve upward momentum may perhaps well presumably web order online online off a downward correction.

In this discipline, LINK tag may perhaps well presumably test preliminary make stronger at $16.18, with the aptitude for extra decline to $13.8 if this make stronger level fails to preserve.