Bitcoin’s worth of $96,125 to $96,557 over the closing hour shows a consolidating market with blended signals from various timeframes, suggesting a cautious formulation for merchants and merchants.

Bitcoin

On the 1-hour chart, bitcoin reveals a engrossing drop from $98,200 to $94,712, followed by a moderate recovery. A spike in promote quantity at some stage in the decline suggests capitulation, while the archaic recovery quantity questions bullish strength. Instantaneous enhance rests at $94,700, with resistance at $96,500. Traders must quiet discontinuance unsleeping for bullish affirmation, comparable to elevated lows and lengthening quantity, before coming into positions. Exits shut to $96,500 or a discontinuance below $94,000 would mitigate transient menace.

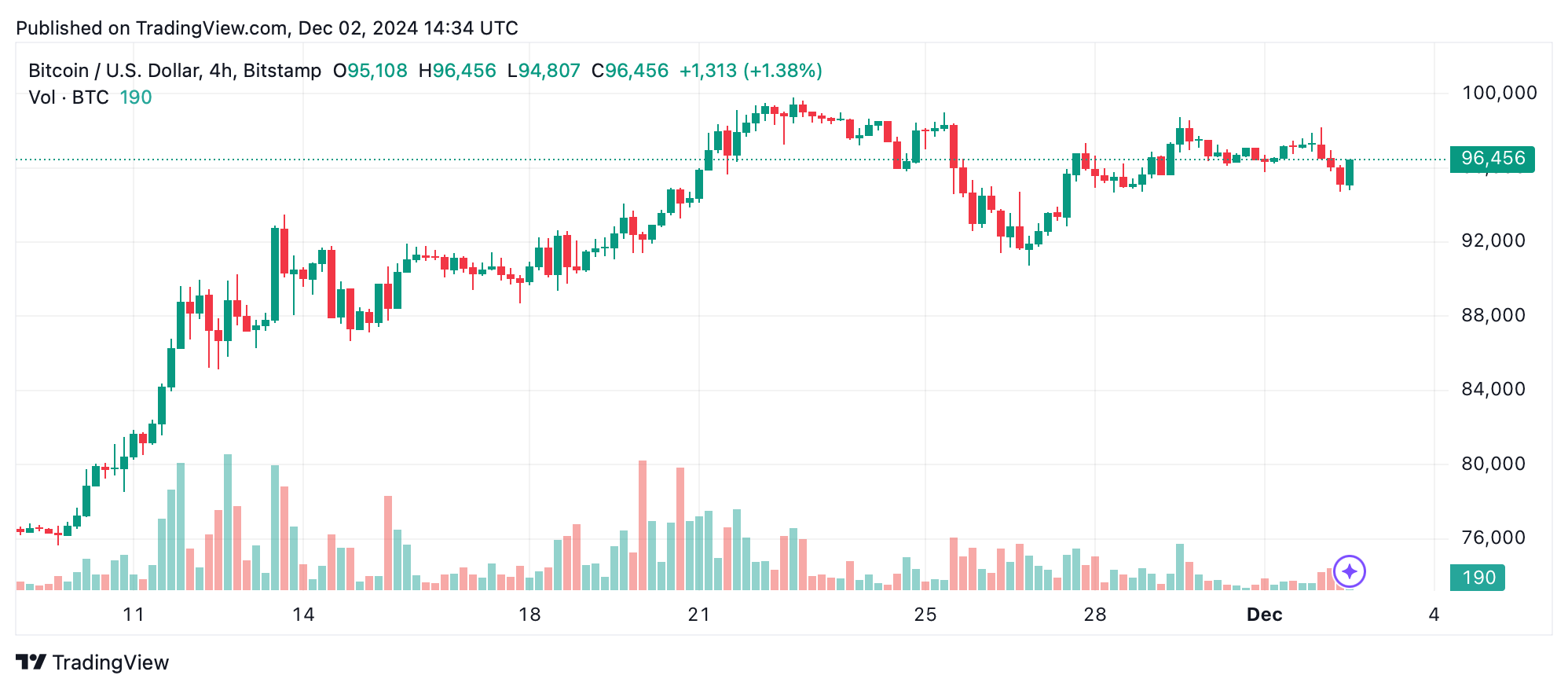

The 4-hour chart shows a medium-time length downtrend, with lower highs and lows forming since the $98,745 mark. Resistance at $98,000-$98,500 and enhance at $95,000 outline a slim shopping and selling range. Elevated promote quantity at some stage in pullbacks strengthens the bearish case, nonetheless a doable reversal shut to $95,000 presents opportunities for bulls. Entry round this enhance, coupled with an exit at $98,000 or a discontinuance-loss below $93,000, balances menace and reward.

The everyday chart shows a broader uptrend with bitcoin nearing the excessive $100,000 resistance stage. Nonetheless, declining quantity of most contemporary candles signals fading momentum. The intraday range of $94,878 to $98,145 aligns with this consolidation fragment. Lengthy-time length merchants must quiet dangle in thoughts coming into positions handiest on a breakout above $100,000 with tough quantity affirmation, while cautious exits must quiet be deliberate if the charge falls below $95,000.

Key oscillators display conceal neutrality, with the relative strength index (RSI), stochastic, and commodity channel index (CCI) all fair. The stylish directional index (ADX) of 47 moreover confirms a lack of sturdy directional momentum. Within the intervening time, momentum (-3,241) and shifting average convergence divergence (MACD) (4,712) level to bearish traits. These signals point out transient warning, requiring extra affirmation for novel trades.

Interesting averages (MAs) underline bitcoin’s broader bullish sentiment. Brief exponential shifting averages (EMA) and simple shifting averages (SMA) diverge, with EMA (10) signaling a aquire at $95,591 and SMA (10) suggesting a promote at $95,940. Nonetheless, all longer-time length averages, at the side of EMA (200) at $68,746 and SMA (200) at $67,207, dwell in tough aquire territory, underscoring prolonged-time length bullish doubtless despite transient volatility.

Bull Verdict:

Bitcoin’s prolonged-time length technical indicators point out bullish strength, with all main shifting averages signaling aquire opportunities. The broader uptrend remains intact, with doubtless for a breakout above $100,000 if accompanied by tough quantity. For merchants, the consolidation fragment would possibly perchance well existing an perfect entry display conceal capitalize on future upward momentum.

Endure Verdict:

Brief charts and oscillators spotlight weakening momentum, with promote signals from momentum and MACD indicators. The failure to maintain beneficial properties above $98,000 and declining shopping and selling quantity develop the menace of further pullbacks. A breach below $94,000 would possibly perchance well signal a deeper correction, tough bitcoin’s resilience at key enhance ranges.